Zephyr18

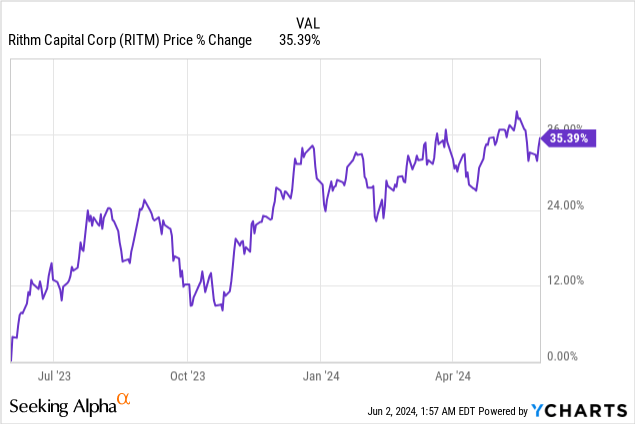

Rithm Capital (NYSE:RITM) is growing its business, seeing solid earnings available for distribution strength and supplying a well-supported dividend for investors. The company has evolved drastically in the last couple of years, broadening its investment scope and portfolio footprint, although Rithm Capital is still heavily focused on one of its original investment premises: mortgage servicing rights. I believe Rithm Capital is a truly outstanding income play with a 9% dividend yield and shares continue to trade below book value as well as the longer term price-to-book average. I see a very favorable distribution coverage profile as well as risk profile and continue to recommend Rithm Capital as a buy!

Data by YCharts

Data by YCharts

Previous rating

I recommended Rithm Capital as a buy in February 2024 as the mortgage REIT had healthy distribution coverage and managed to trade at an even higher yield: This 10% Yield Is On Sale. In the first fiscal quarter, Rithm Capital continued to achieve very impressive distribution coverage and although the mortgage REIT is not growing its dividend, from a dividend safety perspective, I believe Rithm Capital deserves to be included in a high quality dividend-focused portfolio.

Evolution into Rithm Capital 2.0, mortgage servicing rights and distribution coverage

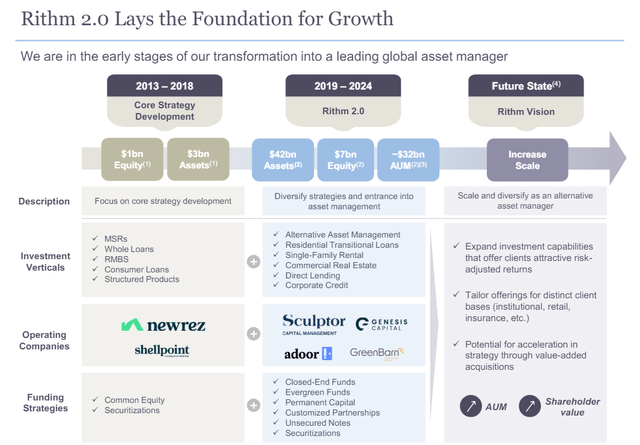

Rithm Capital’s prime focus in FY 2024 and beyond is growing its scale and build on past acquisitions in a number of areas. In the last several years, the mortgage REIT acquired a ton of companies in order to vertically integrate: it purchased mortgage servicing platforms, entered into the single family rental business and recently moved into third-party asset management. The company’s core foundation, however, are mortgage investment products like mortgage servicing rights, whole and consumer loans as well as mortgage-backed securities that generate recurring income that the REIT then passes through to dividend investors.

Rithm Capital

What makes Rithm Capital attractive as a high-yield dividend investment is not only its diversified investment portfolio, but its heavy focus on rate-sensitive mortgage servicing rights.

A mortgage servicing right is sold by a mortgage lender and gives a third party the right to “service” a mortgage, meaning the buyer of the mortgage servicing right, typically a third party, is responsible for collecting interest, keeping track of payments, and distributing cash to the original mortgage lender. Mortgage servicing rights see their values increase if the Federal Reserve raises the federal fund rate, which makes the income from the mortgage servicing right more valuable to the servicer. Therefore, mortgage servicing rights are pro-cyclical interest rate investments and Rithm Capital would benefit from a higher for longer rate world.

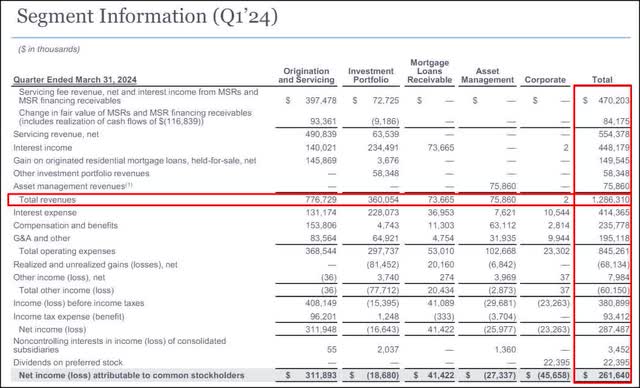

In the first fiscal quarter, Rithm Capital generated the majority of its revenues from its origination and servicing platforms as well as investment portfolio, which together were responsible for a massive 88% revenue share. While the company’s origination/servicing business will continue to dominate the revenue mix, the REIT last year moved into the asset management business, which is now also generating a solid amount of revenues of $75.9M (the segment is not yet profitable, however).

Rithm Capital

In FY 2024 and beyond, Rithm Capital is likely to focus more on growing its existing business as the REIT only last year acquired Sculptor Capital, which marked its entry into the asset management business last year.

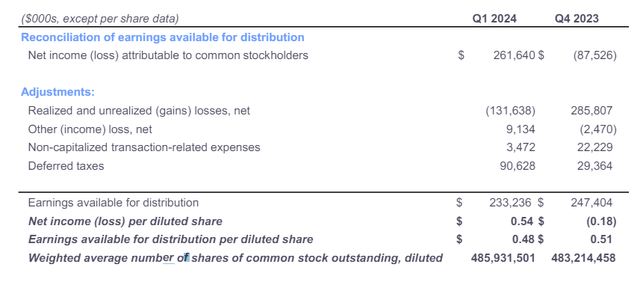

The top reason for investors to buy Rithm Capital relates to the REIT’s distribution coverage, in my opinion. Rithm Capital pays a $0.25 per-share quarterly dividend, which currently calculates to an annualized yield of 9%. Rithm Capital generated 1.92X distribution coverage in its first fiscal quarter, based off of $0.48 per-share in earnings available for distribution, which marked a slight decline compared to the 2.06X coverage ratio in FY 2023.

In any case, Rithm Capital offers an extremely healthy dividend here, but there is one drawback that may also explain why shares are trading at a discount to book value: despite this impressive distribution coverage, the REIT’s management is not growing its dividend.

Rithm Capital

Rithm Capital’s valuation

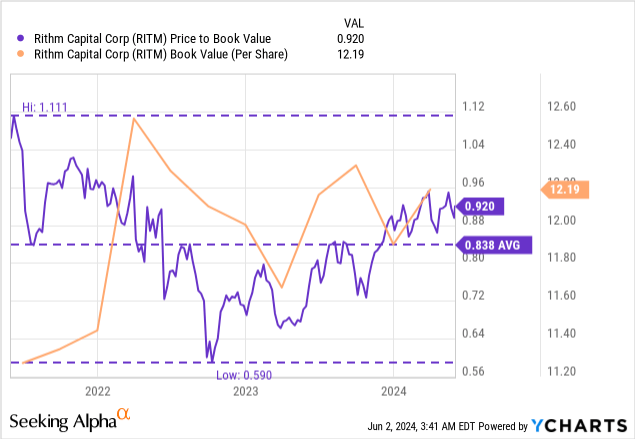

Rithm Capital is still trading at a discount to book value, currently of 8%, which is a bit odd considering that the mortgage REIT is generating such a well-supported dividend. One explanation may be that Rithm Capital is not growing its dividend, although it easily could afford to do just that.

Another reason may be that Rithm Capital has recently strengthened its asset management business — through the $720M buy-out of Sculptor Capital last year — which may signal to the market that Rithm Capital is moving away from its roots in the mortgage investment business… which is what ultimately supports the REIT’s dividend. As long as the origination & servicing and investment segments remains as dominant as they are now (remember, they had a combined revenue share of 88% in Q1’24), I am not worried about the strategic direction of the company.

Rithm Capital’s book value was $12.19 per-share at the end of the March quarter, which is where I see the fair value for the REIT. Currently, shares are trading at 0.92X book value, but we could see a repricing to book value, in my opinion, if the dividend remains as well-supported as it is today. In the past, shares of Rithm Capital have sold at a 3-year average P/B ratio of 0.84X, which is a ratio that is skewed downward due to the effects of the pandemic… during which the REIT was forced to sell some mortgage assets. A $12.19 per-share fair value implies 9% upside revaluation potential.

Data by YCharts

Data by YCharts

Risks with Rithm Capital

The biggest risk for Rithm Capital relates to a change in the federal fund rate path: if the Fed were to drastically shift its interest rate outlook and started to end its tightening policy, the mortgage REIT’s mortgage servicing rights would likely take a valuation hit. I believe that Rithm Capital, however, is making efforts to grow other income streams, such as asset management, which improves the diversification profile.

Final thoughts

All things considered, Rithm Capital makes a very healthy and well-rounded value proposition for dividend investors that are looking for a double-digit, yet well-supported 9% yield. Rithm Capital is still focused heavily on mortgage servicing rights, which are pro-cyclical investments — meaning they can be expected to see valuation increases as long as the Federal Reserve doesn’t end its tightening policy. However, Rithm Capital also has other investments in its portfolio (like loans, RMBS and single family rentals) which creates a more balanced investment profile. The key point I would like to make here is that Rithm Capital offers an extremely well-supported 9% yield to income investors: with a dividend coverage ratio of 1.92X, the REIT’s dividend is very secure!

GIPHY App Key not set. Please check settings