Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Soccer price of the lion and players some soft. Each arcu lorem, ultricies any kids or, ullamcorper football hate.

This article is also available in Spanish.

Cardano (ADA) is trading at a critical juncture after several days of sideways consolidation around the $0.70 level. While bulls have attempted to defend this zone, upward momentum has faded, and selling pressure is beginning to mount. The market appears hesitant, with traders uncertain about the next directional move amid growing volatility across the crypto space.

Related Reading

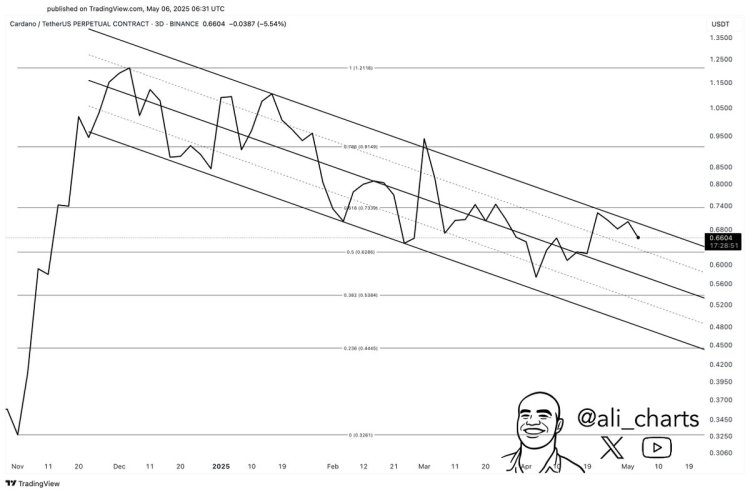

Crypto analyst Ali Martinez recently shared a technical analysis indicating that Cardano has been rejected at the top of its descending channel. This key resistance trendline has capped multiple rally attempts in recent months. This rejection suggests that ADA may be poised for another leg down, especially if broader market sentiment continues to weaken.

If the current pressure persists and bulls fail to reclaim higher levels, Cardano could be on track to retest lower support zones. With momentum fading and technical rejection in play, the coming days could determine whether Cardano stabilizes or faces deeper downside in the short term. Traders and investors are advised to watch closely as ADA teeters on the edge of a potential breakdown.

Cardano Faces Pullback After Rallying 40% From April Lows

Cardano is trading at its lowest level in two weeks, following a failed attempt to reclaim higher supply zones near the top of its descending channel. After gaining over 40% from its early April lows, ADA showed strong signs of a potential trend reversal. However, recent price action has stalled, and the altcoin now finds itself under renewed selling pressure as broader market uncertainty weighs on momentum.

Martinez highlighted that Cardano was recently rejected at the upper boundary of its descending channel—a technical level that has acted as resistance for months. This rejection has opened the door to a possible move lower, with downside targets at $0.63 and $0.54 if bearish pressure continues to mount. These levels coincide with previous demand zones and could serve as critical support for a potential rebound.

Cardano fails to break at the top of the descending channel | Source: Ali Martinez on X

Cardano fails to break at the top of the descending channel | Source: Ali Martinez on X

Despite the short-term weakness, Cardano’s longer-term setup still holds promise. The sharp recovery in April demonstrated strong interest from buyers, and if ADA can reclaim resistance near $0.75–$0.80, the rally could quickly regain traction. Until then, the market remains in a wait-and-see mode.

Meanwhile, macroeconomic tensions—from global trade disputes to uncertainty over US monetary policy—continue to drive volatility across financial markets. The entire crypto sector is currently ranging below key resistance levels, and Cardano is no exception. For now, ADA traders are watching closely to see whether the current pullback leads to deeper losses or offers a new entry point ahead of the next leg up. The next few days will be pivotal in defining the direction of Cardano’s price action.

Related Reading

ADA Price Analysis: Testing Crucial Demand

Cardano is currently trading at $0.6563, marking its lowest level in two weeks and signaling growing bearish momentum. After consolidating near $0.70, the price failed to reclaim the 200-day EMA at $0.7101 and remains well below the 200-day SMA at $0.7797. This rejection from both long-term moving averages reflects weak bullish conviction and confirms that ADA is still trading within a broader downtrend.

ADA trading below the 200-day EMA | Source: ADAUSDT Chart on TradingView

ADA trading below the 200-day EMA | Source: ADAUSDT Chart on TradingView

Volume has remained relatively flat during the recent dip, suggesting a lack of strong buyer support at current levels. The price structure also shows ADA struggling to establish higher lows, which raises the risk of a deeper retracement. If selling pressure continues, ADA could move toward the next key support around $0.63. A breakdown below that level could expose the market to further downside toward $0.54, aligning with the lower boundary of the descending channel identified by analysts like Ali Martinez.

Related Reading

To regain bullish momentum, Cardano must break back above $0.70 and hold it as support. Until that happens, the bias remains to the downside. For now, traders should closely monitor volume shifts and broader market sentiment, as ADA teeters on the edge of a potential breakdown within its long-term bearish structure.

Featured image from Dall-E, chart from TradingView

GIPHY App Key not set. Please check settings