Spot Bitcoin exchange-traded funds (ETFs) in the United States saw a strong resurgence after enduring four consecutive days of outflows that had drained over $1.2 billion from the market.

It’s Jan. 15, SoSoValue data revealed that these funds recorded $755.01 million in net inflows, adding approximately 7,548 BTC to their coffers.

Bitcoin ETF Flows (Source: SoSoValue)

Fidelity’s FBTC emerged as the key driver of these flows, attracting $463.08 million—the fund’s most significant inflow since March 2024. ARK and 21Shares’ ARKB also contributed to the positive trend with $138.81 million in inflows.

Other Bitcoin ETFs also added to the positive trend. Grayscale’s GBTC recorded $50.54 million, while Bitwise’s BITB secured $32.69 million. BlackRock’s IBIT saw inflows of $31.86 million, and VanEck’s HODL contributed $16.98 million.

Meanwhile, Grayscale Bitcoin Mini Trust added $13.69 million, Invesco Galaxy’s BTCO saw $4.47 million, and Franklin Templeton’s EZBC gained $2.9 million.

Ethereum ETFs

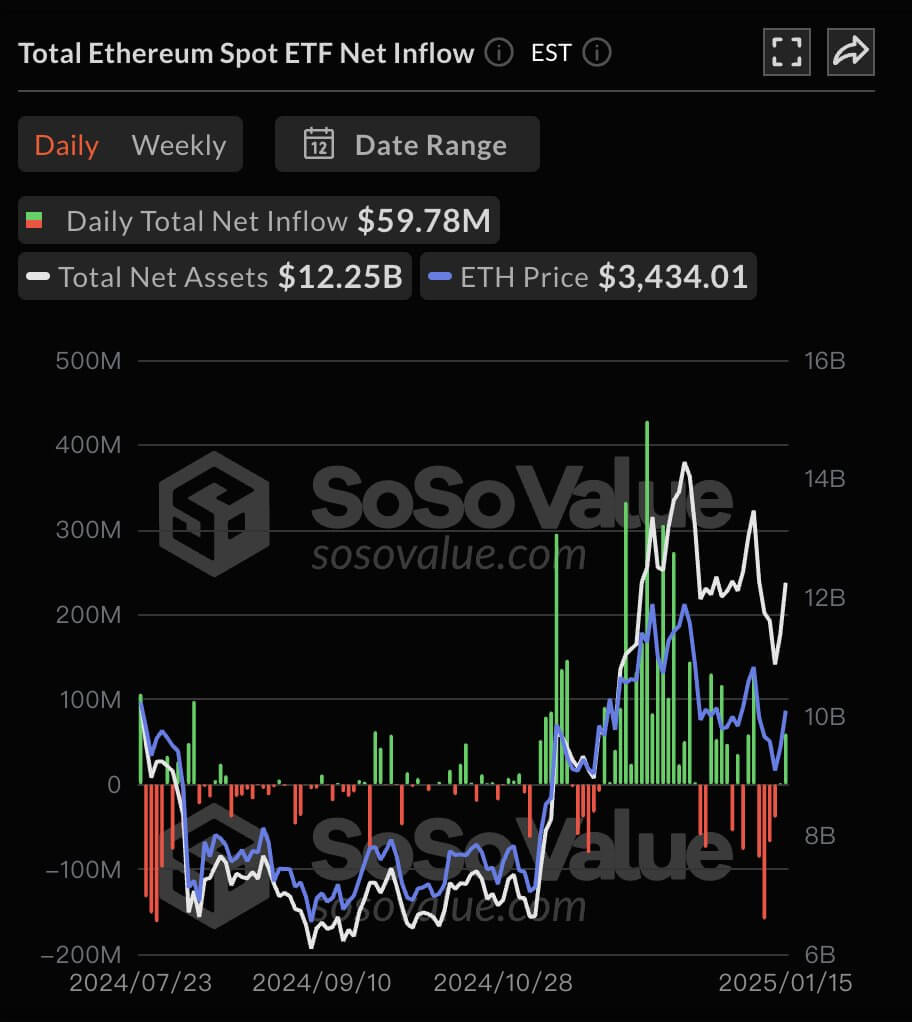

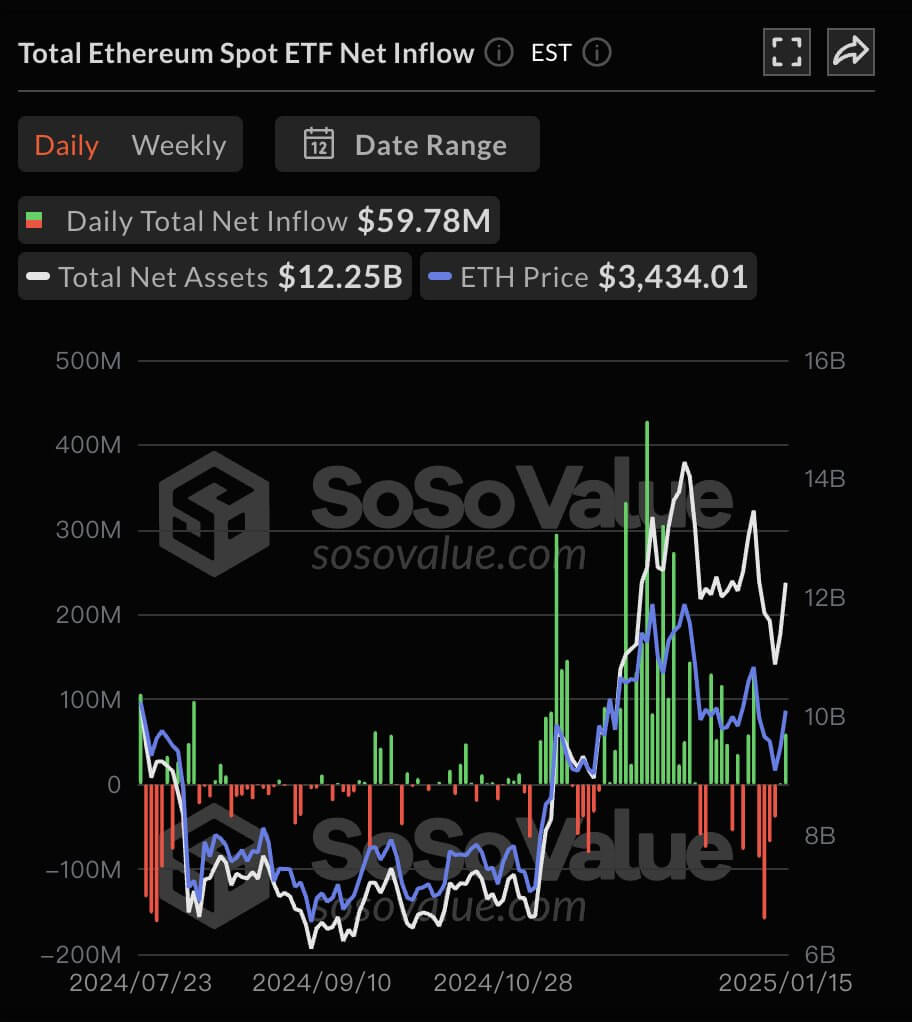

Ether ETFs also performed strongly on Jan. 15, recording $59.78 million in inflows, which translated to 18,520 ETH entering the funds.

Ethereum ETF Flows. (Source: SoSoValue)

Ethereum ETF Flows. (Source: SoSoValue)

SoSoValue data shows that Fidelity’s FETH led this category, attracting $29.32 million. BlackRock’s ETHA followed closely with $19.85 million.

Conversely, VanEck’s ETHV and Grayscale Ethereum Mini Trust saw cumulative inflows of more than $10 million on the day.

Other Ethereum ETF products recorded no flows on the day.

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

GIPHY App Key not set. Please check settings