Unsplash

As Tax Day approaches, many individuals are scrambling to file their taxes accurately and on time. While the prospect of an audit can be daunting, there are steps you can take to minimize your risk and ensure a smooth tax filing process. Here are ten essential things you can do to reduce the likelihood of being audited by the IRS and alleviate some of the stress associated with Tax Day.

1. Double-Check Your Information

Unsplash

Unsplash

Before submitting your tax return, take the time to double-check all the information you’ve entered. Ensure that your name, Social Security number, and other personal details are correct and match the information on file with the IRS. Review your income statements, deductions, and credits for accuracy, and verify that all calculations are correct. Simple errors or discrepancies can raise red flags and increase your chances of being audited.

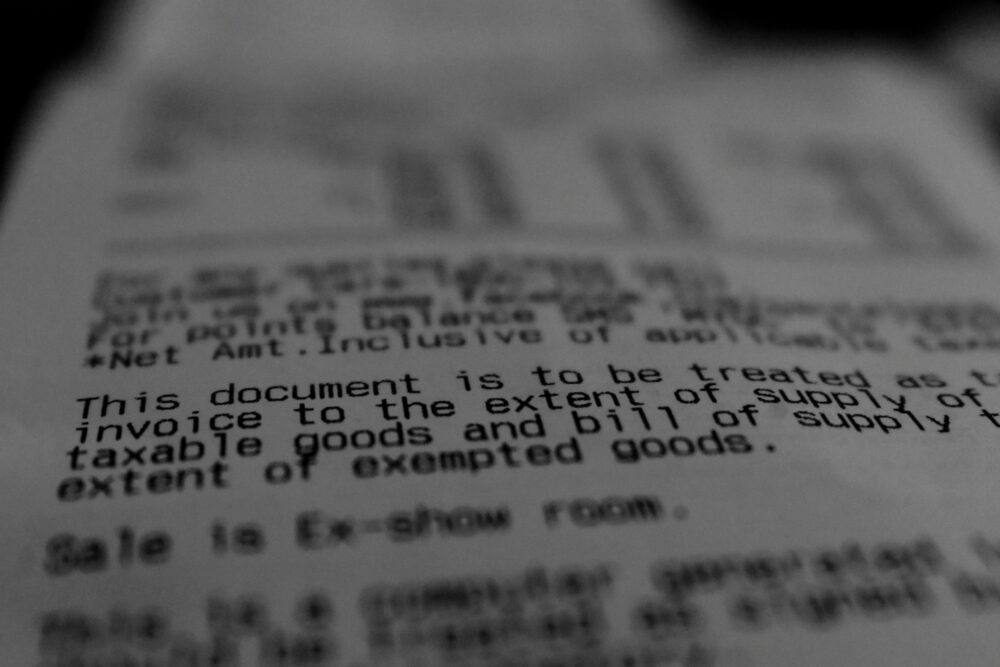

2. Keep Accurate Records

Unsplash

Unsplash

Maintaining accurate records is crucial for a smooth tax filing process and can help you avoid potential audit triggers. Keep organized records of all income, expenses, deductions, and credits throughout the year. This includes receipts, invoices, bank statements, investment statements, and any other supporting documentation related to your taxes. Having comprehensive records on hand can provide evidence to support your tax claims and minimize the risk of an audit.

3. Report All Income

Unsplash

Unsplash

Ensure that you report all sources of income on your tax return, including wages, self-employment income, investment income, and rental income. Failing to report income accurately or completely can raise suspicion and trigger an audit. Use the appropriate forms and schedules to report different types of income, and be honest and transparent in your reporting to avoid potential penalties or legal consequences.

4. Don’t Round Numbers

Unsplash

Unsplash

Avoid rounding numbers on your tax return, as this can appear suspicious to the IRS. Report income, expenses, and deductions accurately to the nearest dollar, and avoid rounding up or down to simplify calculations. Providing precise figures demonstrates attention to detail and reduces the risk of discrepancies that could lead to an audit.

5. Be Honest and Transparent

Unsplash

Unsplash

Honesty is the best policy when it comes to tax reporting, and transparency can help you avoid audits and penalties. Be truthful in your tax filings and provide complete and accurate information to the best of your knowledge. Disclose any relevant financial information, even if it may not be in your favor, to maintain integrity and compliance with tax laws.

6. Don’t Claim Unsubstantiated Deductions

Unsplash

Unsplash

Claiming unsubstantiated deductions or inflating expenses can raise suspicion and increase your risk of an audit. Only deduct expenses that are legitimate, necessary, and supported by documentation. Keep detailed records of expenses such as business expenses, charitable contributions, and medical expenses, and be prepared to provide evidence to substantiate your claims if requested by the IRS.

7. Report Foreign Assets and Income

![]() Unsplash

Unsplash

If you have foreign assets or income, it’s essential to report them accurately on your tax return and comply with IRS reporting requirements. Failure to disclose foreign financial accounts or income can result in severe penalties and legal consequences. Familiarize yourself with Foreign Bank Account Reporting (FBAR) requirements and other reporting obligations for foreign assets to ensure compliance and avoid audits.

8. File Electronically

Unsplash

Unsplash

Filing your taxes electronically is not only convenient but can also reduce the risk of errors and audits. Electronic filing software automatically checks for common errors and prompts you to correct them before submitting your return. Additionally, electronic filing reduces processing time and decreases the likelihood of errors associated with manual data entry, such as transcription errors or illegible handwriting.

9. Be Timely with Payments

Unsplash

Unsplash

Timely payment of taxes owed can help you avoid penalties and interest charges and reduce the likelihood of an audit. If you owe taxes, make sure to pay them by the filing deadline to avoid late payment penalties. Consider setting up a payment plan with the IRS if you’re unable to pay the full amount owed to avoid additional fees and consequences.

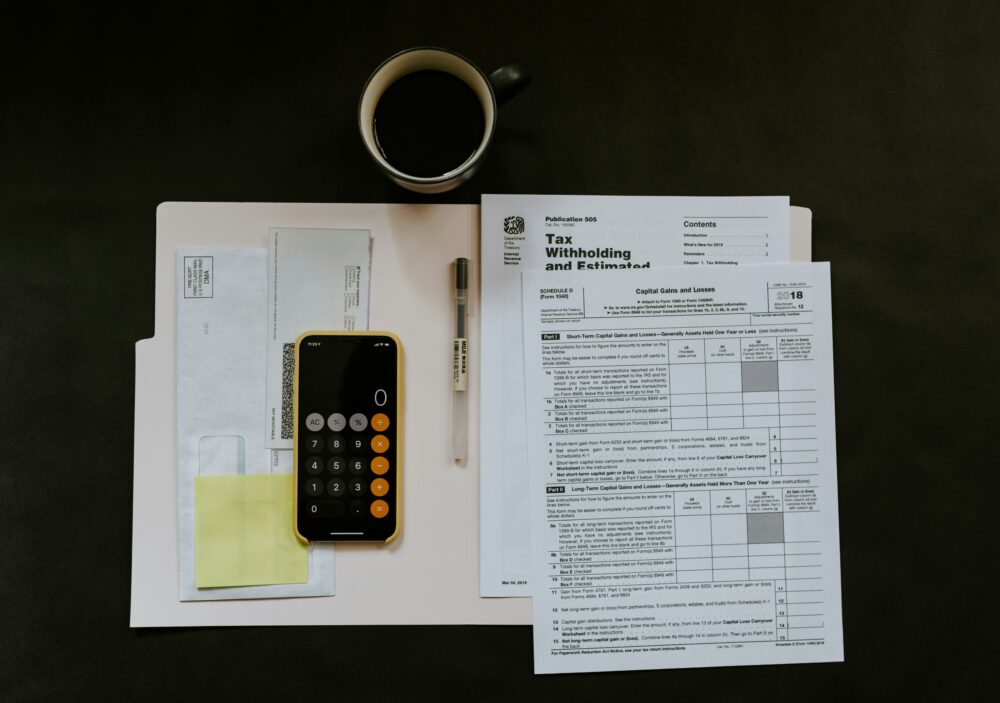

10. Seek Professional Help if Needed

Unsplash

Unsplash

If you’re unsure about how to file your taxes accurately or have complex financial situations, consider seeking professional help from a qualified tax professional or accountant. A tax professional can provide guidance, ensure compliance with tax laws, and help you minimize your risk of an audit. Investing in professional assistance can provide peace of mind and help you navigate the tax filing process with confidence.

Tax Day is Fast Approaching

Unsplash

Unsplash

In conclusion, Tax Day is fast approaching, and taking proactive steps to ensure accuracy and compliance can help you avoid audits and alleviate stress. By double-checking your information, keeping accurate records, reporting all income, and being honest and transparent in your tax filings, you can minimize your risk of an audit and ensure a smooth tax filing process. Remember to file electronically, be timely with payments, and seek professional help if needed to navigate Tax Day with confidence and peace of mind.

GIPHY App Key not set. Please check settings