Hedera (HBAR) emerged as a standout performer in the second quarter (Q2) of the year, reversing the downward trend faced by many projects. The latest report from research firm Messari highlights Hedera’s progress across key financial indicators.

Ivy Q2 Momentum

One of the pivotal highlights of Hedera’s Q2 was the advancement in crucial financial metrics. Despite a 29% quarter-over-quarter (QoQ) dip in circulating market cap to $2.7 billion, HBAR managed to climb six spots from 36 to 30 among all tokens, surpassing similarly priced cryptocurrencies.

HBAR’s market cap fluctuation in the year-to-date time frame. Source: Messer

Per the report, revenue also became a beacon of success for Hedera during Q2, with the network witnessing a 26% uptick in USD revenue, reaching $1.4 million. Moreover, revenue in HBAR surged by 19% quarter-over-quarter to 14.6 million.

Related Reading

The pace of HBAR issuance and circulation remained a focus, with 72% of the total 50 billion HBAR in circulation at the end of Q2. The quarterly distribution of HBAR indicated the release of an additional 1.5 billion HBAR in the upcoming quarter, with a significant allocation of 94% earmarked for ecosystem and open source development initiatives.

While daily accounts created increased 31% sequentially to 11,100, daily active addresses declined 37% to 10,600, reflecting a mixed picture of growth and engagement within the network. Transaction activity rebounded in Q2, as average daily transactions increased 46% to 132.9 million, driven primarily by the Hedera Consensus service.

Staking Surge And DeFi Fluctuations

The report further highlighted Staking in the network, which emerged as a significant trend within the ecosystem, with 62.2% of the circulating supply staked, signaling a high level of engagement from entities like Swirlds and Swirlds Labs.

However, the decentralized finance (DeFi) landscape on Hedera witnessed fluctuations in Q2, with Total Value Locked (TVL) experiencing a decline in both USD and HBAR metrics.

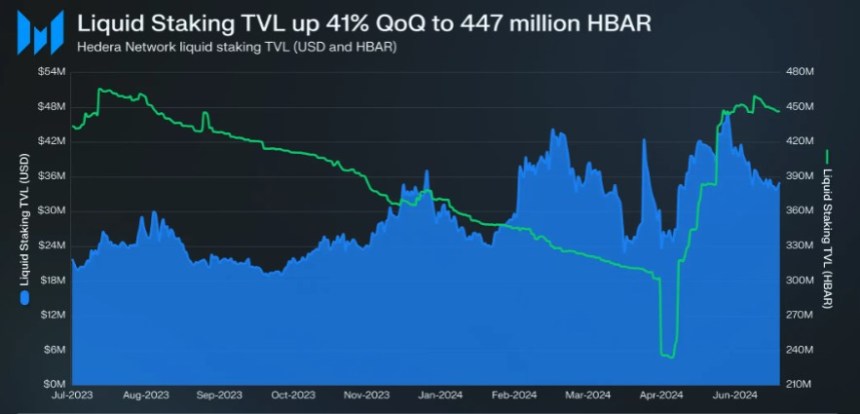

HBAR’s liquid staking TVL performance QoQ. Source: Messer

HBAR’s liquid staking TVL performance QoQ. Source: Messer

Still, Messari asserts that initiatives like the HBAR Foundation’s DeFi TVL growth program have injected vitality into the ecosystem, driving liquidity and awareness. Liquid staking on the other hand, saw a resurgence in Q2, with Stader’s TVL increasing by 41% in HBAR terms.

Related Reading

Lastly, Hedera’s decentralized exchange (DEX) volumes also saw a dip in the second quarter after a bullish first quarter, according to Messari, but it has remained strong year-over-year (YoY).

At the time of writing, HBAR records a significant 22% drop in price over the past month, currently trading at $0.050 amid the general market uncertainty led by increased volatility of the largest cryptocurrencies on the market Bitcoin (BTC) and Ethereum (ETH).

The 1D chart shows HBAR’s price trending downwards. Source: HBARUSDT is TradingView.com

Additionally, CoinGecko data shows that the token has seen a notable decrease in trading volume over the past 48 hours, dropping by 35%. Most importantly, HBAR is still 91% below its all-time high of $0.056 reached in September 2021.

Featured image from DALL-E, chart from TradingView.com

GIPHY App Key not set. Please check settings