small smiles

In my previous article on Blue Owl Capital (NYSE:OBDC) I plotted a rather conservative thesis on this BDC – Blue Owl Capital: There Are 2 Fundamental Showstoppers.

In the article I made it clear that OBDC has indeed some solid fundamentals in place such as diversification across many large-scale businesses, favorable bias towards first lien and senior secured products, and, importantly, a very healthy dividend coverage level that is underpinned by high quality earnings.

However, as the title implies, there were two challenges that I noticed, which made me less bullish on OBDC.

The first and most critical one was related to the underlying portfolio quality, where the weighted average interest coverage of its investments stood at 1.6x, which is certainly not at the high end in the context of how other peers have structured their exposures. Given the pressures in the BDC sector such as spread compression, subdued M&A activity, increasing non-accruals and the increase of systematic risk due to weakening of economy, investing in BDCs that carry average or even below average quality assets is just too risky for me.

The second aspect that held me back from assigning a clear buy rating on OBDC was actually the size issue. While there are multiple benefits from having a sizeable AuM figure as it allows to access cheap financing and diversify, it also comes with a disadvantage of being forced to focus on high ticket size deals for which there is a huge competition from institutional capital. Since the regional banking crisis, many BDCs and large scale private credit players have emerged disrupting the supply and demand dynamics in the upper middle market space. On top of this, we have a subdued M&A and LBO activity, which decreases further the demand for private credit products. All of this leads to two things: 1) yields coming down and 2) securing of sufficient deal volume becoming more difficult. We of these two dynamics we could observe in Q1, 2024 and in several of the prior quarters.

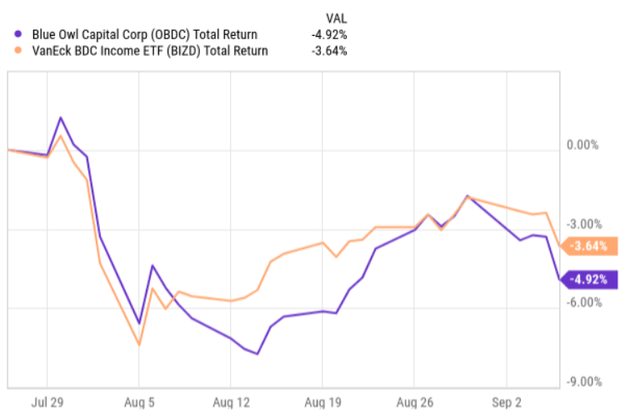

Since the publication of my article the stock price has gone down, registering a slight negative alpha.

Ycharts

However, my thesis was obviously not about shorting OBDC or expecting to see an immediate negative alpha. Instead, my intention was to underscore these structural challenges so that investors could reconsider their current (or prospective) stakes in OBDC and decide whether the position is balanced enough given that the likelihood of OBDC underperforming higher quality BDCs is not immaterial.

Now, relatively recently, OBDC circulated Q2, 2024 earnings deck and announced a merger. Let’s now digest these data points to see whether the case has strengthened or further weakened.

Thesis review

If we look at the Q2, 2024 earnings data, we will notice that OBDC continued to deliver stable results across the board, and in some instances even registering slight improvements relative to the prior quarter.

The NII per share came in at $0.48, which marks a $0.01 of an increase compared to Q1, 2024. Most of this was driven by higher leverage and to a large extent by repayment related income. If we adjusted for the one-off income items (like repayment fees), the result would be almost perfectly flat relative to the previous quarter.

What was surprising to me was that OBDC managed to achieve notable net investment funding surplus amounts even though the upper middle market transaction activity has not yet really opened. During Q2, OBDC originated massive amount of fresh deals (close to $3.3 billion) that was offset by $1.1 billion of repayments, leaving a very nice surplus that has already increased OBDC’s portfolio asset base from which accretive spread capture could take place. As a consequence of this, OBDC’s leverage has ticked up accordingly, reaching 1.2x, which is at the higher end of the capital structure policy.

While all of this could be definitely deemed as a positive sign, the issue around spread compression has not disappeared. Given that the lion’s share of the new investment originations have been associated with refinancing and lending additional capital to primarily existing portfolio companies, the spreads have faced an even greater pressure. For example, the weighted average spread over applicable base rate of new floating rate investment commitments continued to decrease for already fifth quarter in a row. What this means is that the elevated portfolio turnover level that was registered this quarter will push down the overall portfolio yield, which in turn will make it more difficult to grow the NII from here – especially considering the exhausted leverage profile. Yet, for Q3, 2024 I still expect to see either stable or slightly higher NII generation as the uptick in portfolio size has been large enough to offset the unfavorable portfolio turnover (i.e., lower yielding turnover), where full quarter effects have not yet been reported in Q2.

All in all, this is not something that should trigger an exit from OBDC. For instance, the distribution coverage level remain safe at 116% and adjusting for the supplemental dividend, the base dividend coverage lands at 129%, which is one of the highest in the BDC sector. For conservative dividend investors having so huge margin of safety on the dividend coverage is a real asset.

However, there are still some important negatives in place. Here below I have reflected the most critical ones in a condensed manner:

The fact that the leverage profile is largely exhausted limits OBDC’s capacity to meaningfully expand its portfolio without issuing equity, which currently looks like a suboptimal solution given the discount to NAV. Higher leverage increases the risk in the system, which is not what we want during uncertain and volatile times like this. The spread compression imposes direct challenges on the future NII generation, which given the factors above will likely lead to a reduced dividend coverage This quarter we could already see how higher leverage magnifies the negative dynamics in the books – i.e., a slight increase in non-accrual and several minor underperforming positions caused NAV contraction even though the OBDC was able to retain part of the NII generation via a healthy dividend distribution level. In 2025 OBDC will have to refinance $925 million of fixed rate debt that currently yields between 3.75% and 4.0%, which is materially below the current market level financing costs. Once these proceeds get refinanced, the spreads are likely to suffer even further.

Moreover, recently Raymond James downgraded the BDC from Outperform to Market Perform. The reason for this lied in the OBDC’s announcement to merge with Blue Owl Capital Corp. III (NYSE:OBDE) that could highly likely cause some technical drags (e.g., elevated one-off costs, integration risks) on the underlying performance.

I would personally not base my decision to invest (or not) in OBDC due to temporary integration risks that could theoretically render a negative impact on NII results for one or two quarters.

However, by digesting the key aspects of the proposed mergerI just do not any reason to change my investment stance. As we saw in the first chart above, the market seemed to not give any additional benefit to OBDC either.

The idea is that OBDC investors will now benefit from increased scale and diversification that would allow to source cheaper capital. Yet, there are no plans of this merger being immediately accretive to OBDC shareholders, and instead the only quantitative benefits that are expected to be captured over the first couple of quarters after the merger are related to operational synergies (i.e., savings on management fee). This is not that material.

While there are indeed some implicit benefits to this, we have to contextualize this with the fact that now OBDC will be forced to source even greater volumes and find even larger ticket size investment to keep the portfolio size in balance. It will be likely even more difficult to avoid spread compression as for larger ticket size transactions, there is greater amount of institution capital (including traditional banks and public capital markets) that are in the search of large enough investments that produce above average yields.

The bottom line

The Q2, 2024 earnings data largely confirmed my thesis that was outlined in the previous article that OBDC is a fundamentally sound BDC with relatively unattractive NII generation prospects.

While there are several drivers for that, the most significant one is related to its focus on upper middle market loan segment, where after the proposed merger with OBDE the combined BDC will have it even more difficult to safeguard the current spread levels due to a more intense competition in higher ticket size loan (transaction) space.

As a result of this I am maintaining my hold or neutral view on Blue Owl Capital.

GIPHY App Key not set. Please check settings