What you need to know

Meta had its second-strongest quarter in company history, with its Q1 2025 revenue totaling $42.3 billion.Lower Meta Quest sales led to a dip in Reality Labs revenue that was “partially offset” by tripled Ray-Ban Meta sales.Meta warned about “legal and regulatory headwinds in the EU and the U.S. that could significantly impact our business.”During the earnings call, CEO Mark Zuckerberg laid out future company opportunities, primarily related to AI, messaging apps, and ads.

Meta’s first quarter 2025 profits grew by almost $6 billion or 16% over Q1 2024, which Mark Zuckerberg and CFO Susan Li attributed to its major AI push.

Reality Labs revenue hit $412 million, short of its $440 million profits in Q1 2024, while quarterly losses grew to $4.2 billion; that’s a smaller loss than the last three quarters. Li said these losses were “due to lower Meta Quest sales” but “partially offset” by tripled Ray-Ban Meta AI glasses sales.

This seems to paint a bleak outlook on current Quest 3S sales, recent Quest Store growth with younger users aside. And it’s telling that when Zuckerberg laid out the company’s “five major opportunities that we are focused on,” VR didn’t come up.

You may like

Instead, the focus is on “improving advertising, engaging experiences, business messaging, Meta AI, and AI devices,” the latter referring to Ray-Ban Meta glasses and future AR glasses.

In looking for new opportunities, they’re trying to offset the “macro-economic uncertainty” coming from EU regulatory bodies and U.S. tariffs.

The ‘light at the end of the tunnel’ for Reality Labs

(Image credit: Brady Snyder / Android Central)

When asked about Reality Labs’ typical $4 billion in losses per quarter and whether a “light at the end of the tunnel” is coming, Zuckerberg mentioned “doing the work more efficiently,” a typical Meta euphemism for Reality Labs layoffs.

But he also made an optimistic case that these investments laid the groundwork for a major profit boost in the near future.

“If you look at some of the leading consumer electronics products in other categories, by the time they get to their third generation, they’re often selling 10 million units and scaling from there,” Zuckerberg said.

(Image credit: Nicholas Sutrich / Android Central)

Their goal is to scale to that level and then “scaling beyond that for the generations after that,” which matches Zuckerberg’s vision of “billions of AI glasses” in the next “five to ten years.”

The Meta Quest 3 and 3S are well beyond third-generation if you take Oculus Rift and Go into account. So when Zuckerberg refers to a third-gen boost, he likely means Ray-Ban Meta 3 glasses, aka the Hypernova AR glasses rumored to arrive this year with a $1,000 price tag and monocular display. If so, his goal of scaling to 10+ million in sales seems optimistic, but we’ll have to see how things play out.

Strong Ray-Ban sales aside, there are four times the monthly active Ray-Ban Meta users than a year ago, and Meta says “the number of people using voice commands is growing even faster.”

The new standalone Meta AI app is meant to appeal to U.S. users (Image credit: Meta)

Meta’s “five major opportunities” for further growth include using their internal AI to build better ad campaigns, recommending more relevant social media and video content via AI, and creating “AI business agents that can do customer support and sales” in apps like WhatsApp and Messenger.

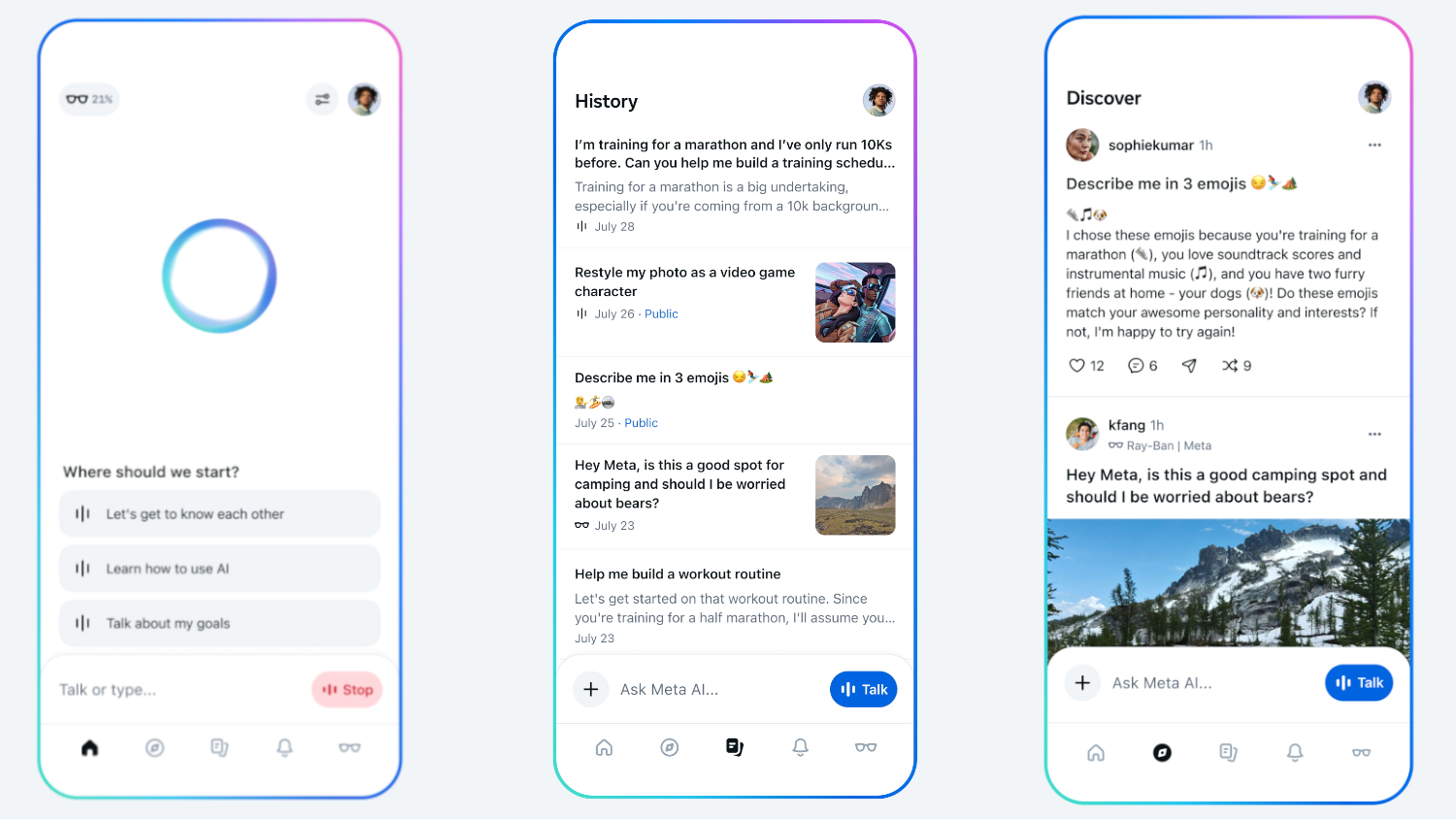

In other words, most AI profits will come from integrations into current apps or behind-the-scenes work. But Meta also explained why it needed to convert Meta AI into a standalone app, which it did this week.

International WhatsApp users like to message the Meta AI in-app, but Zuckerberg admitted that they are “clearly not the primary messaging app in the United States” thanks to iMessage. So Americans have fewer opportunities to use Meta Ai.

That’s why this standalone app is important to “establishing leadership as the main personal AI that people use,” Zuckerberg says, with “faster access” and a “more built-out feature set” appealing to power users who might prefer ChatGPT or Gemini Live for now.

(Image Credit: Meta AI)

Meta’s CFO said that the company is “well-positioned to navigate the macro-economic uncertainty” and “legal and regulatory headwinds” facing the company.

Meta didn’t discuss the recent Congressional antitrust hearingsnor did any investors bring them up.

Instead, Meta seems to be worried about the EU ruling that its “subscription for no ads model is not compliant with the Digital Markets Act (DMA),” the same DMA that’s pushing Apple to open up its watch ecosystem and Google to lessen its Search monopoly.

European ads account for 16% of its profits, Li said, and while Meta is “in the process of engaging with the European Commission,” they seem to think this could lead to a significant dip in profits.

In addition, Meta noted “reduced spend in the U.S. from Asia-based e-commerce exporters…in anticipation of the de minimis exemption going away on May 2” for Trump’s Chinese tariffs.

Ultimately, Meta predicted that Q2 2025 profits will range from $42.5–45.5 billion; they’re expecting further growth, but that $3-billion range stems entirely from these regulatory issues and potential tariff fallout.

GIPHY App Key not set. Please check settings