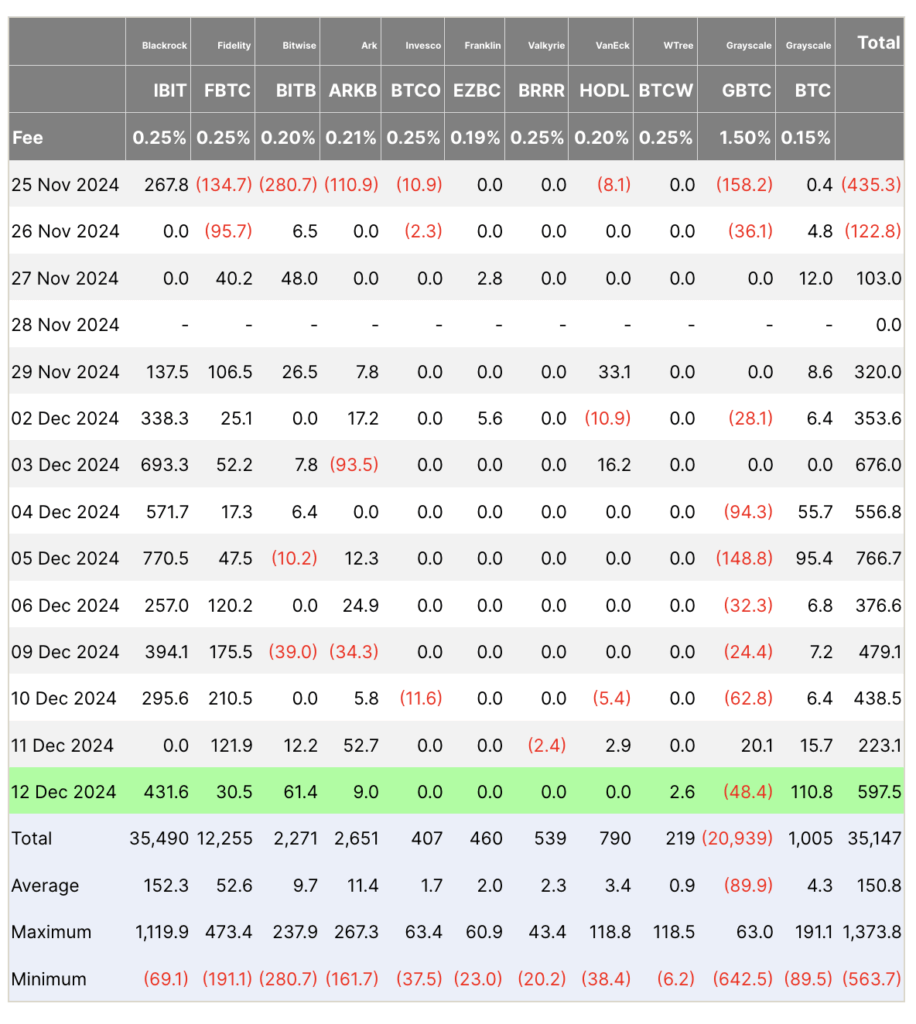

Spot bitcoin ETFs recorded more than $4 billion in combined inflows from Dec. 2 through Dec. 12, according to Farside data. The figures include flows into BlackRock, Fidelity, Bitwise, Ark, Invesco, Franklin, Valkyrie, VanEck, WTree, and Grayscale products. These entries tallied across several funds, moved through the market shortly after Bitcoin surpassed the $100,000 mark on Dec. 5 and continued amid steady price action.

Cumulative totals from Dec. 2 reached $353.6 million, with Dec. 3 adding $676 million, followed by several other days posting hundreds of millions each. Activity slowed on Dec. 11, registering $223.1 million, before rising to $597.5 million on Dec. 12. The aggregate figure across the reporting period exceeded $4.4 billion.

BlackRock and Fidelity contributed strongly to total flows with no outflows and persistent inflows over $100 million. The pattern suggests steady demand during a period when bitcoin traded near record territory.

Bitcoin ETFs (Source: Farside Investors) Analyst

Bitcoin ETFs (Source: Farside Investors) Analyst ![]()

![]()

Liam ‘Akiba’ Wright Editor-in-Chief at CryptoSlate

Also known as “Akiba,” Liam Wright is a reporter, podcast producer, and Editor-in-Chief at CryptoSlate. He believes that decentralized technology has the potential to make widespread positive change.

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

GIPHY App Key not set. Please check settings