Costco – known for its membership-based business model and massive warehouse stores – has not only redefined retail but has also consistently demonstrated robust financial performance, making it a beacon for investors seeking stability and growth. As a result, there a myriad reasons why Costco’s stock is considered by many as a ‘stock to own forever.’

From its unwavering commitment to customer satisfaction and employee welfare to its strategic growth initiatives and resilient business model, Costco delivers on nearly every front. Whether you’re a seasoned investor or new to the stock market, understanding the unique position Costco holds in the retail sector and its potential for sustained long-term growth could be pivotal in making informed investment decisions.

Costco Stock Is a Dividend Growth Stock

A dividend growth stock is a company that raises its dividend payout consistently over time. Costco is one of these kinds of companies. Here is Costco’s share price and dividend payments over the last 10 years.

Over time, the amount Costco has paid in dividends has also climbed dramatically. At the beginning of 2014, dividends were hitting $0.31 per share, but as of the start of 2024, dividends were sitting at $1.02 per share. That’s an increase of approximately 230 percent.

Costco occasionally pays out special dividends, giving shareholders an unexpected boost. For example, in December 2023, there was a payout of $15.00 per share, and that was in addition to the regular quarterly dividends. A similar (though smaller) special dividend was paid in December 2020, giving investors an additional $10.00. May 2017 had a $7.00 special dividend, and there were many others before that date.

Ultimately, Costco had a revenue figure of $253.45 billion for the 2024 fiscal year. That represented a 5.02 percent year-over-year increase. Generally, shareholders aren’t surprised by Costco’s success, and that’s why COST is considered a dividend growth stock worth holding.

Costco Stock Projections

As of October 2024, Costco’s stock price sat at $890.75, representing a high point for not just the past 12 months but also the company’s entire history on the market. While some may assume that means buying COST now isn’t a great move, that isn’t necessarily the case. Professional stock raters have a mixed assessment of the company primarily based on the recent run up in pricing.

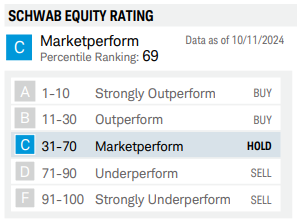

For example, Schwab rates Costco as a hold, based on growth and valuation.

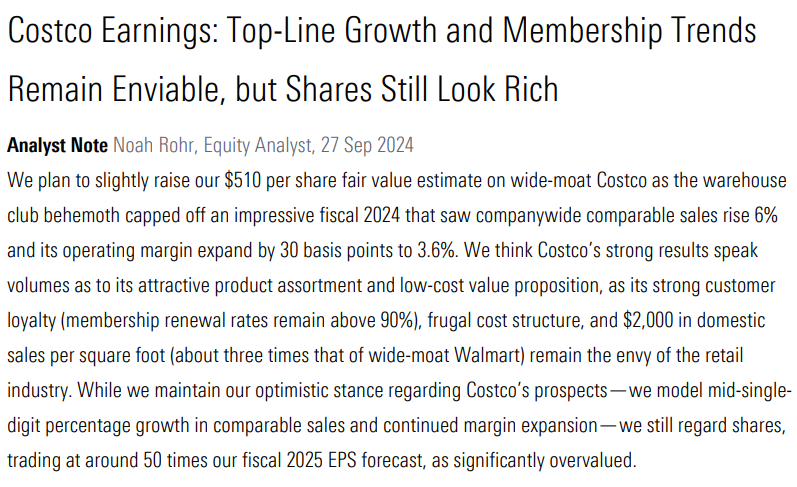

Morningstar gives Costco 1 out of 5 stars, largely citing the stocks current valuation. Here is an excerpt of their latest report:

However, while Costco’s share price is high, these professional ratings maybe somewhat out of touch with Costco’s store economics.

Costco is seeing its in store sales rise consistently, and it’s domestic sales are beating Walmart – the retail giant often seen as Costco’s biggest competitor – in that department. Costco’s e-commerce sector is also rebounding. Plus, the company is increasing its membership prices (something that occurs approximately every 5 to 6 years), while retaining about 91% of its members on annual basis, creating avenues for additional revenue.

Finally, Costco’s pace of warehouse growth appears to be accelerating. In fiscal year 2024, Costco opened 30 stores – up from 23 in 2022 and 2023. And, in addition the company plans to open an additional 29 locations in 2025 (source: fool.com).

Is Costco Stock Safe?

While it’s true that stocks are considered the most risky type of investing asset class, pending any major changes in Costco’s business conditions, the shares are generally considered a safe bet.

The company has an excellent history of financial stability a good reputation and an incredibly loyal customer base, both of which play in shareholders’ favor. In addition, the company currently has $9.9 Billion in cash and $1.2 Billion in short term investments, suggesting it has substantial cash to weather any challenges.

Currently, there are 890 Costco Warehouse stores, and the retailer has a presence in 47 states, Puerto Rico, Canada, and many other countries. Plus, Costco.com gives customers another convenient way to shop. As a result, Costco is generally accessible – even with the membership requirement – and fans of the store continue to flock to it for bargains. For investors, that creates growth opportunities not just today but well into the future.

Do you own Costco stock? If so, do you think you’ll keep it forever? If you don’t have any Costco stock, is there a specific reason you’re steering away from this investment option? Share your thoughts in the comments below.

Read More:

Does Costco Offer a Free One-Day Guest Pass?

Money Wasters: Don’t Purchase These Items from Costco

Source link

GIPHY App Key not set. Please check settings