Smart rings are one of the fastest-growing wearable categories today. But based on information Ultrahuman shared with me, most of its customers are iPhone owners. As a writer for an Android site, I was curious why — and what that means for Android-only smart rings like the Galaxy Ring.

It’s rare for tech companies to share their Android/iOS splits. But during an Ultrahuman factory tour when I got to make a smart ring by hand, the Ultrahuman execs shared a couple of surprising factoids about their smart ring business.

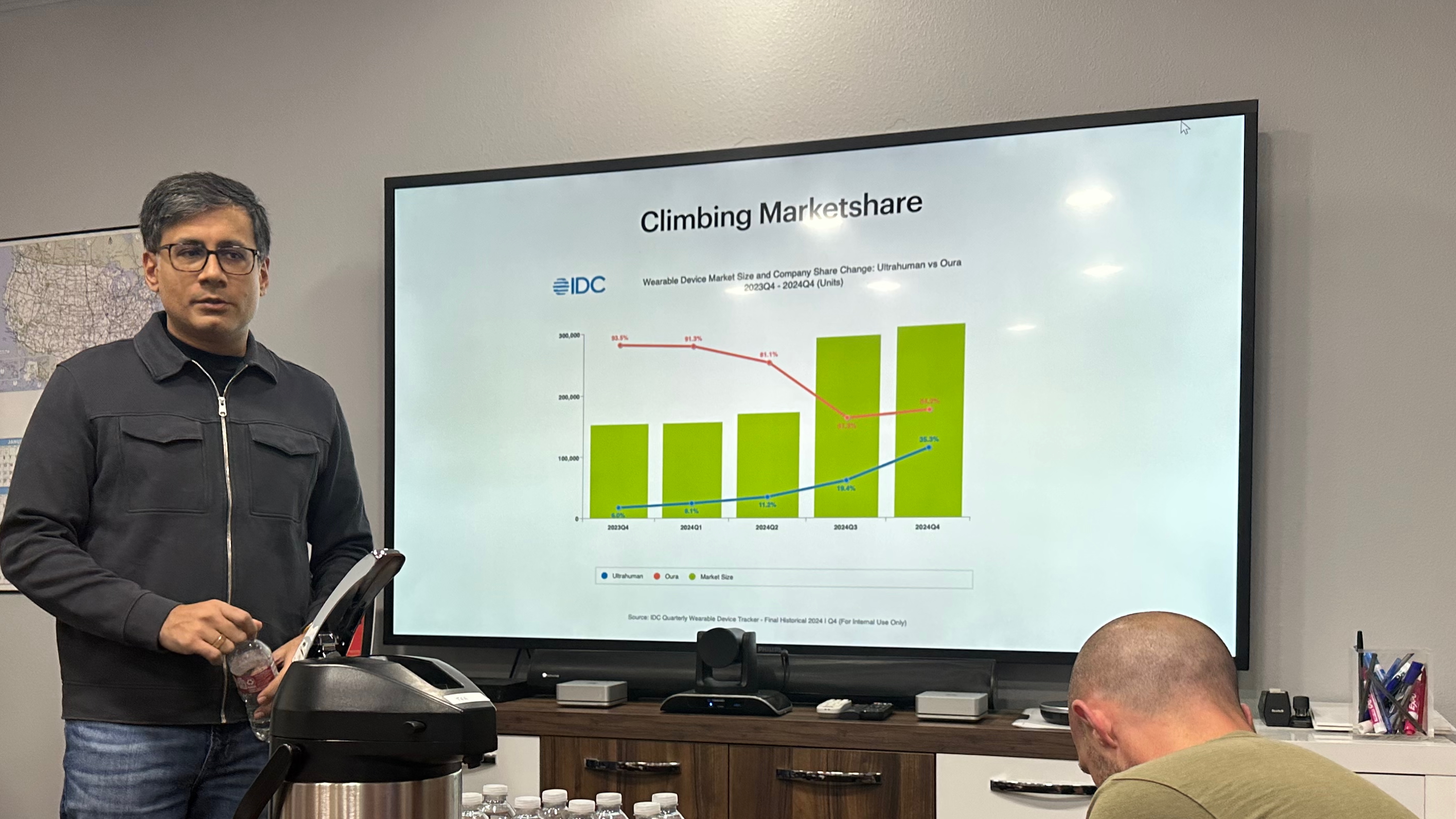

First, the Ultrahuman Ring Air has blown up in popularity. Its business has grown by 15 times in the last 18 months, and its share of total smart ring sales grew from 12% in 2023 to 35% in 2024, according to IDC stats. The Oura Ring still dominates more than half of global sales, but the sub-free Ring Air has done well.

You may like

(Image credit: Android Central)

Apparently, Ultrahuman has female customers to thank for this surge. In 2023, 75% of its customers identified as male in the app; now, 60% of its users are female.

At the same time, Ultrahuman confirmed that 75–80% of Ultrahuman’s customers use the iOS app, and that hasn’t changed much over the last couple of years. While its European and Asian sales may skew Android, as soon as the U.S. became the Ring Air’s largest market, iOS became the overwhelming focus.

While I don’t have stats for other companies, this Cognitive Market Research report includes charts showing that a majority of smart ring owners use Android worldwide, but that at least 40% of smart ring sales come in North America.

And again, about 75–80% of North American smart ring owners use iOS, even though nearly half of North American phones use Android.

Why many Android users haven’t hopped on the smart ring train yet

(Image credit: Apoorva Bhardwaj / Android Central)

I asked Ultrahuman’s CEO and CBO about this iOS/Android gap. They answered that iOS users like “closed systems” and put more stock on “aesthetics,” and so they’re happy to buy an all-in-one device like a smart ring that curates the experience and information for you.

He also mentioned it being a matter of demographics, that iOS users — or North American techies — might have more discretionary income to spend on smart rings.

By contrast, he thinks that Android users like “customization,” “personalization,” and the ability to “overclock” devices with enough effort. A screen-less smart ring doesn’t fit that description, because you can’t peek under the hood or activate developer settings (as you can on Wear OS).

(Image credit: Nicholas Sutrich / Android Central)

Another reason could be the Galaxy Ring, since so many Android users prefer Galaxy phones and might want the best integration. An unconfirmed report suggested Samsung bumped its Galaxy Ring production from 400,000 to 1 million last year due to high demand, so maybe the Android crowd simply ignored non-Samsung options.

It’s odd, then, that IDC sales figures don’t seem to reflect that, with Oura and Ultrahuman owning close to 90% of global smart ring sales by the end of 2024.

I believe the Galaxy Ring’s Android exclusivity works against it because North Americans with disposable income for a $399 ring either (A) own an iPhone or (B) already have a Galaxy Watch or another smartwatch that costs less and does more.

Worldwide, Android users with less income still buy smart rings, based on the stats available. But they have so many options in the $150–300 range that the Galaxy Ring has trouble standing out, besides the Samsung label.

How smart rings might appeal more to the Android crowd

(Image credit: Derrek Lee / Android Central)

Ultrahuman’s Mohit Kumar believes their business won’t be quite as iOS-skewed once they push more sales in Europe and Asia. But still, there’s a reason why they started making their rings in Texas: smart rings have a growing market Stateside. So demographics aside, I asked whether they want to court the North American Android crowd more.

He argued that they’re already taking those steps by adding more customization to the Ultrahuman app. PowerPlugs allow users to choose what data they see like AFib or Vitamin D, and the new UltraSignal developer platform and public APIs let anyone access the PPG data and use it for their own applications.

Otherwise, if we’re talking “power users,” then a Galaxy Ring 2 could deliver closer integration with other devices, like gestures to control smart glasses, NFC for Samsung Pay, or haptic feedback for phone notifications.

But most smart rings will remain understated, fashionable, and somewhat expensive wellness or medical devices, rather than customizable, overclockable tech.

Obviously, some Android users buy smart rings! But I’m curious if, as a collective, they’ll ever embrace rings as iOS users have, or if they’ll happily stick with Wear OS watches or fitness watches and see smart rings as an expensive novelty more than a necessity.

GIPHY App Key not set. Please check settings