The launch of spot Ethereum ETFs has yet to live up to the market’s initial optimism, as reflected in their performance over the past few weeks.

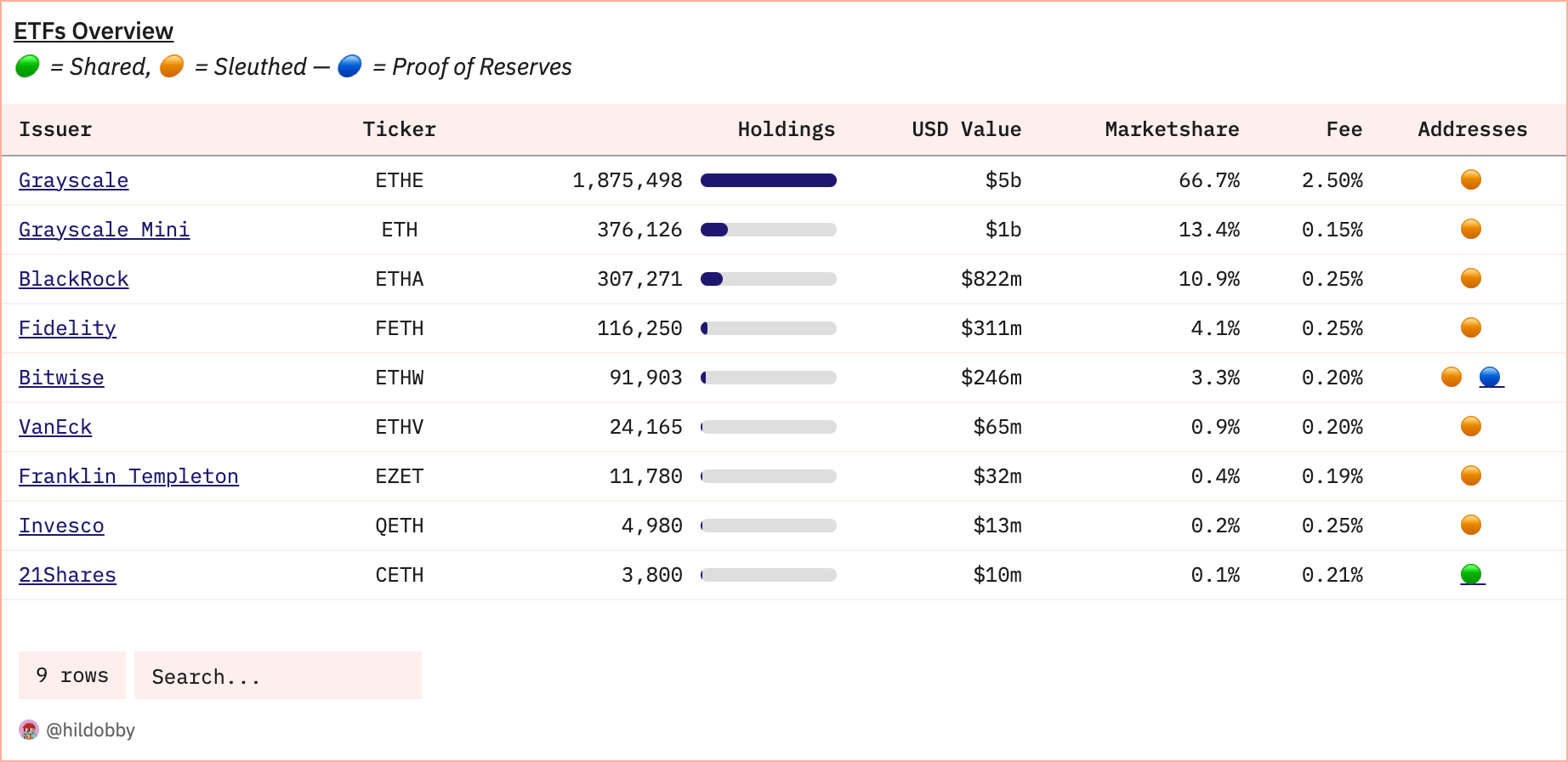

The Ethereum ETFs’ total on-chain holdings currently stand at approximately 2.81 million ETH, valued at around $7.33 billion, which accounts for about 2.3% of Ethereum’s total supply.

Despite these significant holdings, the net flows since launch have been negative, with a total outflow of 136,700 ETH.

Graph showing spot Ethereum ETF flows from July 24 to Aug. 19, 2024 (Source: Dune Analytics)

The outflows are primarily attributable to Grayscale’s ETHE, which recorded a withdrawal of $487.88 million on the first trading day alone. Other Ethereum ETFs have seen consistent inflows, but these have not been sufficient to offset the drag from ETHE.

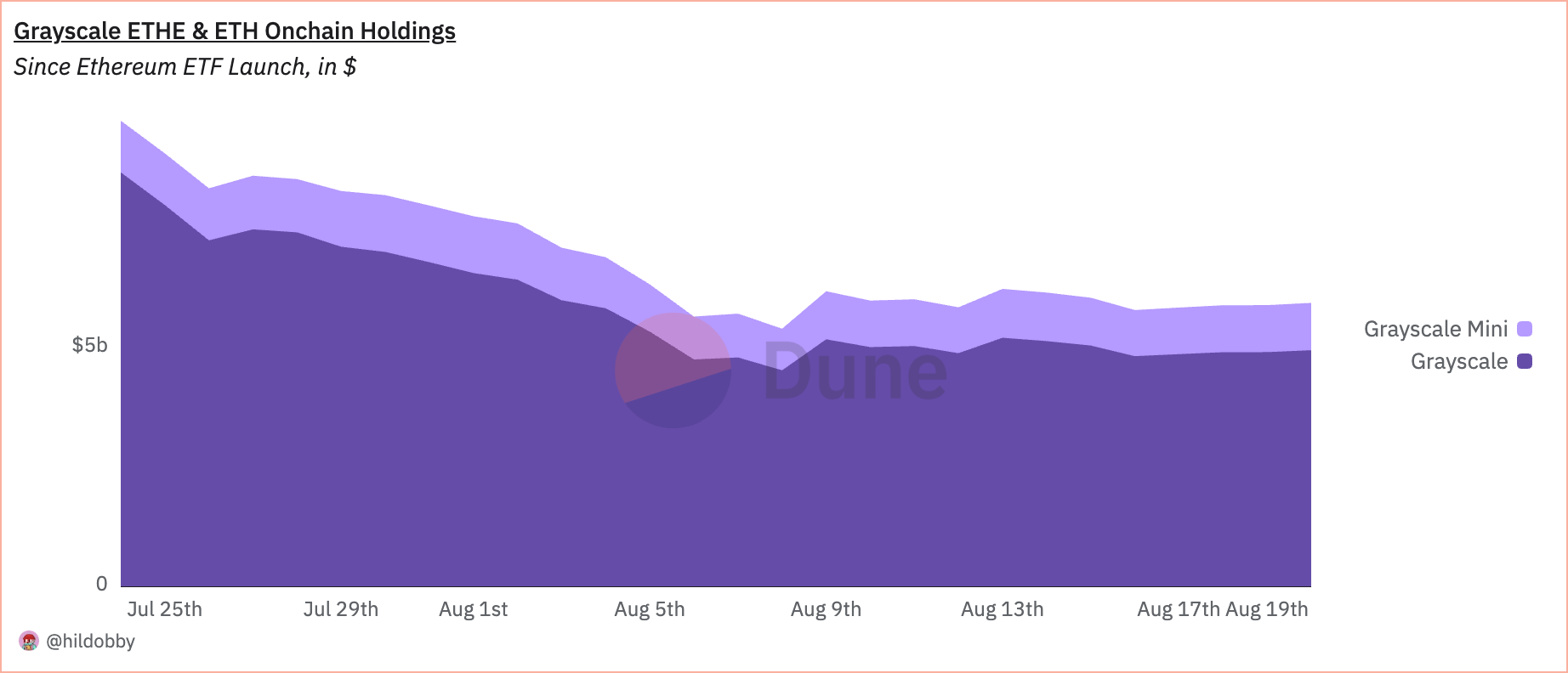

Graph showing Grayscale’s ETHE and ETH holdings from July 24 to Aug. 19, 2024 (Source: Dune Analytics)

Graph showing Grayscale’s ETHE and ETH holdings from July 24 to Aug. 19, 2024 (Source: Dune Analytics)

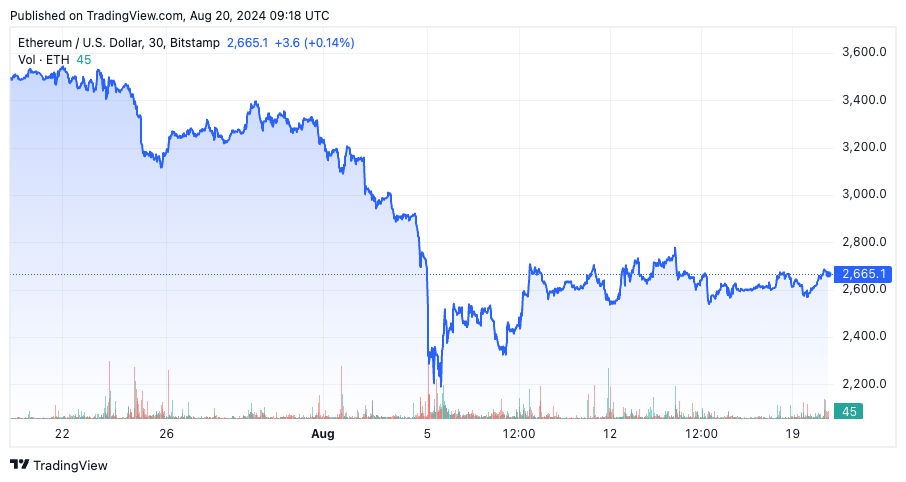

The market’s reaction to these outflows has been reflected in Ethereum’s price, which has struggled to maintain momentum post-launch. After an initial rise in anticipation of the ETF launches, Ethereum’s price dropped significantly, hitting a low of $2,338 on Aug. 7.

Although there has been some recovery since then, with prices hovering around $2,600, the overall sentiment remains cautious. The broader market downturn has compounded this uncertainty, leading to a lack of clear upward momentum for Ethereum.

Graph showing the price of Ethereum from July 20 to Aug. 20, 2024 (Source: CryptoSlate ETH)

Graph showing the price of Ethereum from July 20 to Aug. 20, 2024 (Source: CryptoSlate ETH)

Adding to the complexity, the Ethereum futures market has shown a marked increase in leverage ratios, signaling heightened risk-taking among traders. This spike in leverage suggests that while some investors are betting on short-term price movements, the broader sentiment remains volatile. The market’s reaction to these leveraged positions could further exacerbate price fluctuations, particularly if negative sentiment continues to dominate.

Despite these challenges, there is still a significant institutional interest in Ethereum-based financial products. BlackRock’s iShares Ethereum Trust (ETHA) has consistently attracted some of the highest inflows among Ethereum ETFs, signaling that not all players are bearish on Ethereum’s long-term prospects.

Table showing the total ETH holdings and market share of spot Ethereum ETFs on Aug. 19, 2024 (Source: Dune Analytics)

Table showing the total ETH holdings and market share of spot Ethereum ETFs on Aug. 19, 2024 (Source: Dune Analytics)

Moreover, the overall market for Ethereum ETFs has shown some positive movement, with occasional days of net inflows, particularly as outflows from ETHE have begun to slow. This has led some analysts to speculate that the worst of the outflows may be over, potentially setting the stage for a recovery in both ETF flows and Ethereum’s price.

The current state of Ethereum ETFs shows that the market is still finding its footing amid broader volatility and specific challenges related to Grayscale’s ETHE.

While the initial performance has been underwhelming compared to spot Bitcoin ETFs, the slowing outflows from ETHE and continued institutional interest suggest that there may be room for optimism in the medium to long term.

However, for now, Ethereum and its ETFs remain in a precarious position, with its future performance likely tied closely to broader market trends and the actions of major institutional players.

The post Grayscale outflows overshadow Ethereum ETF inflows appeared first on CryptoSlate.

GIPHY App Key not set. Please check settings