Quick Take

On Aug. 8, Bitcoin surged to reclaim the $60,000 mark, a significant recovery from its low of $49,000 on Aug. 5.

Bitcoin

This resurgence in Bitcoin’s price coincided with notable inflows of $194.6 million into Bitcoin ETFs, marking the most significant inflow since July 22. BlackRock’s IBIT led the charge with a $157.6 million inflow, its largest since July 29. Fidelity’s FBTC saw an inflow of $65.2 million, the first since July 26, while Ark’s ARKB and WisdomTree’s BTCW recorded inflows of $32.8 million and $118.5 million, respectively. However, Grayscale’s GBTC experienced a significant outflow of $182.9 million, the largest since April 8.

Bitcoin ETF Flows: (Source: Farside)

Ethereum

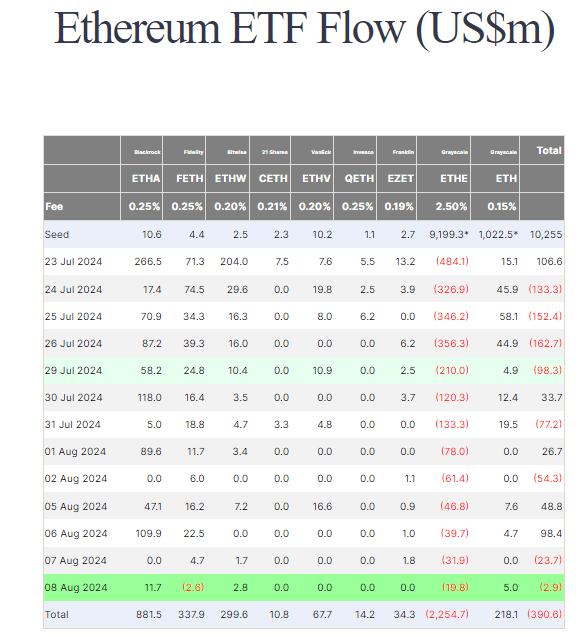

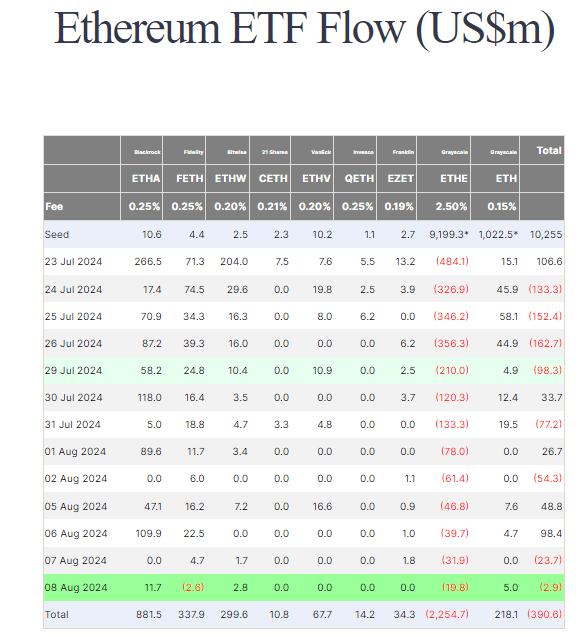

In contrast, Ethereum ETFs experienced a $2.9 million outflow. Grayscale’s ETHE saw reduced outflows of $19.8 million, while BlackRock’s ETHA registered an inflow of $11.7 million. Despite these figures, total outflows for Ethereum ETFs now stand at $390.6 million, according to Farside data.

Ethereum ETF Flows: (Source: Farside)

Ethereum ETF Flows: (Source: Farside)

Bitcoin ETF options are expected to go live in Q4, potentially driving further market activity.

Latest Alpha Market Report

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

GIPHY App Key not set. Please check settings