The US dollar has surged to its strongest levels in years, fueled by optimism surrounding Donald Trump’s return to the presidency.

Over the past year, the dollar has gained ground against major global currencies thanks to a rally fueled by the Federal Reserve rate cuts and the economic challenges of other countries, such as Japan.

US Dollar Index (Source: Tradingview)

Historically, such dollar dominance poses challenges for risk assets like Bitcoin, but the narrative is different this time. The president’s vocal support for the top crypto has created an unusual dynamic that has sparked a sharp rise in Bitcoin’s value since his re-election.

Bitcoin analyst Joe Consorti stated that the flagship digital asset is navigating its longest stretch of dollar strength in over two years.

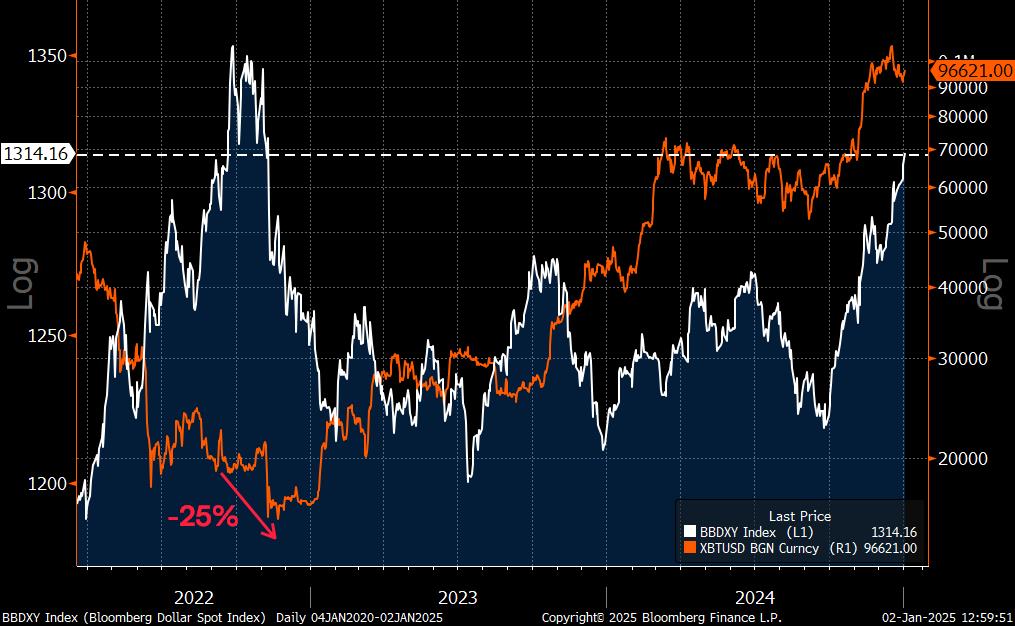

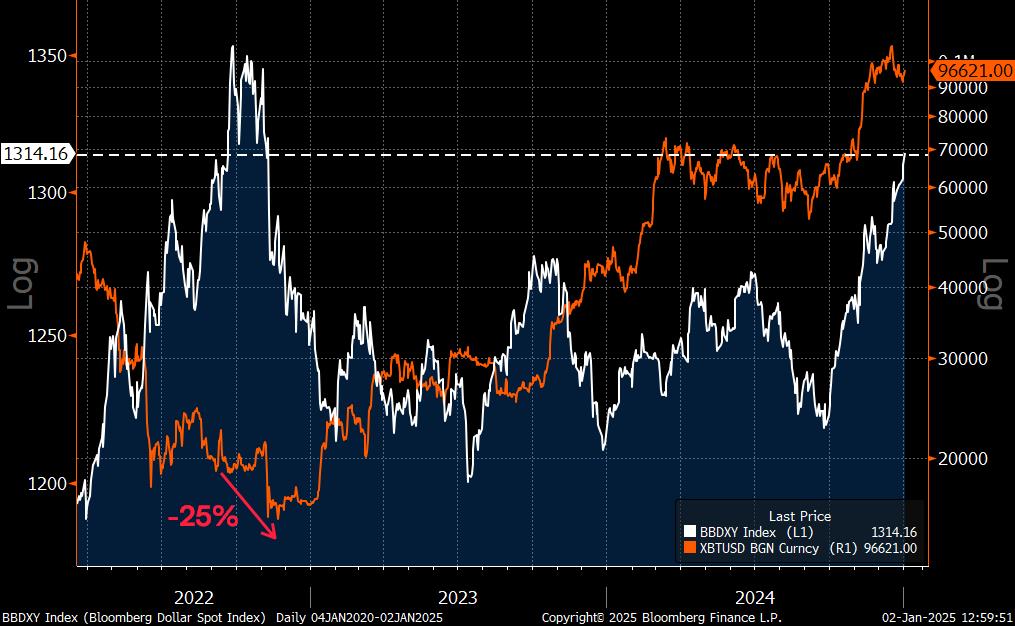

Bitcoin Dollar Performance (Source: X/ Joe Consorti)

Bitcoin Dollar Performance (Source: X/ Joe Consorti)

According to him, historical trends suggest caution as Bitcoin’s value dropped by 25% during the last comparable dollar rally. So far, it has corrected 15%, with potential for further declines as dollar momentum continues.

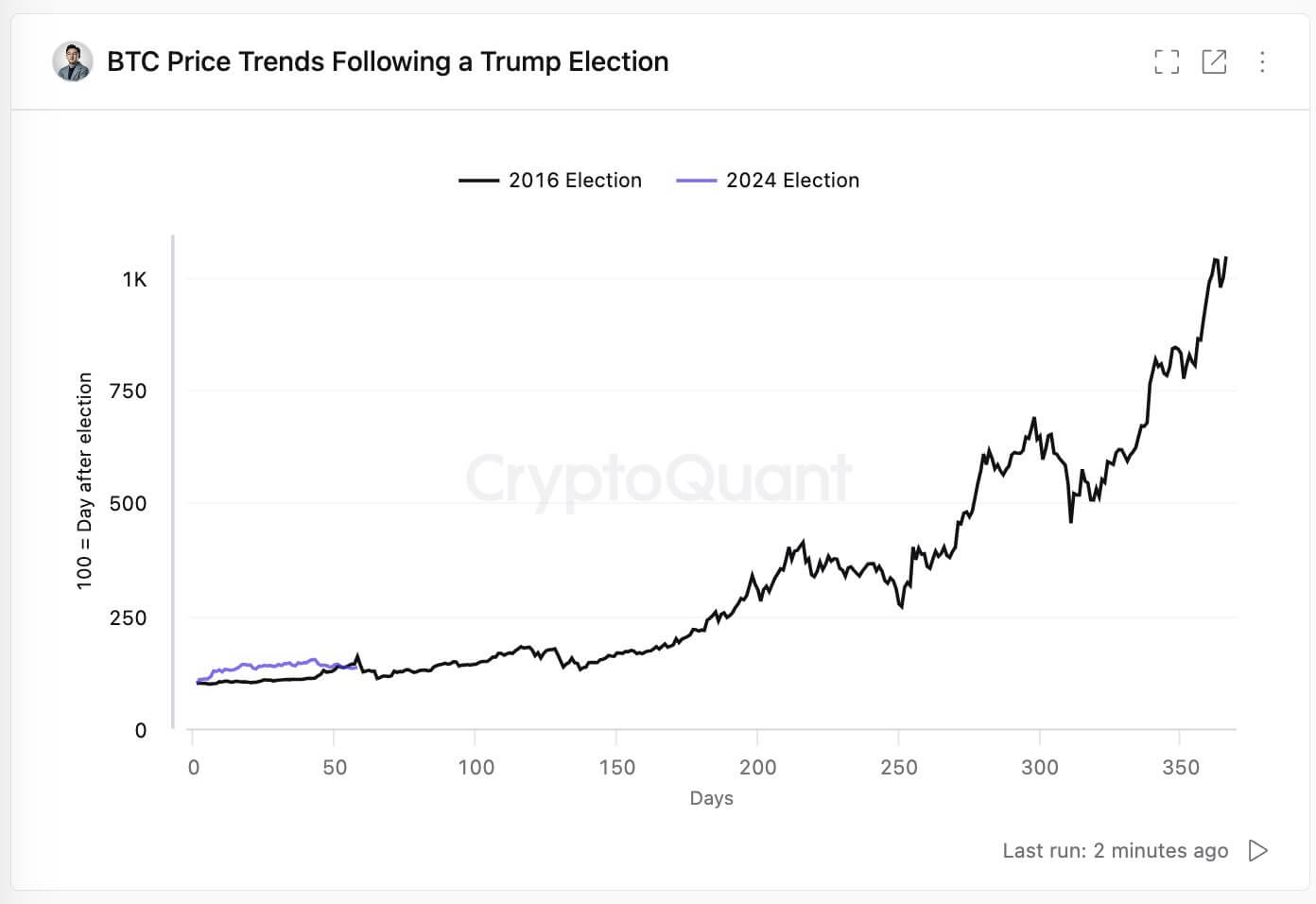

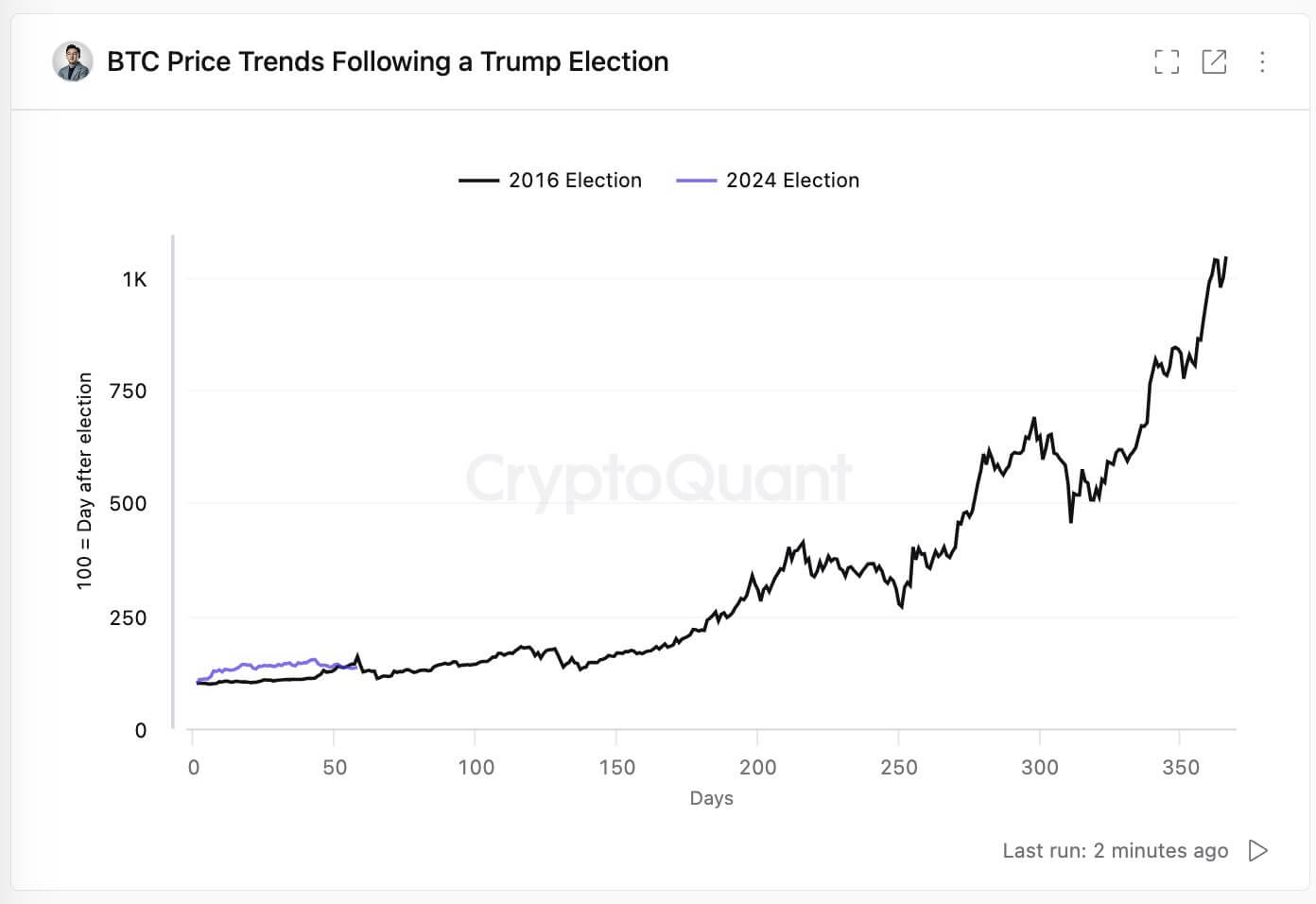

However, optimism persists among industry leaders. CryptoQuant CEO Ki Young Ju pointed out that the Trump administration could usher in a pro-crypto era that would reduce regulatory risks and increase institutional interest, which might drive greater adoption of Bitcoin, stablecoins, and other digital assets.

Bitcoin Performance Under Trump (Source: CryptoQuant)

Bitcoin Performance Under Trump (Source: CryptoQuant)

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

GIPHY App Key not set. Please check settings