hapapapa

Brief Review Of Nvidia’s Q2 FY2025 Report

Ahead of its Q2 FY2025 earnings print, Nvidia Corporation (NASDAQ:NVDA) was projected to achieve quarterly revenues and Normalized EPS of $28.71B and $0.64, respectively.

Nvidia Q2 FY2025 Estimates

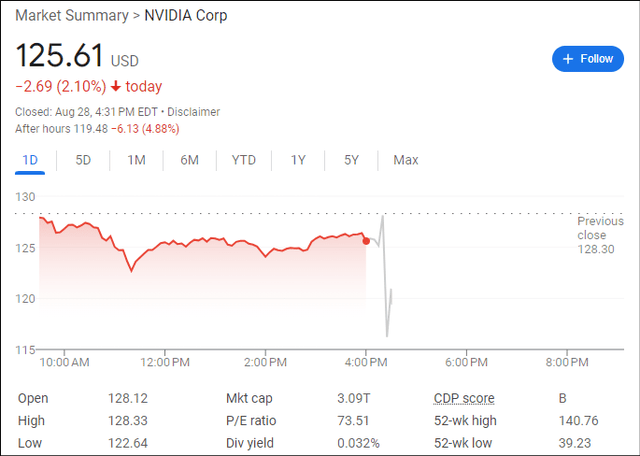

With Nvidia posting $30.04B in revenues and $0.68 in normalized EPS for Q2 FY2025, the semiconductor giant has delivered yet another double-beat on consensus street estimates; however, the stock is tumbling lower in the after-hours session, down -5% at the time of writing:

Google Finance

While Nvidia is still delivering AI-powered hypergrowth, the quantum of the top and bottom-line beats narrowed further in Q2 amid a contraction in gross margins. Given the post-ER sell-off, I think it is fair to say that Nvidia failed to meet Mr. Market’s lofty pre-ER expectations.

In my earnings preview note, I expressed caution on NVDA:

Ahead of its upcoming Q2 FY2025 report, Nvidia Corporation stock is experiencing significant volatility. While a double beat is likely, the sustainability of Nvidia’s rapid growth and high margins remains uncertain. Despite Nvidia’s strong business performance and leadership in the burgeoning AI chips market, I maintain a “Neutral/Hold” rating due to valuation concerns and a troublesome technical setup.

Source: “Nvidia: You Have Been Pumped And Warned By The Cloud Hyperscaler Honchos.”

And given the adverse market reaction to Nvidia’s double-beat (plus solid Q3 guidance of $32.5B ($800M above consensus estimate) and announcement of a new $50B buyback program), my neutral stance seems justified.

But let’s dig deeper into the numbers!

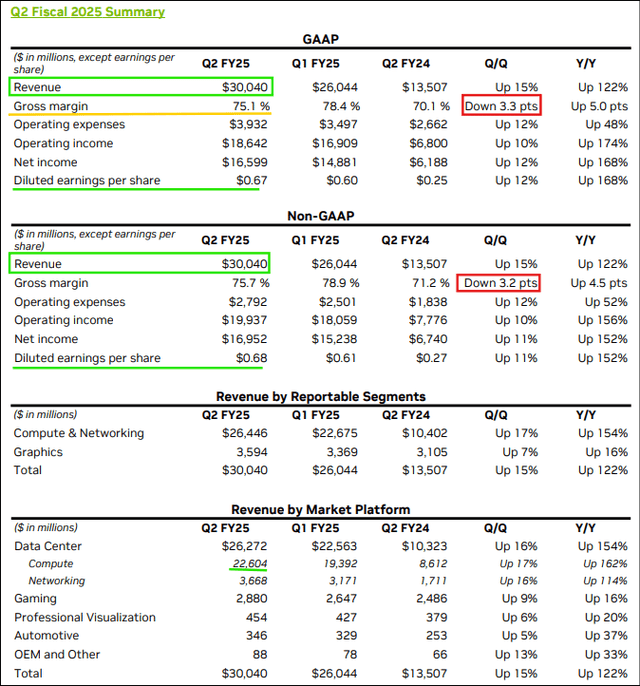

Nvidia Investor Relations

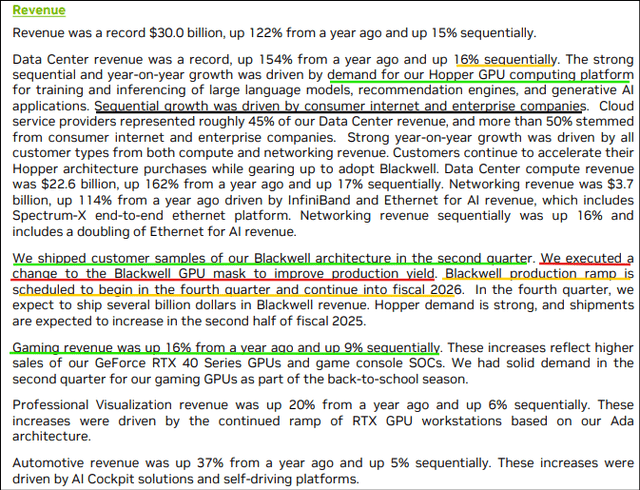

In Q2 FY2025, Nvidia’s Data Center revenue increased to $26.27B (+154% y/y, +16% q/q) driven by strong demand for Nvidia’s Hopper GPU computing platform, with sequential growth coming from consumer internet and enterprise companies. While Nvidia’s Data Center revenues weren’t going to grow at triple-digit rates forever, the sequential growth slowing down to 16% q/q points to marked deceleration ahead!

Nvidia Investor Relations

In addition to the obvious strength in the Data Center segment, Nvidia delivered strong results in its Gaming, Professional Visualization, and Automotive segments. The +16% y/y growth in Gaming was a standout number, given poor performance in this space from its rival Advanced Micro Devices (AMD).

Now, at this point, Nvidia is undoubtedly a Data Center-centric business (~87% of total revenues), and so, a delayed production ramp for Blackwell due to changes in the Blackwell GPU mask threatened to introduce significant uncertainty into the semiconductor giant’s otherwise rosy business outlook.

However, according to Nvidia’s CEO, Blackwell samples were shipped out in Q2, and the next-gen GPUs are on track for ramped-up production in the back half of FY2025. Here’s what CEO Jensen Huang had to say in the Q2 FY25 release:

Hopper demand remains strong, and the anticipation for Blackwell is incredible. NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.

Blackwell samples are shipping to our partners and customers. Spectrum-X Ethernet for AI and NVIDIA AI Enterprise software are two new product categories achieving significant scale, demonstrating that NVIDIA is a full-stack and data center-scale platform. Across the entire stack and ecosystem, we are helping frontier model makers to consumer internet services, and now enterprises. Generative AI will revolutionize every industry.

– Jensen Huang, founder and CEO of Nvidia.

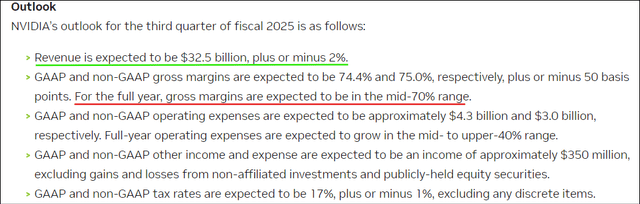

Given the cyclicality associated with semiconductors and the fact that some of its largest customers – cloud hyperscalers – are building their own in-house AI chips and partnering with other players (like Advanced Micro) in the industry, I think Nvidia’s medium-to-long-term demand (growth and margins) remains questionable. While Nvidia Q2 revenue guidance of $32.5B exceeding street expectations of $31.7B is positive, the gross margin contraction seen in Q2 (non-GAAP gross margins: -320 bps q/q) is set to deepen to the low-70s in the back half of FY2025.

Nvidia Investor Relations

With its vast first-mover advantage in AI, Nvidia’s hardware + CUDA software ecosystem is commanding tremendous pricing power. However, as I alluded to in “Nvidia Q1 FY2025 Review: AI Party Rolls On, But I Refuse To Dance,” Nvidia’s gross margins contracting to a low 70% level could be an indication of deteriorating pricing power (despite Nvidia’s plan of generating SaaS revenues with Blackwell GPUs). On the earnings call, Nvidia leadership said that the inventory crunch for its Hopper GPUs is easing. Did Huang & Co. just fumble the ball?

Is Nvidia’s current margin profile sustainable? Based on historical data for the semiconductor industry, I don’t think so, but only time will reveal the truth.

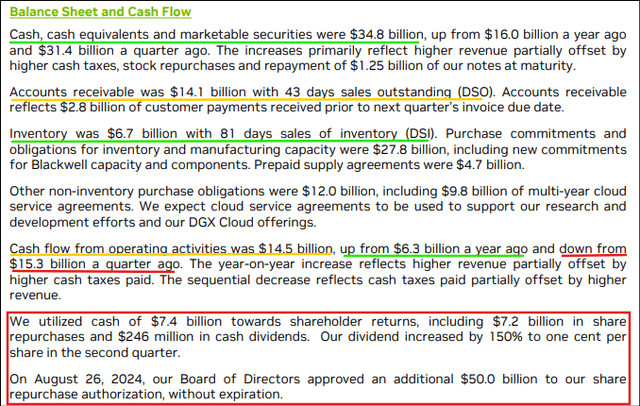

Now, in Q2 FY2025, Nvidia’s quarterly operational cash flow rose to $14.5B (up $6.3B y/y), and quarterly free cash flow jumped to $13.5B (up $6.5B y/y) – however, both of these figures were down sequentially (on a q/q basis) due to higher cash taxes.

Nvidia Investor Relations

In recent quarters, I have insisted on Nvidia strengthening its balance sheet in preparation for a cyclical downturn:

While Nvidia’s balance sheet is robust, I would personally like NVDA to raise some capital at current valuation to bolster its cash position and bring it in line with a level that resembles other $1.8T companies. The semiconductor industry is cyclical by nature, and I want Nvidia to have a massive cash hoard that can allow the company to keep growing through an industry downturn.

Source: “Nvidia’s Q4 Report Is A Blowout: Buy, Sell, Or Hold?”

Yes, Nvidia’s cash and short-term investments have increased to $34.8B; however, the company aggressively returning its free cash flows back to shareholders at NVDA current valuation (~20x P/S) continues to perplex me. In Q2 FY2025, Nvidia returned $7.4B to shareholders via stock buybacks and dividends, and the semiconductor giant just announced a fresh addition of $50B to its buyback program.

Given the historical cyclicality associated with semis, I still think that raising capital at a $3T+ market capitalization is a far better idea for Nvidia than returning capital to shareholders via buybacks at ~20x P/S (FY2025E).

Nvidia’s Fair Value And Expected Returns

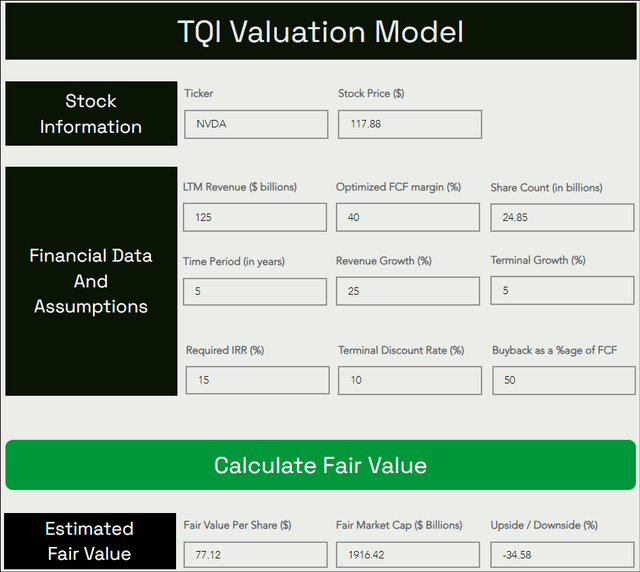

In light of Nvidia’s Q2 FY2025 report, I am sticking with my pre-earnings valuation model assumptions for the semiconductor giant:

TQI Valuation Model TQIG.org (TQIG.org)

On the back of a 6% post-ER dip in NVDA stock, the gap between Nvidia’s stock price and our fair value estimate has narrowed; however, at $118 per share, NVDA remains significantly overvalued in my book.

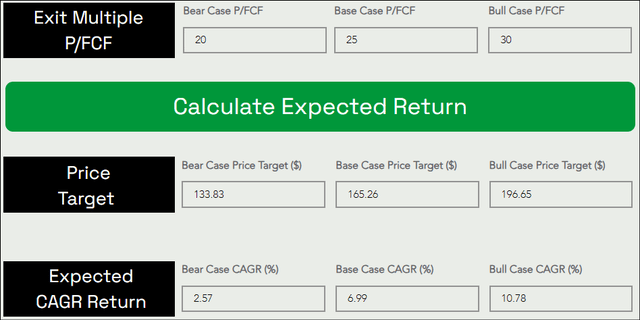

Assuming a base case exit multiple of 25x P/FCF, I see Nvidia rising to $165 per share by 2029. This price target translates to a 5-year expected CAGR return of ~7% from current levels.

TQI Valuation Model (TQIG.org)

While Nvidia’s 5-year expected CAGR has improved from 5.34% to 6.99% in light of its post-ER dip, it continues to fall short of my investment hurdle rate (of 15%) and long-term market – S&P 500 (SP500) – returns (of 8%-10% per year). Hence, Nvidia is still not an attractive investment under our valuation process.

Concluding Thoughts: Is NVDA Stock A Buy, Sell, Or Hold After Q2 Earnings?

In my view, Nvidia Corporation remains the most obvious “picks and shovels” play in the AI gold rush; however, a lot of future success is already baked into Nvidia’s current stock price, and the long-term risk/reward doesn’t justify the allocation of fresh capital right now. Due to unfavorable risk/reward and sheer lack of a margin of safety, I am going to stick to the sidelines on Nvidia Corporation stock.

Earlier in the week, I laid out the following scenarios:

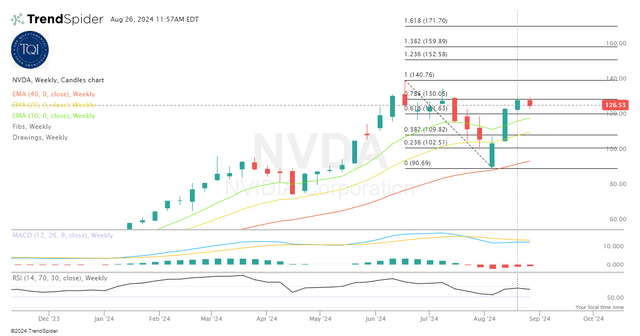

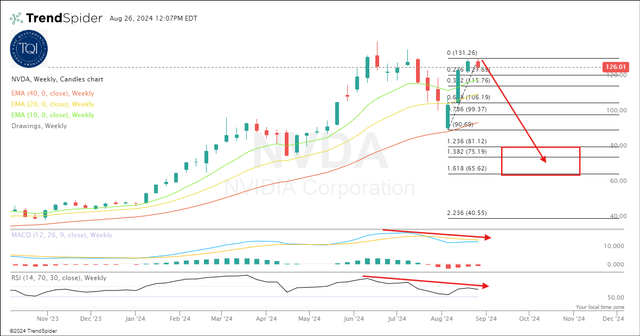

Technically, NVDA stock has regained short-term momentum ahead of earnings after re-claiming the 10-week and 20-week moving averages. However, the bounce in NVDA stock seems to be pausing at the key 78.6% Fibonacci retracement level.

If we do see NVDA making a sustained push above $130, I think the ongoing bounce can extend to $140 and then to the $152-171 range.

Nvidia Stock Chart 08/26/2024 (TrendSpider)

On the flip side, given the ongoing rollover in momentum indicators – Weekly RSI and MACD – selling pressure could re-appear in upcoming sessions. A strong rejection from the 78.6% Fibonacci retracement level could spark a deeper drawdown, which could send NVDA stock spiraling down to the $65-81 range marked on the chart below.

Nvidia Stock Chart 08/26/2024 (TrendSpider)

Source: “Nvidia: You Have Been Pumped And Warned By The Cloud Hyperscaler Honchos.”

Given the 5-6% drop in Nvidia Corporation stock post-earnings, I believe we are seeing a strong rejection from the key 78.6% Fibonacci level. If this sell-off sticks and picks up steam in the upcoming sessions, a deeper drawdown to the $65-81 range is a plausible outcome for the next 6-12 months.

Key Takeaway: Considering Nvidia’s long-term risk/reward and technicals, I continue to rate Nvidia Corporation stock “Neutral/Hold” at $118 per share.

Thanks for reading, and happy investing! Please share your thoughts, questions, or concerns in the comments section below.

GIPHY App Key not set. Please check settings