Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Soccer price of the lion and players some soft. Each arcu lorem, ultricies any kids or, ullamcorper football hate.

This article is also available in Spanish.

XRP has been resting at the $2 level, but indications of movement are increasing. One crypto analyst by the name of “J4b1” recently stated that purchasing XRP at $2.20 is not too late. In fact, he thinks that it may be the perfect time, just before things change dramatically. His assertions are founded on historical price action, Ripple’s current strategy, and what institutions may do next.

Related Reading

XRP Price Kept Stable By Ripple’s Monthly Activity

Ripple’s dominance over XRP’s supply is an important aspect of J4b1’s argument. Every month, the firm releases 1 billion XRP from escrow but sells only a fraction of it. The remaining amount is put back into escrow. These sales tend to occur via over-the-counter (OTC) channels rather than open markets. In the analyst’s view, this practice prevents Ripple from experiencing sharp price fluctuations.

Is XRP about to explode or already overpriced?

Is buying at $2.20 smart or is it too late? Let’s break it down with data, historical context, and Ripple’s price control strategy. 🧵👇 pic.twitter.com/UHvbYD4GJl

— J4b1 (@XRPJ4b1) May 4, 2025

He used an example: if Ripple wants to transfer $200 million using 100 million XRP, every coin will have to be worth $2. If the price rises too rapidly, Ripple can sell more. If it falls too far, they may buy some back. This strategy could be one of the reasons why XRP has not broken through the $2.20 barrier.

Institutional Demand Could Change Everything

J4b1 mentioned a few things that could drive XRP up. He cited possible regulatory clarity from a new US administration that could be more crypto-friendly. He also talked about the possibility of an XRP spot ETF and the growth of tokenized assets on the XRP Ledger.

The analyst believes that if institutions begin accumulating in large quantities, Ripple’s current approach may not be sufficient to contain the price. If demand outstrips the supply Ripple has, the price may surge.

XRP market cap currently at $125 billion. Chart: TradingView.com

XRP’s History Holds Clues

XRP’s journey began in 2012, when it was worth less than a penny. It picked up pace over the years as Ripple sold it to banks as a means of making cross-border payments faster and cheaper. That momentum took XRP to a high of $3.80 in the 2017 bull run.

Related Reading

But everything changed when regulators stepped in. In 2015, Ripple was fined by FinCEN. Then, in 2020, the SEC lawsuit struck, slowing down XRP’s adoption and keeping the price under control. Nevertheless, Ripple continued to build, acquiring companies like Metaco and obtaining licenses across the globe.

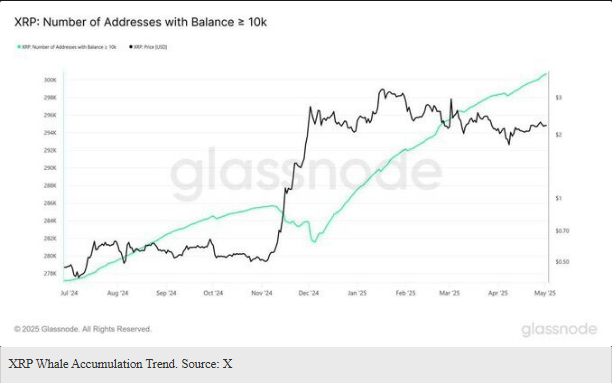

Whale Wallets Are Growing Rapidly

Meanwhile, as XRP’s price remains stagnantthe large holders are filling up. According to recent statistics, there are now more than 300,000 addresses holding a minimum of 10,000 XRP. That’s an increase from around 281,000 as of December 2024. Whale wallets continue to rise even though the price remains largely flat around $2.20.

That type of buildup tends to indicate a sense that prices may rise further in the future. It’s occurring as global uncertainty increases, which may be encouraging investors to get ready for the next major move.

For the time being, XRP traders are paying close attention. A quick move on the upside may not be far away.

Featured image from Gemini Imagen, chart from TradingView

GIPHY App Key not set. Please check settings