belterz/E+ via Getty Images

Earnings of Civista Bancshares, Inc. (NASDAQ:CIVB) will most likely dip this year before recovering next year on the back of a recovery in the net interest margin. The bottom line will also receive support from healthy loan growth. Overall, I’m expecting the company to report earnings of $1.76 per share for 2024, down 36% year-over-year, and $1.86 per share for 2025, up 6% year-over-year. The year-end target price suggests a high price upside from the current market price. Additionally, the company is offering a good dividend yield of 3.9%. Based on the total expected return, I’m adopting a buy rating on Civista Bancshares.

Margin’s Trend Reversal in Sight

The net interest margin plunged by 13 basis points in the second quarter, after dropping by 22 basis points in the first quarter and 55 basis points in the last nine months of 2023. There’s a good chance that the upcoming interest rate cuts will reverse the margin’s downtrend.

As mentioned in the 10-Q filing, Civista’s liabilities are more rate-sensitive than assets in a falling interest rate environment. This means the reduction in the cost of funds will outweigh a reduction in asset yields. The liability-sensitivity is partly attributable to the deposit mix which is heavy on interest-bearing demand, savings, and money market deposits. These deposits are quick to re-price after interest rate events and make up around 45% of total deposits. On the other hand, loans are slow to re-price because an overwhelming majority of the loan portfolio is in real estate loans. These real estate loans made up a hefty 89% of total loans at the end of June.

I’m expecting the Fed funds rate to decline by 25 basis points in the last quarter of 2024 and 100 basis points in 2025. As a result, I’m expecting the net interest margin to be almost stable in the third quarter of 2024 before rising by two basis points every quarter through the end of 2025.

Loan Growth to Moderate After an Impressive Quarter

Civista Bancshares’ loan portfolio grew by an impressive 4.0% during the second quarter, or 16.2% annualized. This growth rate is higher than the compounded annual growth rate of 12.9% for the last five years.

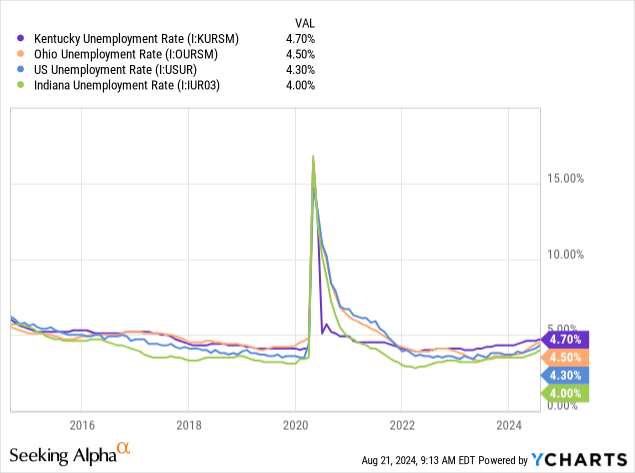

Civista operates in the Ohio counties of Erie, Crawford, Champaign, Cuyahoga, Franklin, Logan, Summit, Huron, Ottawa, Madison, Montgomery, Henry, Wood, and Richland. The company also has some presence in Indiana and Kentucky. Moreover, its equipment leasing and finance company caters to clients in all 50 states. Nevertheless, most of Civista’s operations are concentrated in Ohio. As shown below, Ohio’s unemployment rate has been quite low recently compared to its history. Additionally, the state’s unemployment rate is close to the national average.

Data by YCharts

Data by YCharts

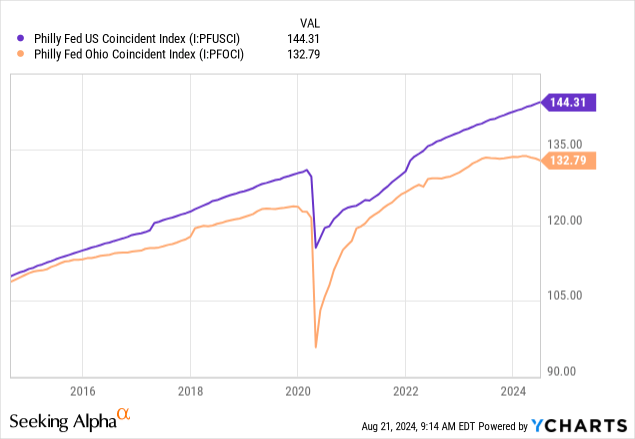

However, another economic metric depicts a less rosy picture of Ohio’s economy. The state’s economic activity has faltered in recent months, as shown by the coincident index.

Data by YCharts

Data by YCharts

Keeping these metrics in mind, I’m expecting loan growth to slow down slightly from the second quarter’s above-average growth rate. I’m expecting the loan portfolio to grow by 1.5% every quarter through the end of 2025. Further, I’m expecting deposits to grow in line with loans. The following table shows my balance sheet estimates.

Financial Position FY19 FY20 FY21 FY22 FY23 FY24E FY25E Net Loans 1,694 2,032 1,971 2,518 2,825 3,065 3,253 Growth of Net Loans 9.4% 20.0% (3.0)% 27.7% 12.2% 8.5% 6.1% Other Earning Assets 362 374 565 620 653 669 697 Deposits 1,679 2,189 2,417 2,620 2,985 3,068 3,256 Borrowings and Sub-Debt 275 183 203 542 454 626 651 Common equity 330 350 355 335 372 383 401 Book Value Per Share ($) 19.6 21.8 23.2 22.4 24.5 25.3 26.5 Tangible BVPS ($) 14.5 16.5 17.6 13.3 15.6 16.4 17.6 Click to enlarge Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified)

Earnings Likely to Recover Next Year After Slipping This Year

Earnings will most likely be lower this year compared to last year because of the net interest margin’s plunge in the first half of the year. Further, the margin’s recovery starting later this year will likely lift earnings next year. The anticipated loan growth will also support earnings. To arrive at my earnings estimate, I’m also making the following assumptions.

I’m expecting the provision expense to total loan ratio to return to the 2023 level after remaining elevated in the first half of this year due to unusually high loan originations. I’m expecting non-interest income to grow at an annual rate of around 11%, the same as the average for the last three years. I’m expecting the efficiency ratio (calculated as non-interest expenses divided by total revenue) to remain almost unchanged from the second quarter’s level.

Based on these assumptions, I’m estimating earnings of $1.76 per share for 2024, down 36% year-over-year. For 2025, I’m expecting the company to report earnings of $1.86 per share, up by 6% year-over-year. The following table shows my income statement estimates.

Income Statement FY19 FY20 FY21 FY22 FY23 FY24E FY25E Net interest income 85 90 95 110 125 114 122 Provision for loan losses 1 10 1 2 4 7 6 Non-interest income 22 28 31 29 37 41 46 Non-interest expense 67 71 78 90 108 116 124 Net income – Common Sh. 34 32 40 39 41 27 28 EPS – Diluted ($) 2.01 2.00 2.63 2.60 2.73 1.76 1.86 Click to enlarge Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified)

Risks Are Mostly Unproblematic

Civista Bancshares’ risk level appears low. Firstly, uninsured deposits amounted to $390.7 million at the end of June 2024, representing 13% of total deposits, as mentioned in the earnings presentation. This level is quite comfortable as Civista had cash and unpledged securities of $415.5 million at the end of June, which easily covers the uninsured deposits.

Further, non-performing loans are already very well provided for. Allowances for credit losses were 327% of non-performing loans at the end of June 2024. Non-accrual loans made up just 0.50% of total loans at the end of the last quarter.

Adopting a Buy Rating

Civista Bancshares is offering a dividend yield of 3.9% at the current quarterly dividend rate of $0.16 per share. The earnings and dividend estimates suggest a payout ratio of 36% for 2024, which is higher than the five-year average of 21% but easily sustainable. Therefore, I’m not expecting an increase in the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Civista Bancshares. The stock has traded at an average P/TB ratio of 1.31x in the past, as shown below.

FY19 FY20 FY21 FY22 FY23 Average T. Book Value per Share ($) 14.5 16.5 17.6 13.3 15.6 Average Market Price ($) 21.4 16.0 22.7 22.5 17.5 Historical P/TB 1.47x 0.97x 1.29x 1.70x 1.12x 1.31x Click to enlarge

Source: Company Financials, Yahoo Finance, Author’s Estimates

Multiplying the average P/TB multiple with the forecast tangible book value per share of $16.40 gives a target price of $21.50 for the end of 2024. This price target implies a 31.6% upside from the August 20 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

P/TB Multiple 1.11x 1.21x 1.31x 1.41x 1.51x TBVPS – Dec 2024 ($) 16.4 16.4 16.4 16.4 16.4 Target Price ($) 18.2 19.8 21.5 23.1 24.8 Market Price ($) 16.3 16.3 16.3 16.3 16.3 Upside/(Downside) 11.5% 21.5% 31.6% 41.6% 51.7% Click to enlarge Source: Author’s Estimates

The stock has traded at an average P/E ratio of around 8.5x in the past, as shown below.

FY19 FY20 FY21 FY22 FY23 Average Earnings per Share ($) 2.01 2.00 2.63 2.60 2.73 Average Market Price ($) 21.4 16.0 22.7 22.5 17.5 Historical P/E 10.7x 8.0x 8.6x 8.7x 6.4x 8.5x Click to enlarge Source: Company Financials, Yahoo Finance, Author’s Estimates

Multiplying the average P/E multiple with the forecast earnings per share of $1.76 gives a target price of $14.90 for the end of 2024. This price target implies an 8.7% downside from the August 20 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

P/E Multiple 6.5x 7.5x 8.5x 9.5x 10.5x EPS 2024 ($) 1.76 1.76 1.76 1.76 1.76 Target Price ($) 11.4 13.2 14.9 16.7 18.4 Market Price ($) 16.3 16.3 16.3 16.3 16.3 Upside/(Downside) (30.2)% (19.4)% (8.7)% 2.1% 12.9% Click to enlarge Source: Author’s Estimates

Equally weighting the target prices from the two valuation methods gives a combined target price of $18.20, which implies an 11.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 15.4%. Hence, I’m adopting a buy rating on Civista Bancshares.

GIPHY App Key not set. Please check settings