The Urban Dictionary defines hopium as “the metaphorical substance that causes people to believe in a false hope,” and “an addiction to false hopes.” Further, hopium “represents the belief that the situation will someday improve.”

Now, there’s nothing wrong with a little hope. Without it, we’d never get up every morning to face the day. We all hope that each day will be better than the last and that our overall situation will improve over time. We hope that fate will be kind and maybe even generous. The problems start when hope is our only coping mechanism or solution to our problems.

The quote has been attributed to various sources, but someone once said, “Hope is not a plan.” It’s a wise statement. Hope is great, but you need an actionable plan to back it up. It’s wonderful to hope for a promotion and a larger salary, but you need a plan to make yourself invaluable at work. It’s fine to hope to retire with a million bucks, but you need a plan for saving and earning that money. Hoping to make a fortune from your novel is great, but what’s the plan for writing and marketing that book? You’re in trouble if you’re relying strictly on hope to get you somewhere.

Even worse, a hopium addiction can not only stop you from moving forward on your dreams, it can actively destroy your progress and leave you worse off than before. Hopium can ruin you financially if it’s your only plan. How? It leaves you at the mercy of every scam, con, grift, and get-rich-quick scheme on the planet. Hopium addicts are so convinced that someone or something will swoop in to save them that they fall for nearly every trick in the book. Often more than once. They desperately want to believe that something easy (or requiring no effort whatsoever) will make everything better. This leads to a large amount of money lost and spent for no gain whatsoever.

Sometimes a hopium addiction is a symptom of a larger problem. Depression, anxiety, trauma, or addiction to other substances is at the root of the problem. All of these things can make it impossible to create an actionable plan, pushing someone toward false hope. Other times, it’s a learned response. When older relatives based their financial lives on hope, it’s easy to fall into the same pattern. Rarely is the problem simple laziness. Most of the problems that result in hopium addiction are treatable. The trick is to recognize the problem so that you can address the underlying cause.

What are some signs of someone who is addicted to hopium, especially when it comes to finances? Anyone who believes/falls for any/all of the following is probably a hopium addict.

Scam Jobs

Hopium addicts are among the first to sign up for too-good-to-be true jobs. Look out for the jobs that offer six-figure salaries for five hours of work per week, or those that require you to pay/transfer money for “supplies” or “training.” These jobs are always scams, but they hook people hoping for an easy way to make money.

Get Rich Quick Crypto Scams

While crypto itself might not be a scam, there are many scam actors in the crypto space looking to cash in on those hoping for easy riches. Even if you dodge the scams, hopium can lead you to gamble more than you can afford to lose on a risky investment.

Ponzi Schemes & Pyramid Schemes

Ponzi schemes are investment/business scams that promise large payouts with very little investment. Usually, the leader of the scheme is taking your money and using it to pay earlier investors in a (usually) non-existent business or investment. Eventually, the whole thing collapses into legal and financial ruin.

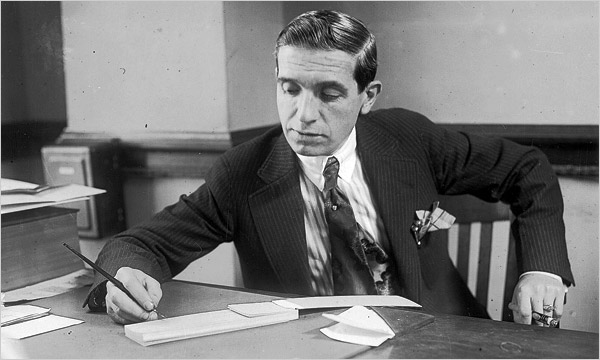

Charles Ponzi, Namesake of the scheme,1920. Image Source: Wikipedia.

Charles Ponzi, Namesake of the scheme,1920. Image Source: Wikipedia.

Pyramid schemes (sometimes known as multi-level marketing schemes) are a bit different. A recruiter entices you in with promises of big money with very little work. You join the business, ostensibly to sell products, but your primary “job” is to recruit others into the business. Your income comes from this recruitment, not product sales. You’re also likely required to purchase products, even if you already have more than you can sell. There are likely other fees, as well. Eventually, you discover that you can’t recruit enough people to make money, and no one’s buying the products now filling your garage. You’ve sunk money and time (and probably damaged some relationships with overzealous recruiting) into this and gained nothing.

Both of these investments/businesses are attractive to hopium addicts because they promise a lot of money with little to no effort.

Romance Scams

We all hope for love in your lives and scammers know this. They seek out lonely people online and lure them into giving them money. It may start with small amounts, but eventually, the amounts get larger. The hopium addict falls for it because they believe this person likes/loves them. There may also be promises of future money/marriage into money. (“My funds are stuck in legal limbo and I’ll pay you back triple when it clears up,” or, “When we get married, I’ll move you into my Malibu mansion.”) It’s all fake, but ripe for those who hope for an easy life of love and money.

Gambling/Lottery

Casinos, lotteries, and betting are some of the oldest hopium attractants in the world. It’s fine to use such things recreationally. Buying lottery tickets or gambling can be a bit of fun, after all. But if you’re spending more than you can afford in the hope of solving your financial problems, you’re likely a hopium addict. (And this often eventually evolves into a full-blown gambling addiction where the high from playing and betting is even greater than the hope.)

Crumpled lottery ticket.

Crumpled lottery ticket.

Religious Conmen

There is a case for donating to your church or favored religious organization. However, a hopium addict easily falls prey to the charismatic “preacher” or who promises god will bless you with riches if you donate to his/her organization. Often this comes with a promise that the donation will be repaid many times over through religious means. While the theological basis for Gods blessing is beyond the scope of this article, many preachers of the prosperity gospel have amassed tremendous personal wealth. Per the BBCthis raises questions about their ethics or motivations.

Real Estate Scams

Hopium addicts are often strapped for a place to live, or they dream of a much nicer place. This makes them easy targets for real estate scams. Apartments or homes that aren’t really for rent (or don’t even exist), but which you must pay a “fee” to see. Deposits are required for sight-unseen homes or apartments. Pictures that make homes look wonderful and urgent language that the listing must be bought sight unseen due to demand when the reality is a shack in disrepair. Land in a prime location that’s ridiculously underpriced, but which either doesn’t exist at all or is being sold by a scammer who doesn’t own it. Never rely on hope when dealing in real estate. Always deal with legitimate brokers and check all the legal aspects before committing any money.

Courses From “Gurus”

There are plenty of scammers who promise easy money if you just take their course. The guru will show you how to achieve success with little effort. It may be a course in real estate, investing, day trading, franchising, etc. Whatever the case, if you just take the course you’ll learn all you need to know to be a millionaire! While there might be some truth in the claims, any success will come from you doing actual hard work over many years, not just paying a ton of money for a course.

Day Trading/Shorting Stocks

Trading is a controversial topic. Many institutional traders and high powered money managers are able to beat the market through high frequency day trading. However, the statistics are not favorable for most day traders. According to the Motley Fool, fully 95% of day traders lose money.

While some people do make money by aggressively trading stocks or attempting to short stocks (Gamestop, for example), most people lose their shirts. Even if the hoped-for riches materialize, most people fail to get out with their profits (greed) and instead gamble more and more, hoping to gain even more. When it begins to collapse, they trade more, hoping to get back to profitability. (“One more trade will turn this around,” becomes the mantra.)

If you have a sound plan for getting in and out and a strict trading budget, aggressive trading may be a viable strategy. However, most hopium addicts end up losing large sums of money.

“Manifestation” Scams

You’ve probably heard of “The Secret” or “The Law of Attraction.” The basic premise is that you can think things into being, including money and prosperity. There may or may not be some truth to it, however, it’s also an idea ripe for scammers to prey on hopium addicts. They will sell you courses, books, and other materials on how to think your way to prosperity. Some will sell coaching services to teach you the way. Worse, when the money doesn’t materialize, you’ll take an emotional beating. You’ll be told that you’re not thinking correctly and it’s your fault that the money isn’t coming. Positive thinking is great, but it’s no substitute for actually taking action to earn money.

Easy Money Scams/Fake Check Scams

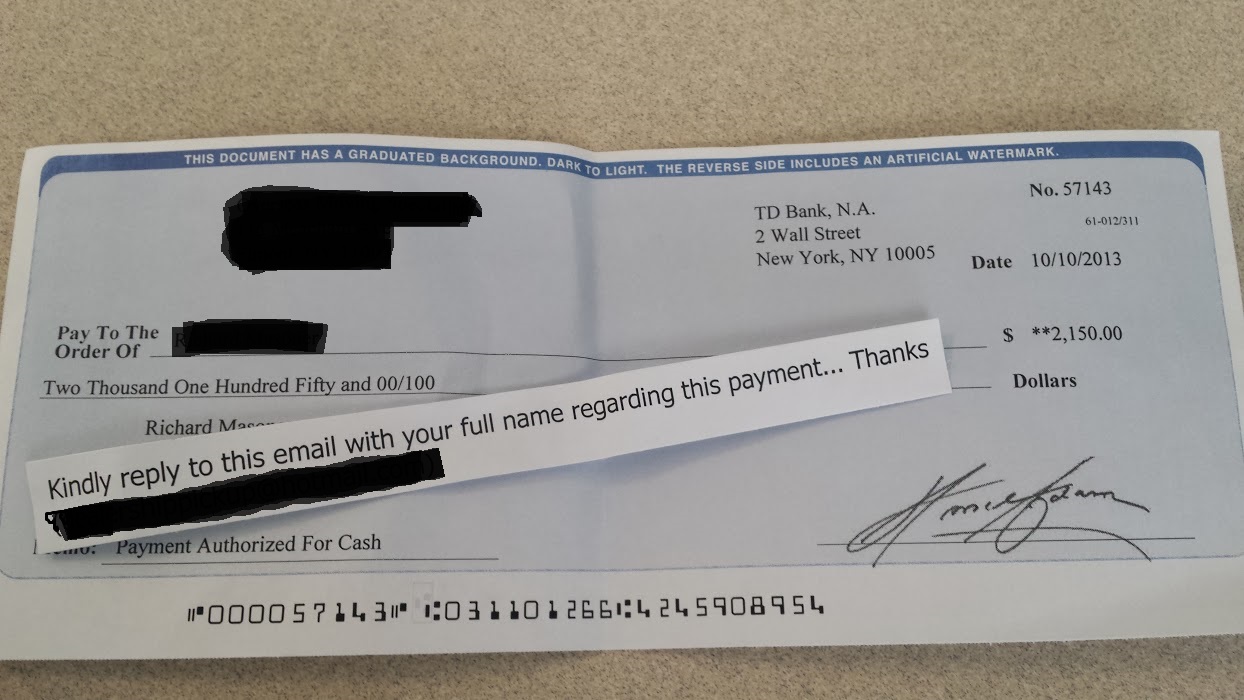

Example of a fake check. Image source: Richard Masoner via Flickr.

Example of a fake check. Image source: Richard Masoner via Flickr.

Any time someone offers you a chance for easy money if you’ll just facilitate a payment to another person, it’s a scam. Someone agrees to buy your item for over the asking price if you’ll just wire the overage to someone else. An email offers you $500 if you’ll just deposit a check for $1,000 and send $500 of it to someone else. The $500 is yours to keep! If there’s a sob story, panic, or a weird process attached to the money offer, it’s a scam. Even money that seems truly free rarely is. The hopium addict falls for this stuff because the lure of easy money is just too strong.

So What’s The Antidote To Hopium?

The antidote to hopium is to take control of your money, figure out exactly how much you have, what you owe, and work out your spending and savings budget.

It isn’t easy. If it were, nobody would ever have financial problems. However, as stated above, hope isn’t a plan. To get past a hopium addiction, you need a step-by-step plan and you need to take action on your plan.

That may mean more education to help with earning potential, or multiple jobs to pay off debt or save more. You need to get deeply involved in your finances and understand what you owe and to whom, and what the interest rates are on that debt. Then you need a payoff plan.

Even if you’re managing to hold things together, you need to figure out what you’re spending money on each month and see if there are ways to optimize that spending to create more room for savings. It’s messy work, particularly if you’ve let things go for a while. However, it’s work that has to be done if you want to move from hoping things will be okay to making sure they are okay.

Read More:

Act Like Life Makes Sense

Phone and Internet Scams to Watch Out For

The #1 Scam Prevention Technique

Cure Your FOMO to Save Money

Yes, Work From Home Scams Still Exist – Here’s What You Should Know

What Happens to Unused Cashback Accounts?

GIPHY App Key not set. Please check settings