Adam Gault

This coming week will be busy with data likely to show that the job market remains healthy and that inflationary pressures persist. If this is the case, it will mean that rate cut odds for 2024 will continue to dissipate, causing Treasury rates to rise and the dollar to strengthen. Under that scenario, as we move forward, we should see financial conditions tighten, credit spreads widen, and implied volatility rise, weighing on equities. The data will start pouring in on Monday morning, with the ISM manufacturing report, followed by the JOLTS on Tuesday morning, ADP and ISM Services on Wednesday, and the official US Job report on Friday.

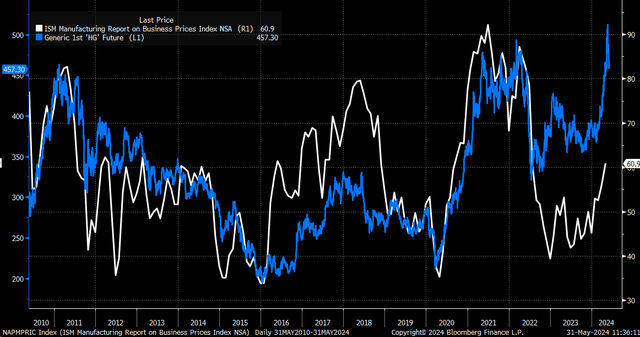

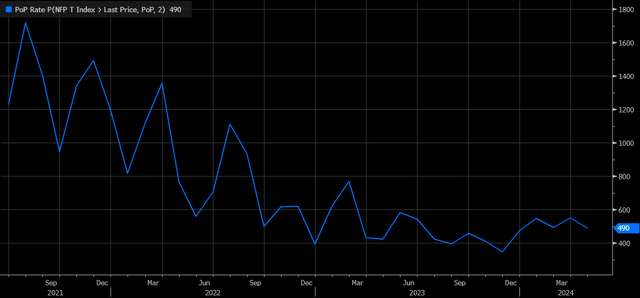

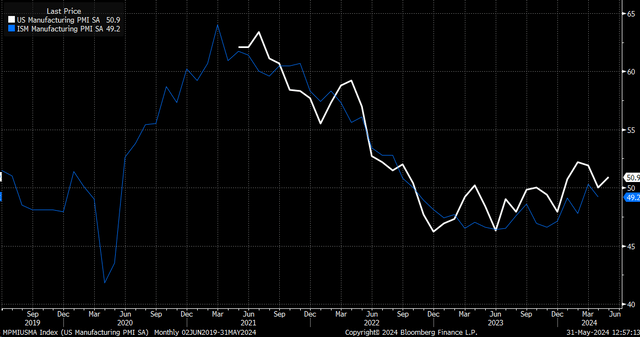

ISM Manufacturing

The ISM manufacturing index is expected to rise to 49.7 from 49.2 in May, bringing it closer to that 50 reading, which determines whether the sector is expanding or contracting. Meanwhile, the critical prices paid index is expected to slip to 60 from 60.9. The price paid index will be one of the first looks at inflation for May and given the surge in many metal prices in May, it wouldn’t be a surprise to see that number come in hotter than expected.

Bloomberg

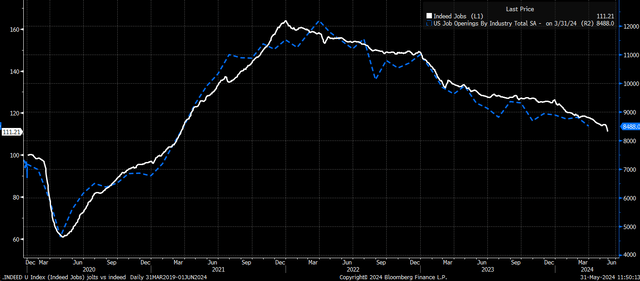

Job Openings

The JOLTS data is expected to show a slight drop in open jobs to 8.37 million in April from 8.49 million in March. This number is difficult to predict and can be subject to significant revisions. Data from Indeed job postings shows that the current trend continues to decline steadily, and the declines seem to have even quickened in May, which will be something to watch for next month.

Bloomberg/ Indeed/ St. Louis Fed

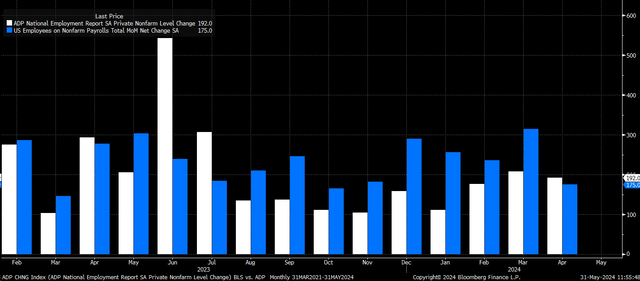

ADP

Meanwhile, ADP is expected to show that 175,000 jobs were created in May, down from 192,000. If one thing is clear about this data set, it has nearly no noticeable relationship to the actual government job report that comes later in the week. They do not seem to trend in the same direction, with periods where ADP employment was rising monthly while official government data was slowing month to month.

Bloomberg

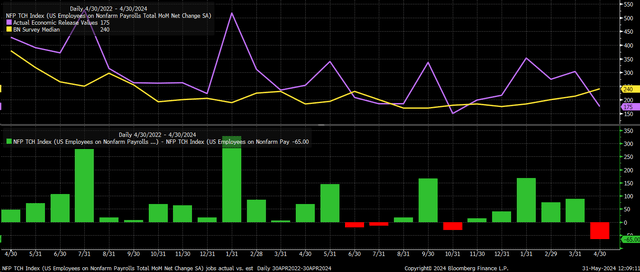

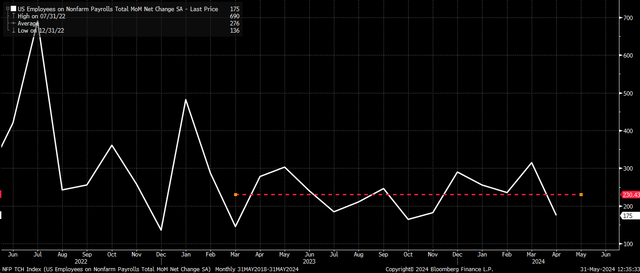

BLS Job Report

The job report is expected to show that the US added 190,000 jobs in May, up from 175,000 in April. Meanwhile, the unemployment rate is expected to remain unchanged at 3.9%, while average hourly earnings are expected to increase by 3.9% y/y in line with April and by 0.3%, up from 0.2% m/m.

Analysts have tended to underestimate the number of jobs created each month. Last month was the first time analysts overestimated the number of jobs created in several months.

Bloomberg

It is possible that with the Easter holiday being recognized in March instead of April was to blame and that April was a glitch. When combining the numbers of jobs created in March and April, the total came to 490,000, which was basically in the same range as the last few readings.

Bloomberg

If job hiring is slowing, it would likely appear in the May data, as analysts expect. But if the job market isn’t slowing, and the slower pace in April was due to the effects of an early Easter, then perhaps we should see the number of jobs created snap back and move closer to or above the average of 230,000 since March 2023.

Bloomberg

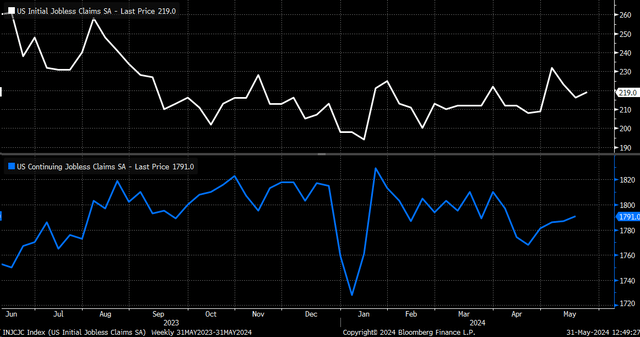

Too Low?

At least on the surface, analysts’ estimates seem to be sticking with prior trends. The bigger question is if these expectations are too low. There isn’t much to say that the unemployment rate is due to rise meaningfully, with initial jobless claims and continuing claims relatively unchanged for some time.

Bloomberg

Given the surge in commodity and shipping prices over the past couple of months, the estimates could be understating the inflationary pressures that are building once again on the manufacturing side of the equation. The S&P Global Manufacturing PMI, which gave preliminary readings for May, has already moved into expansion and is back above 50.

The S&P Global PMI noted that manufacturers:

Bloomberg

If price pressures are building and the job market does rebound in May, then it is entirely possible again that rates on the yield curve will need to rise. The divergences between the Fed and other central banks will only widen, further strengthening the dollar because rate cuts will be pushed further out in time.

Additionally, another factor comes on Thursday. This is when the ECB is expected to cut its overnight rate by 25 bps. The market places the odds for a rate cut by the ECB at 95%. The market expects the next rate to come in October or December. If the markets catch any signs from the ECB that the next rate cut could come sooner, well, that could play into driving that divergence even more.

At least until proven otherwise, the job market and inflation have remained sticky, and there is very little evidence to support that this is not currently the case. May is likely to show that not much has changed.

GIPHY App Key not set. Please check settings