Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Soccer price of the lion and players some soft. Each arcu lorem, ultricies any kids or, ullamcorper football hate.

This article is also available in Spanish.

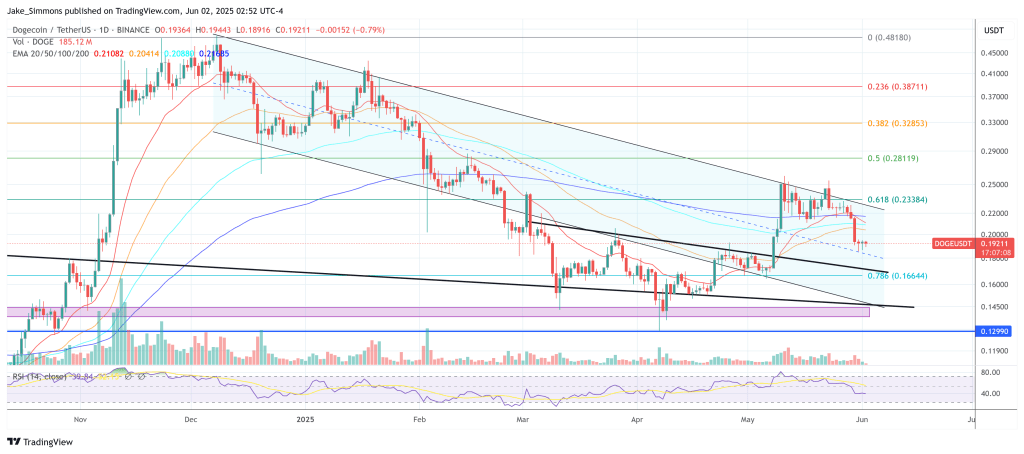

Dogecoin begins June balanced on the knife-edge of a major technical fulcrum, its next decisive swing likely to be dictated by a narrow band of support that both Kevin (@Kev_Capital_TA) and Cantonese Cat (@cantonmeow) have brought into sharp relief.

Dogecoin Showdown At $0.19

On Kevin’s daily view the focus is the $0.1901–$0.1839 corridor. The zone is not arbitrary: it is anchored by the 50 percent Fibonacci retracement of the explosive May 11 surge ($0.2597) and is buttressed overhead by the 0.618–0.65 retracement cluster at $0.1976 and $0.2005.

Related Reading

Friday’s long red candle sliced through the Ichimoku conversion line and halted within a whisker of that 0.50 fib, producing the first genuine retest of the newly minted floor. A daily close below would expose the 0.382 marker of the same leg at $0.1694 and, beyond that, the lower rail of the multi year-long descending trend line now angling toward the $0.14s later this month. Conversely, a sustained bid inside the band would confirm it as the staging ground for another upside attempt toward the 0.703 extension at $0.2117.

Dogecoin technical analysis, 1-day chart | Source: X @Kev_Capital_TA

Dogecoin technical analysis, 1-day chart | Source: X @Kev_Capital_TA

Cantonese Cat’s analysis frames the identical area as the neckline of an inverse head-and-shoulders carved out over three months. The mid-March swing low formed the left shoulder, the early-April capitulation produced a deeper head, and the early-May trough completed the right shoulder.

The neckline—shaded turquoise between roughly $0.187 and $0.194—was pierced decisively on May 9, after which price has drifted back for a textbook throw-back retest. Holding the neckline keeps the reversal intact; slipping beneath it would void the pattern and hand momentum back to bears.

Dogecoin inverse head and shoulders pattern, 1-day chart | Source: X @cantonmeow

Dogecoin inverse head and shoulders pattern, 1-day chart | Source: X @cantonmeow

Long-Term DOGE Outlook Remains Bullish

A broader perspective comes from Cantonese Cat’s monthly chart, where Dogecoin has printed seven straight inside the $0.16 to $0.42 range. That compression appears within a primary bullish trend defined by successive higher highs (May 2024 and November 2024) and higher lows (August 2024 and April 2025).

Related Reading

Inside-bar squeezes of this length rarely remain dormant: statistically the break often travels a distance comparable to the range of the parent candle—about 26 cents in this case—once either side wrests control. Until that break arrives, the $0.16 floor and the $0.42 ceiling of November’s wick delineate the outer limits of consolidation.

Dogecoin price analysis, 1-month chart | Source: X @cantonmeow

Dogecoin price analysis, 1-month chart | Source: X @cantonmeow

Resistance overhead remains layered. Should buyers defend the neckline and reclaim the $0.20 handle, Kevin’s $0.2117 extension becomes the first waypoint. Beyond lies the $0.25–$0.26 band, which capped May’s rally. A clean move through that shelf would almost certainly signal that the monthly compression has resolved higher and put the $0.29 figure line on the radar.

For now, however, the market’s field of vision has narrowed to a stripe barely one cent wide. It is here—between $0.190 and $0.184—that the memecoin’s inverse head-and-shoulders neckline meets Kevin’s critical Fibonacci shelf. As the analysts agree, Dogecoin’s immediate fate hinges on whether that ledge holds or crumbles in the days ahead.

At press time, DOGE traded at $0.19211.

DOGE needs to hold the mid-line of the channel, 1-day chart | Source: DOGEUSDT on TradingView.com

DOGE needs to hold the mid-line of the channel, 1-day chart | Source: DOGEUSDT on TradingView.com

Featured image created with DALL.E, chart from TradingView.com

GIPHY App Key not set. Please check settings