Dzmitry Skazau

Market overview

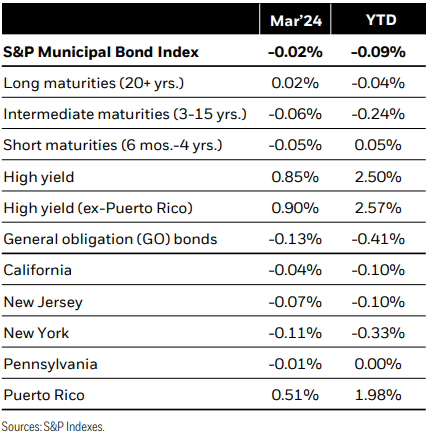

Municipal bonds posted marginally negative performance in March amid heightened macro uncertainty. Interest rates were volatile but ended slightly firmer as stronger-than-expected economic data was counterbalanced by dovish guidance from the Federal Reserve. Municipals underperformed comparable Treasuries across the curve, bogged down by rich valuations and weakening supply-and-demand dynamics. The S&P Municipal Bond Index returned -0.02%, bringing the year-to-date total return to -0.09%. Lower-rated credits and the 15-year part of the yield curve performed best.

Issuance, propelled by several large deals, increased to $36 billion in March and outpaced reinvestment income from maturities, calls, and coupons by over $12 billion. After benefiting from several months of net negative issuance, the transition back to net positive supply acted as a considerable drag. Deals were oversubscribed just 4.0 times on average, below the year-to-date average of 4.5 times, with higher-quality issues struggling even more. Luckily, demand remained firm, with the asset class garnering consistently positive mutual fund flows.

Looking ahead, April has been one of the worst-performing months over the past five years, which we believe warrants continued caution. We anticipate that seasonal supply-and-demand dynamics will remain a near-term headwind. Issuance is expected to tick up in April, while reinvestment income is expected to further decline, exacerbating the onus of net positive supply. At the same time, demand tends to wane mid-month as investors raise cash to fund their tax bills. Amid this backdrop, we remain patient but would view any material cheapening as an opportunity to put money to work at more attractive levels.

Strategy insights

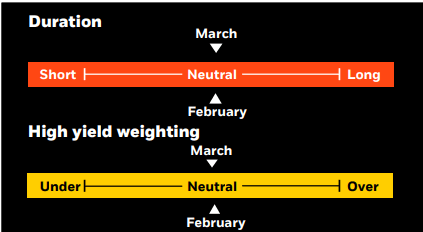

We favor a neutral duration posture overall. We continue to advocate a barbell yield curve strategy, pairing front-end exposure with an increased allocation to the 15-20-year part of the curve. We prefer single-A rated credits but think high yield offers an attractive risk-reward opportunity, given favorable structures and the ability to generate alpha through security selection.

Overweight

States that primarily rely on consumption taxes Essential-service revenue bonds Flagship universities Select issuers in the high-yield space

Underweight

States overreliant on personal income taxes, especially California Speculative projects with weak sponsorship, unproven technology, or unsound feasibility studies Senior living and long-term care facilities Lower-rated private universities Stand-alone and rural health providers

Credit headlines

The Metropolitan Transportation Authority (MTA) board approved the agency’s congestion pricing toll plan, the first such program in the nation. Most passenger and small commercial vehicles entering the Manhattan central business district (CBD), defined as local streets and avenues south of and inclusive of 60th Street, will be required to pay $15 (EZ Pass rate) during peak traffic periods from 5 a.m. to 9 p.m. on weekdays and from 9 a.m. to 9 p.m. on weekends. These vehicles will pay only once daily. Trucks and some buses will be charged $24 or $36 depending on their size and use during peak hours. The roughly $1 billion in expected toll receipts annually is statutorily dedicated to MTA capital improvements, reducing the pressure on other revenue streams to fund capital needs. Tolls in the CBD could also increase mass transit use. While the outcome of several lawsuits against the program remains, a major hurdle was cleared last year when the Federal Highway Administration found no significant environmental impact from the plan. According to the MTA, nearly all toll readers have been set up in the designated 110 locations, and tolling is expected to start June 15. Even with a smooth transition on the scheduled start date, risks to the tolling program include any future changes to the toll rate structure and potential exemptions.

Total state government tax revenues rebounded nicely in the fourth quarter of 2023 with overall tax revenues increasing by 5.6%, compared to the same quarter in 2022. All three of the largest tax streams outpaced receipts, compared to the same quarter last year. Sales taxes rose 2.7%; personal income taxes were up 9.4%; and corporate taxes increased by 15.0%. The increase in revenues ended four prior quarters of declines, as state receipts appear to be normalizing.

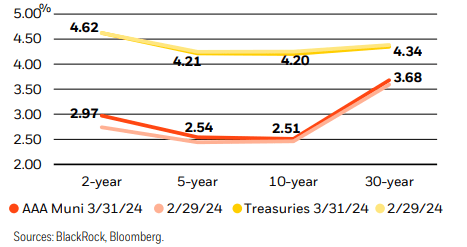

Municipal and Treasury yield movements

Municipal performance

Investment involves risk. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. There may be less information available on the financial condition of issuers of municipal securities than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. A portion of the income from tax-exempt bonds may be taxable. Some investors may be subject to Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of March 7, 2024, and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to pass. Any investments named within this material may not necessarily be held in any accounts managed by BlackRock. Reliance upon information in this material is at the sole discretion of the reader.

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BlackRock is a trademark of BlackRock, Inc or its affiliates. All other trademarks are those of their respective owners.

Prepared by BlackRock Investments, LLC, member FINRA.

Not FDIC Insured • May Lose Value • No Bank Guarantee

This post originally appeared on the iShares Market Insights.

GIPHY App Key not set. Please check settings