Thomas Barwick

Market Discussion

At first glance, it’s easy to think that the Federal Reserve’s decision to lower short-term interest rates in September removed a big uncertainty hanging over the market. The fact that Federal Reserve officials shifted their focus from fighting above-target inflation to supporting the job market likely explains the recent equity market rally, which lifted the S&P 500 Index and the Russell 2000® Index to new record highs.

But look under the hood, and signs of concern and cautiousness seem to remain. Even as the Federal Reserve has embarked on its first easing cycle since 2019, money continues to flow into areas of ‘relative safety’ (nominal), including longer-dated bonds. In addition, companies sitting on large piles of cash have outperformed. Take Berkshire Hathaway, one of the top holdings in our Strategy. Warren Buffett and team have been selling stocks more aggressively than they have in over two decades. As a result, Berkshire entered the third quarter with over $275 billion in cash and cash equivalents. Although cash represents more than one-fourth of the company’s total equity value and lower interest rates are an earnings headwind, the stock hit a new high and outperformed in the quarter.

The September rate cut may have answered some questions about the direction of monetary policy, but it also highlights the risk of making a future policy error, in either direction. To be clear, we agree with the Federal Reserve’s conclusion that restrictive policy would further dampen economic activity (not that we can forecast interest rates); however, further meaningful interest rate reductions could indicate a deteriorating labor market. Jobs have traditionally been the ultimate decider on where the economy goes, and though the current unemployment rate of 4.2% is low by historical standards, it’s almost a percentage point higher than in early 2023.

Investors appear to be paying attention, as the last two major spikes in market volatility took place in early August and early September, coinciding with the release of the Labor Department’s two most recent jobs reports. On August 5th, the CBOE Volatility Index, a fear gauge priced by the options market, climbed to its third-highest reading in 20 years, reaching a level only exceeded by the financial crisis in 2008 and the global pandemic in 2020.

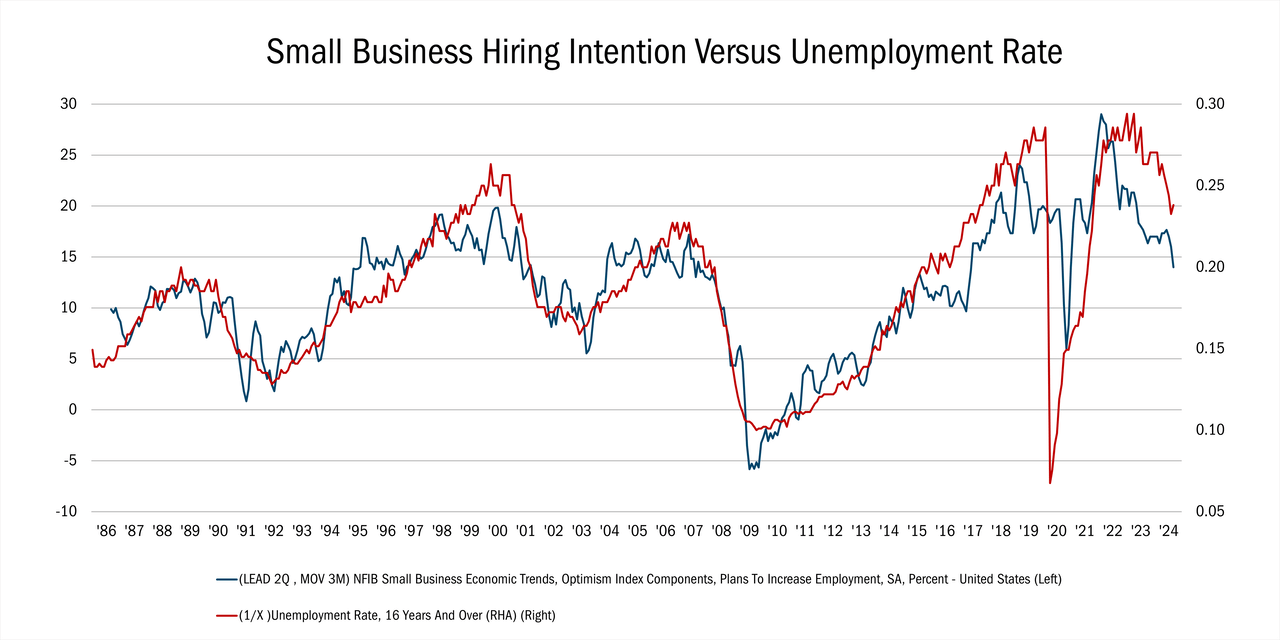

Don’t be surprised if anxiousness persists with the job market softening even as the Federal Reserve has shifted into a less restrictive mode. Historically, there has been a strong correlation between the unemployment rate and two economic indicators — the NFIB Small Business Optimism Index and the ISM Services Purchasing Managers Index. Ongoing weakness in both indicates the potential for unemployment to climb to around 6% (see below).

Source: FactSet Research Systems Inc., 1/31/1986 to 9/30/2024 This chart represents small businesses’ hiring intention compared to the unemployment rate. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Concerns surrounding the demand for labor have already led to major intra-quarter swings in the market that belie the overall gains in major benchmarks. For instance, small-cap value stocks outpaced large-value by more than 7% from the end of June to late July only to reverse and underperformed by more than 6% in the subsequent three weeks, thanks to the weak jobs report that triggered a selloff. We would not be surprised to see further volatility until the labor market finds its footing. In the meantime, we are comforted by the fact that our all-cap Strategy is uniquely positioned to take advantage of opportunities whether they arise in small-, mid-, or large-cap businesses, as long as they fit within our 10 Principles of Value Investing™ process.

Attribution Analysis

Our Strategy rose 8.76% in the third quarter, trailing the Russell 3000® Value Index, which returned 9.47%. Stock selection was favorable by about 0.5% led by Consumer Discretionary holdings, but this outperformance was more than offset by our overweight to underperforming holdings in the Consumer Staples sector and a modest cash position.

While many of our top contributors in the quarter were large-caps stocks, including Berkshire Hathaway (BRK.B), small-cap stocks in Deciles 4 and 5 generated our best performance. Our holdings in Decile 4 (businesses with market caps between $3.5 billion and $6.4 billion) returned 14.98%, compared with 9.28% for the same grouping within the Russell 3000® Value index. In Decile 5 (market caps between $2 billion and $3.5 billion), our portfolio gained 17.2%, versus the benchmark’s 9.55%.

Portfolio Activity

In the third quarter, our mid-cap weighting rose modestly to 35%, up from 30% at the end of June driven by new holdings including several mid-sized industrial companies. We want individual security selection to drive our performance, not factor bets, including those on company size. That’s why we construct our portfolio from a bottom-up perspective, as exemplified in the following holdings:

Industrials – An industrial company added this quarter was Robert Half (RHI), a leading temporary staffing and consulting firm that places finance, accounting, and technology experts at small- and medium-sized businesses. Though staffing is a deeply cyclical business, Robert Half’s relative performance is positively correlated with a weakening job market. So, rising unemployment could, ironically, be a favorable catalyst for RHI shares going forward.

This is not our first time owning the company; we held Robert Half in 2017-18 during a modest cyclical downturn and subsequent recovery. We revisited the company in the aftermath of a more than 50% drop in the stock from its all-time high achieved in early 2022. RHI shares fell to their lowest level since 2020 because demand for their services had declined on a year-over-year basis for seven consecutive quarters, a length of fundamental pressure only rivaled by the recessionary conditions experienced in 2001-2002 and 2008-2009.

However, we believe the durability of RHI’s cash flows should prove greater than what the market is pricing in, and we’re confident the company is underearning relative to normalized profitability. RHI enjoys industry-leading profitability and free cash flow generation. The company has no debt and has $500 million of cash on its balance sheet, equivalent to more than $5 a share.

The stock is currently trading at a high earnings multiple of nearly 22X, but that’s because, in our estimation, profits are depressed. Free cash flow to enterprise value yield is more than 5% today — but greater than 10% based on what, we believe, is mid-cycle profitability. Meanwhile, 100% of Robert Half’s free cash flow is being returned to shareholders through dividends and buybacks. We expect revenue to continue falling for several quarters, but we believe the upside potential is asymmetrically skewed relative to downside risks.

Real Estate – Public Storage (PSA), the second-largest owner and operator of self-storage facilities globally with over 3,000 properties, was a meaningful outperformer during the quarter.

This is another company we’ve returned to after originally purchasing shares in 2019, when the industry was pressured by elevated supply. We exited the position in 2023, after rents peaked on a cyclical basis and the company sought to acquire a public competitor, a deal management ultimately walked away from after a topping offer was placed by another industry peer.

We began purchasing shares early this year, as the industry’s fundamentals looked to be stabilizing. Supply, for instance, had been constrained by higher interest rates and permitting delays, which set up a scenario for better pricing power. PSA’s margins had also improved, driven by its “property of tomorrow” initiative to modernize the company’s facilities, including digitizing the leasing process, installing LED lights, and adding solar power to improve asset-level profitability.

PSA maintains the highest credit rating of any public REIT, resulting in a cost of capital advantage versus both public and private competitors. At the same time, self-storage’s short lease terms and high tenant turnover create a barrier to entry for large financial buyers, including private equity investors who don’t have operating expertise.

We purchased PSA shares at a price/funds-from-operation (FFO: a proxy for earnings per share used by REITs and defines the cash flow from operations) ratio of ~15X, below where high-quality REIT peers were trading at the time, despite PSA’s lower leverage and superior profitability. While the company’s valuation has increased since reestablishing our ownership, we believe PSA can grow FFO per share faster than peers with less risk, owing to its self-funded capital program.

Consumer Staples – The convenience store operator Dollar General (DG) was our worst performer during the quarter. The retailer, with more than 19,000 stores, 80% of which are in rural towns with populations of less than 20,000, recently slashed its 2024 earnings guidance, sparking a late-summer sell-off.

Same-store comparable sales and margin guidance were cut meaningfully, implying a significant slowdown in the second half of the year. While some of the troubles may be due to the financial challenges of its core customers, with average incomes of just $35,000, Dollar General is also losing market share because of Walmart’s initiative to reduce entry-level pricing. Management acknowledged a need to invest in promotions to stimulate demand, but they refute concerns that DG needs to invest more in store-level labor.

Our Strategy maintains a small position in DG due to a significant industry exposure in the benchmark, but we continue to monitor the company’s fundamentals. We’re looking for comparable sales to stabilize, driven by promotional activity; a boost in labor investments; and management to downsize store expansion plans to improve free cash flow generation and accelerate deleveraging efforts.

Meanwhile, the stock currently trades at less than 14X estimated Wall Street earnings, which is well below its median multiple of 16.5X since the company’s IPO. DG also trades at 0.9X enterprise value to sales, below its median post-IPO multiple of 1.25X.

Outlook

While the headlines are focused on what’s changed, we can’t help but notice the things that have not. Many of the mixed economic signals we’ve noted in the past seem to remain firmly in place, such as weakening consumer credit metrics and payroll gains. However, we believe this is an environment where investors need to take what the market is giving. For us, that means remaining true to our 10 Principles of Value Investing™, which demands that we seek attractively priced, well-managed businesses that can grow intrinsic value over time.

Robert Half is a good example of the opportunities we see today. The intrinsic value of RHI shouldn’t be based upon peak or trough earnings but rather average profits over time, which have grown to higher highs and higher lows over decades. Yet, since the end of 2019, the company’s shares have traded from a low of less than $33 per share to a high of greater than $125 per share. We don’t believe the company’s value swings this wildly. As such, we seek to take advantage of this volatility.

Thank you for your continued trust and confidence.

Composite Returns*

9/30/2024

Since Inception (%) 10-Year (%) 5-Year (%) 3-Year (%) 1-Year (%) YTD (%) QTD (%) Opportunistic Value Equity Composite (Net of Advisory Fees)** 10.18 9.52 11.22 10.87 23.79 14.64 9.13 Opportunistic Value Equity Composite (Net of Bundled Fees) 8.16 7.61 9.52 9.34 22.10 13.46 8.76 Russell 3000® Value 7.78 9.17 10.61 8.70 27.65 16.23 9.47

Click to enlarge

Source: FactSet Research Systems Inc., Russell Investment Group, and Heartland Advisors, Inc.

*Yearly and quarterly returns are not annualized. The Strategy’s inception date is 9/30/1999.

**Shown as supplemental information. The US Dollar is the currency used to express performance. Returns are presented net of advisory fees and net of bundled fees and include the reinvestment of all income. The returns net of bundled fees were calculated by subtracting the highest applicable sponsor portion of the separately managed wrap account fee from the net of advisor fees return.

Past performance does not guarantee future results.

The Opportunistic Value Equity Strategy seeks to capture long-term capital appreciation by investing in companies with market capitalizations greater than $500 million. The Strategy’s flexible pursuit of value positions it as a core holding for investors.

In addition to stocks of large companies, the Opportunistic Value Equity Strategy invests in stocks of small- and mid-cap companies that are generally less liquid than large companies. The performance of these holdings generally will increase the volatility of the strategy’s returns.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

Heartland Advisors, Inc. (the “Firm”) claims compliance with the Global Investment Performance Standards (GIPS®). The Firm is a wholly owned subsidiary of Heartland Holdings, Inc., and is registered with the Securities and Exchange Commission. For a complete list and description of Heartland Advisors composites and/or a presentation that adheres to the GIPS® standards, contact the Institutional Sales Team at Heartland Advisors, Inc. at the address listed below.

As of 9/30/2024, Berkshire Hathaway Inc. (BRK.B), Dollar General Corporation (DG), Public Storage (PSA), and Robert Half International, Inc. (RHI) represented 3.46%, 0.84%, 3.70%, and 0.83% of the Opportunistic Value Equity Composite’s net assets, respectively.

The future performance of any specific investment or strategy (including the investments discussed above) should not be assumed to be profitable or equal to past results. The performance of the holdings discussed above may have been the result of unique market circumstances that are no longer relevant. The holdings identified above do not represent all of the securities purchased, sold or recommended for the Advisor’s clients.

Statements regarding securities are not recommendations to buy or sell.

Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Separately managed accounts and related investment advisory services are provided by Heartland Advisors, Inc., a federally registered investment advisor. ALPS Distributors, Inc., is not affiliated with Heartland Advisors, Inc.

The statements and opinions expressed in this article are those of the presenter(s). Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The specific securities discussed, which are intended to illustrate the advisor’s investment style, do not represent all of the securities purchased, sold, or recommended by the advisor for client accounts, and the reader should not assume that an investment in these securities was or would be profitable in the future. Certain security valuations and forward estimates are based on Heartland Advisors’ calculations. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

There is no guarantee that a particular investment strategy will be successful.

Sector and Industry classifications are sourced from GICS®. The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®.

Because of ongoing market volatility, performance may be subject to substantial short-term changes.

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

In certain cases, dividends and earnings are reinvested.

There is no assurance that dividend-paying stocks will mitigate volatility.

CFA® is a registered trademark owned by the CFA Institute.

Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Frank Russell Investment Group.

Data sourced from FactSet: Copyright 2024 FactSet Research Systems Inc., FactSet Fundamentals. All rights reserved.

Heartland’s investing glossary provides definitions for several terms used on this page.

Click to enlarge

GIPHY App Key not set. Please check settings