JHVEPhoto/iStock Editorial via Getty Images

Canadian Tire Corporation (TSX:CTC.A:CA) retails automotive products, petroleum, gardening products, plumbing and electrical products, as well as other products with brands such as Canadian Tire, SportChek, and Mark’s. As the name suggests, Canadian Tire’s operations are in Canada. The company operates over 1400 locations nationwide. In addition to retail operations, Canadian Tire offers financing services in its locations.

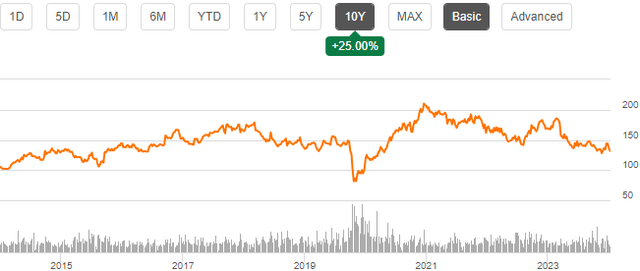

With usually stable operations, Canadian Tire has positioned itself as a good dividend payer – currently, the stock has a dividend yield of 5.32%. The good and growing dividend covers for quite a mediocre stock appreciation in the past decade, especially as Canadian Tire’s stock has been slowly falling from 2021 forward as earnings have softened from a heightened level.

Ten Year Stock Chart (Seeking Alpha)

Long-Term Earnings Profile

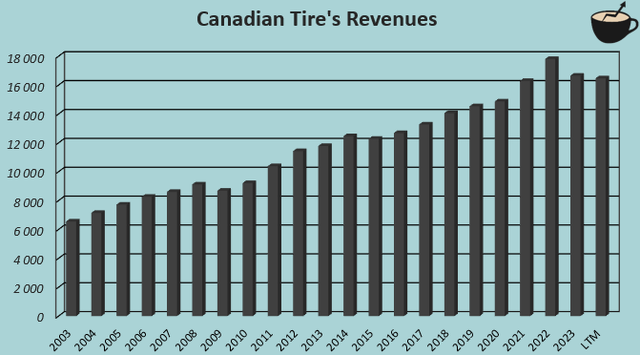

Canadian Tire has grown in a stable manner over the long-term, achieving a revenue CAGR of 4.8% from 2003 to 2023 including a couple of acquisitions and organic growth investments in the retail network. The growth hasn’t come very cheaply, though, as Canadian Tire’s return on equity only stands at 5.2% currently. Over a longer period, the return on equity has been clearly better though with a five-year average of 15.9%.

Author’s Calculation Using TIKR Data

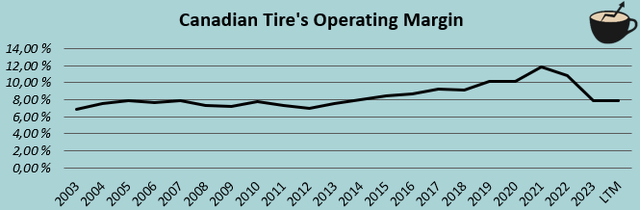

The retail network growth has also been able to drive higher margins over the long term, elevating the operating margin from 6.9% in 2003 to 10.1% in 2019 prior to the Covid pandemic. Since, the margin has fluctuated higher and is currently lower at a trailing 8.0% due to the pandemic’s, and macroeconomic, effects. Still, overall, the company has achieved increasing margins over the long term and continues to achieve stable earnings.

Author’s Calculation Using TIKR Data

Temporary Weakness Meets Tough Comparison Earnings Level

Although Canadian Tire is overall a stable company, it has faced recent earnings pressures – after an operating income of 1.92 billion CAD in 2022, the income has fallen into a current trailing 1.31 billion CAD as sales have fallen from the pandemic peak. The company’s gross margin has stayed incredibly stable, and SG&A hasn’t scaled meaningfully from 2022, but modestly lower revenues have contributed with negative operating leverage into lower margins.

In 2023, revenues fell by -6.5%, and the Q1/2024 results followed with -4.9% in year-over-year revenues. The revenues are a reversal of incredibly strong revenues during the Covid pandemic – in 2020, Canadian Tire achieved a strong 16% growth in comparable sales, well above inflation in Canada in the period. Sales increased by 9.6% in 2021 and by 9.3% in 2022 with the pandemic boosting demand for many of the company’s offered products. While the current revenue declines are related to macroeconomic turbulence, I believe that the majority of the recent decline in earnings is due to a normalization into historical demand. From 2019 to current trailing revenues, Canadian Tire has grown revenues at a CAGR of 3.0%. The growth is slightly below Canada’s inflation in the period, also pointing towards some signs of the communicated macroeconomic pressure affecting sales.

To me, it seems that some elevation in revenues should be seen in the medium term as macroeconomic pressures relieve, likely also bringing the operating margin closer to the pre-pandemic level. Investors shouldn’t expect the earnings level achieved during 2021 and 2022 in the next few years, but healthy increases seem to be a reasonable expectation.

Private Label Growth Aids Margin Expansion

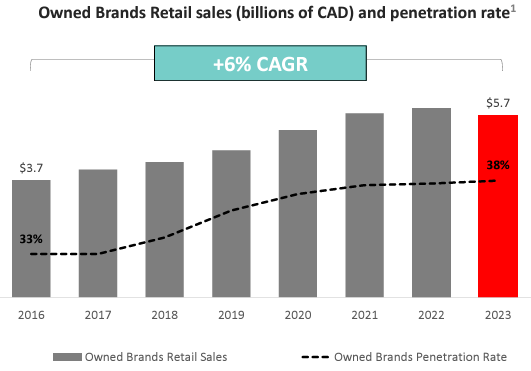

Private label sales have been a great long-term earnings driver. Canadian Tire sells a range of self-owned brands including Paderno, Motomaster, and Mastercraft. In 2023, self-owned brands already accounted for 38% of the company’s retail sales. Canadian Tire continues to push for higher penetration in the brands, as the company is able to generate higher gross profit from the private label brands, driving earnings growth.

CTC.A March 2024 Investor Presentation

Continued growth in the penetration should contribute into margins positively, and already seems to be a significant driver in the long-term margin expansion. Room for further penetration is starting to get smaller, though, making significant growth in private label sales more challenging.

Valuation Provides a Good Earnings Yield

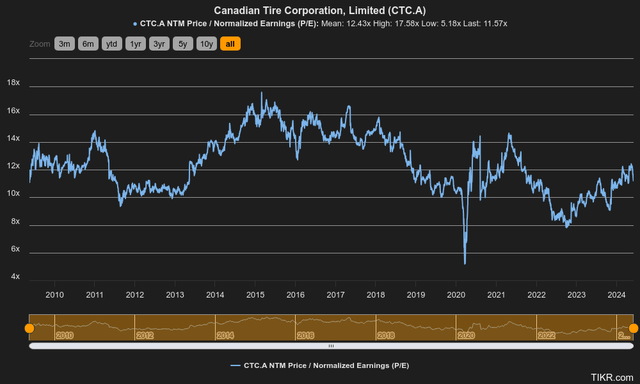

Currently, Canadian Tire’s stock trades at a forward P/E of 11.6, very slightly below the 15-year average of 12.4. In my opinion, the earnings multiple seems to price in quite a stable performance going forward, although some earnings elevation should be seen afterwards as macroeconomic pressures subside.

Forward P/E (TIKR)

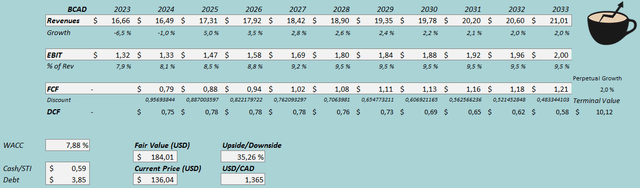

To estimate a fair value for the stock, I constructed a discounted cash flow model (DCF model). In the model, I estimate stable revenues in upcoming 2024 quarters, leading to a -1% revenue fall in the year. Afterwards, I estimate a growth of 5% in 2025 due to a better macroeconomic situation aiding demand. After 2025, I estimate a gradual slowdown into a 2% perpetual growth.

As sales get healthier, I estimate margin expansion from 7.9% in 2023 into a sustained level of 9.5%, slightly below the 10.1% achieved already in 2019 – I believe that the estimate is a good, conservative baseline expectation. Canadian Tire has a healthy cash flow conversion, although increasing working capital needs and some expansion capital expenditures should weaken the conversion slightly.

With these estimates, the DCF model estimates Canadian Tire’s fair value at $184.01, around 35% above the stock price at the May 31st close – at the current price after a stock price fall from 2021 highs, the stock represents an attractive opportunity when eyeing a potential earnings recovery.

DCF Model (Author’s Calculation)

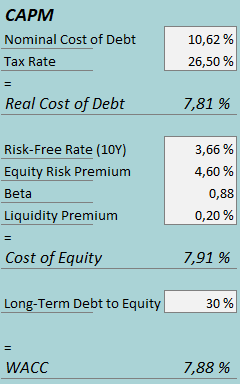

A weighted average cost of capital of 7.88% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, Canadian Tire had around 102 million CAD in interest expenses. With the company’s current amount of interest-bearing debt, Canadian Tire’s annualized interest rate comes up to quite a high figure of 10.62% – I believe that interest expenses also cover capital leases which I don’t account as interest-bearing debt for financing purposes. I estimate a long-term debt-to-equity ratio of 30%, slightly lower than currently. For the risk-free rate on the cost of equity side, I use Canada’s 10-year bond yield of 3.66%. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for Canada, updated on the 5th of January. Seeking Alpha estimates Canadian Tire’s beta at a figure of 0.88. Finally, I add a small liquidity premium of 0.2%, creating a cost of equity of 7.91% and a WACC of 7.88%.

Takeaway

Canadian Tire has a long-term track record of driving modest & stable revenue growth through the company’s retail network expansion. Margins have also been expanded over the long term with good operating leverage and increased penetration in private label sales. While the company is currently facing sales declines from strong pandemic-period financials and current macroeconomic pressures also pressuring margins, the medium-term outlook is fairly good with Canadian Tire’s stable track record. The current valuation seems to leave an undervaluation on the stock – I initiate the stock at buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

GIPHY App Key not set. Please check settings