tiler84/iStock via Getty Images

Generally speaking, the current interest rate environment has created a wider option space for yield-seeking investors to deploy their capital at relatively acceptable yields. Before the FED decided to aggressively hike interest rates, it will be very difficult to get high-quality yield that is above 5%, especially when it came to equity type investments. Now we are talking about how to capture yields that are at 7% or above, while not sacrificing the quality angle.

Having said that, finding equity instruments that offer double-digit yields or close to that still, in most cases, imply elevated financial risk. For yield-seeking investors, high quality BDCs could be a solution, but it is clear that all eggs should not be put in the same basket. Theoretically, investors could explore CEFs or option-based ETFs, but in those cases, either the underlying risk level remains too high (for high yielding CEFs due to notable reliance on external leverage) or the equity-like upside potential is lost (usually option-based ETF use covered calls, which inherently cap the upside).

So, to access close to double-digit yields without excessive concentration in BDCs, CEFs or option-based ETFs, investors have to really dig deep in the company financials to avoid value traps or the so-called “sucker yields”.

Below in the article, I will elaborate on two equity REITs that:

Yield 9% or above. Have the necessary business to generate sustainable cash flows. Are close to an inflection point of understanding whether the dividend will be cut or not.

In other words, I am fundamentally bullish on the two REITs presented below. In fact, I am even long one of them. However, in my opinion, given the current financial dynamics, it would make sense for investors to keep these names on their radar and wait for some important data points before going long.

#1 Global Medical (NYSE:GMRE)

GMRE is a small-cap equity REIT, which operates in the medical office segments. It has ~ 185 properties spread across 34 states. Since the demand is so strong for these system-critical services, GMRE has enjoyed very high occupancy levels in all of the years since the IPO. Currently, GMRE’s properties are 96% occupied and are underpinned by mostly triple-net leases, which carry a weighted average maturity term of 5.8 years. The portfolio rent coverage sits at 4.8x, which is a clear indicative of robust tenant mix.

Performance-wise, GMRE has been delivering fairly stable AFFO results, which in the past couple of years have revolved around $0.20 – $0.24 per share (on a quarterly basis). There was a nice growth momentum right before the FED decided to hike. However, since the cost of capital went up, GMRE was forced to put its M&A strategy largely on hold and wait for a period of higher interest rate certainty, where both the sellers and buyers could agree on equilibrium cap rate levels.

Given the increased probabilities of experiencing some interest rate cuts soon, GMRE has slowly turned back to the M&A markets in order to capture some additional cash flows that could offset the rising expenses from less favorable cost of debt.

The way how GMRE funds these M&A moves is almost entirely through the use of liquidity that has been obtained by divesting parts of the existing portfolio. Namely, what we have seen is GMRE selling several properties at relatively low cap rates (from 6% to 7%) and using that capital to accommodate higher cap rates investments. This way, GMRE achieves positive delta in the cash flows, which could be used to balance out the incremental expenses from more expensive borrowings.

For example, during the recent quarter (Q2, 2024) GMRE signed a sales and purchase agreement covering 15 properties at a blended average cap rate of 8%. Yet, if we look at quarter-to-quarter AFFO dynamics, we will notice that the AFFO per share has dropped. Here it is important to note that it is primarily explained by the lagged effects between the moment of previous asset disposals and the moment of when GMRE puts the freshly obtained capital at work.

With that being said, we have to also be cognizant of the AFFO payout. Based on the Q2, 2024 AFFO per share result, the AFFO payout is slightly above 95%. Taking the Q1, 2024 result, which, in my opinion, will be achieved in the next quarter, the AFFO payout lands at 91%.

All other things being equal, we could theoretically consider this is a safe metric, especially against the backdrop of secular tailwinds, embedded rent escalators and accretive M&A strategy (including the embedded value, where 6% – 7% cap rate transactions served as a testament to that).

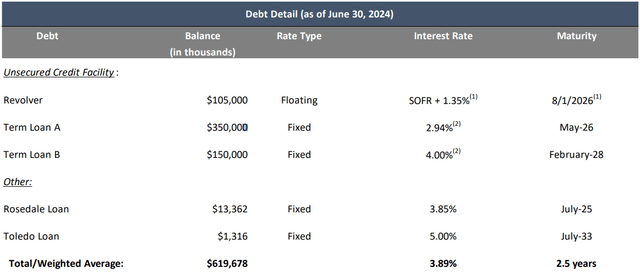

Yet, the issue is that the cost of financing will not remain constant. The weighted average interest rate for GMRE is 3.9%, which is clearly below the market level financing. The weighted average maturity on these borrowings is 2.5 years, which means that GMRE will have to refinance the existing loans at, presumably, higher interest rates. Now, putting this in the context of thin dividend coverage, we arrive at a potential problem (i.e., risk of a dividend cut).

GMRE Q2, 2024 Earning Supplemental

If we look at the table above, Term loan A is the only issue here, as it is both material and signed at a very low fixed rate.

I see two elements that could mitigate the negative effects from rolling over Term loan A:

FED moves quickly with the interest rate cuts, which could decrease the spread between the current financing rate and the new one that GMRE will need to obtain in the market. GMRE activates more its M&A strategy (i.e., divests sizeable portions of its portfolio at low cap rates and invests the proceeds back at higher cap rates) and thus secures meaningful AFFO growth that could offset the pressure from higher debt cost base.

In my view, investors could consider waiting some quarters to see progress in any of these two points. If the progress is there, the prospects of a continued dividend coverage should improve. In that case, I would also personally be adding more to my existing position in GMRE.

#2 Slate Grocery REIT (OTC:SRRTF)

Slate Grocery is also a small-cap equity REIT with a pure-play exposure to grocery anchored properties. In the portfolio, Slate has 116 properties that are distributed across 23 different states and are currently 95% occupied. The existing leases have a weighted average outstanding term of 4.8 years. In other words, quite similar fundamental characteristics to those of GMRE.

Also, just as in the case of GMRE, Slate is also underpinned by inherently defensive cash flows as the demand for grocery-anchored properties is less sensitive to the macroeconomic shocks.

When it comes to the cash generation and core results, the current momentum for Slate is in a better position than for GMRE. For instance, in Q2, 2024 Slate delivered yet another strong quarter, registering the same property net operating income growth of 3.5% on a year-over-year basis. This change has stemmed from very strong leasing spread statistics, where during the recent quarter the lease spread capture was in the double-digit territory. The new leasing deal contracts generated a spread of 28% above comparable average in-place rents, while the non-option renewal leasing activity resulted in a blended spread of 12.8%. As a result of this and slightly higher occupancy level, the AFFO per share increased by 4.5%.

In terms of the growth prospects, the necessary elements are there, with the most vital one being the average in-place rent level of $12.56 per square foot remains significantly below the market average of ~ $23.4. This provides a solid base for Slate to grow the cash flows going forward (as we could already witness it in the Q2, 2024 earnings data).

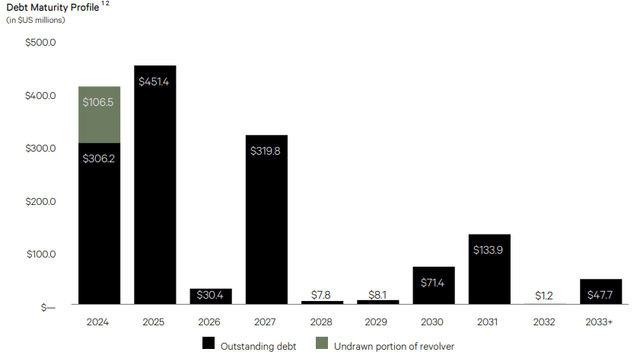

However, there is also an issue here related to the dividend coverage or too aggressive AFFO payout. Currently, based on Q2, 2024 results, the AFFO payout is 93%, which as in GMRE’s case indicates a minimal margin of safety. The problem becomes more meaningful, once we take into account that Slate’s weighted average cost of financing sits at 4.5% (which is below market level) and there are notable fixed rate debt maturities coming due in 2024 and 2025.

The chart below captures the essence nicely, showing how close the moment of potentially increased cost of financing (and thus even more stretched dividend coverage) is for Slate.

SRRTF Investor Presentation

Yet, the commentary in the Q2, 2024 earnings call by Blair Welch – Chief Executive Officer – sends a strong message that Slate is about to access relatively cheap financing, and if we read between the lines, I would argue that there is a basis for assuming that a dividend cut will not happen:

Yes. We’ve been actively contacting all of our lenders. We’re quite pleased to report there’s activity on the bank side, on the LifeCo side, on the CMBS side for grocery-anchored real estate. We hope to be announcing here in the next quarter some of our finalized plans for refinancing. But we’ve been working on it and unlike other types of real estate, there is active demand from lenders to lend to grocery-anchored. So we do not foresee significant changes or issues with our capital stock, and we’re pretty pleased about it. But we’ve been working on it for a while because you know how the market is but I think we’re going to be pleasantly surprised with how we can execute it.

As opposed to GMRE, here investors can really wait for the Q3, 2024 data to come in that will reveal how Slate has managed to execute the 2024 refinancings and whether the new cost of financing allows avoiding compression in the dividend coverage metric.

Personally, if the new financing rate will not be materially above the current one for the fixed rate borrowings that expire this year, I will immediately open a position in Slate.

The bottom line

While finding equity instruments that offer attractive yields has become possible, to access close to double-digit yields, while keeping the risks balanced and not relying too much on specific (volatile) asset classes that inherently provide elevated yields, investors have to be very selective. Even if sound cases are found, oftentimes there are still some question marks remaining as to how really sustainable the yields are.

Global Medical REIT and Slate Grocery REIT offer ~ 9% yields that are underpinned by robust and defensive cash flows. The only issue in both cases is relatively tight dividend coverage ratio, which leaves little margin of safety to keep the dividends uncut after near-term cheap debt refinancing.

Looking at the fundamentals, there is strong evidence that the dividends will be kept after the forthcoming debt rollovers. However, given that these dates are relatively close, and we need really a couple of quarters for GMRE and only one quarter for Slate to understand the situation deeper, I would recommend putting both of these names on investor radars and pull the trigger once incremental data points confirm the positive trajectory.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

GIPHY App Key not set. Please check settings