Spot Bitcoin exchange-traded funds (ETFs) have reached an impressive benchmark, crossing $100 billion in net assets. According to SoSoValue datathis achievement represents 5.4% of Bitcoin’s total market value.

Spot Bitcoin ETFs Data (Source: X/Balchunas)

The 12 Bitcoin ETFs, launched by prominent issuers such as BlackRock and Fidelity, have reached this milestone in just 10 months since their debut in January. Leading the pack is BlackRock’s iShares Bitcoin Trust (IBIT), which manages $45.4 billion in assets.

Grayscale’s GBTC takes the second spot with $20.6 billion, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) follows in third with $18.4 billion. Other notable contributors include the Ark 21 Shares BTC ETF (ARKB) at $4.6 billion and Bitwise BITB at $4 billion.

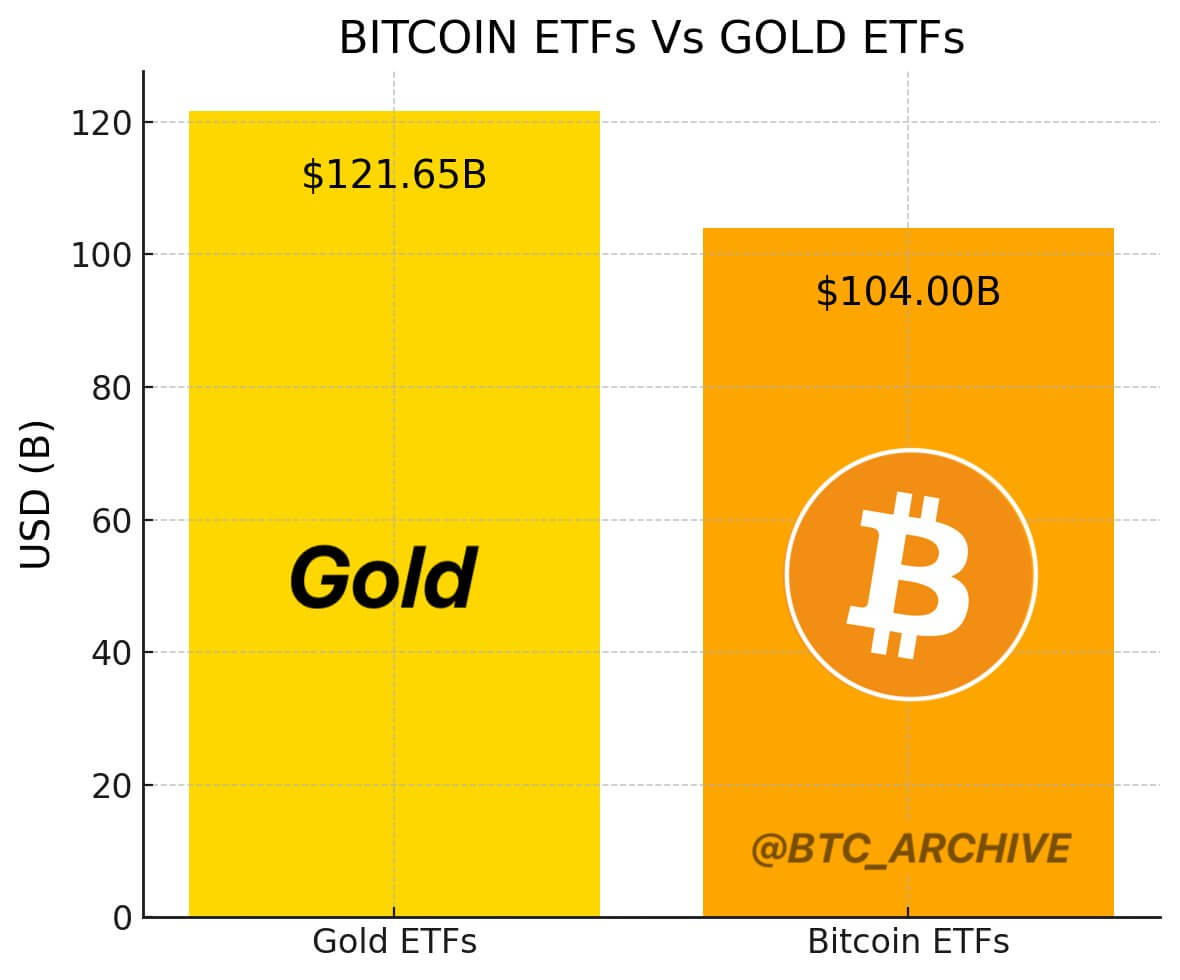

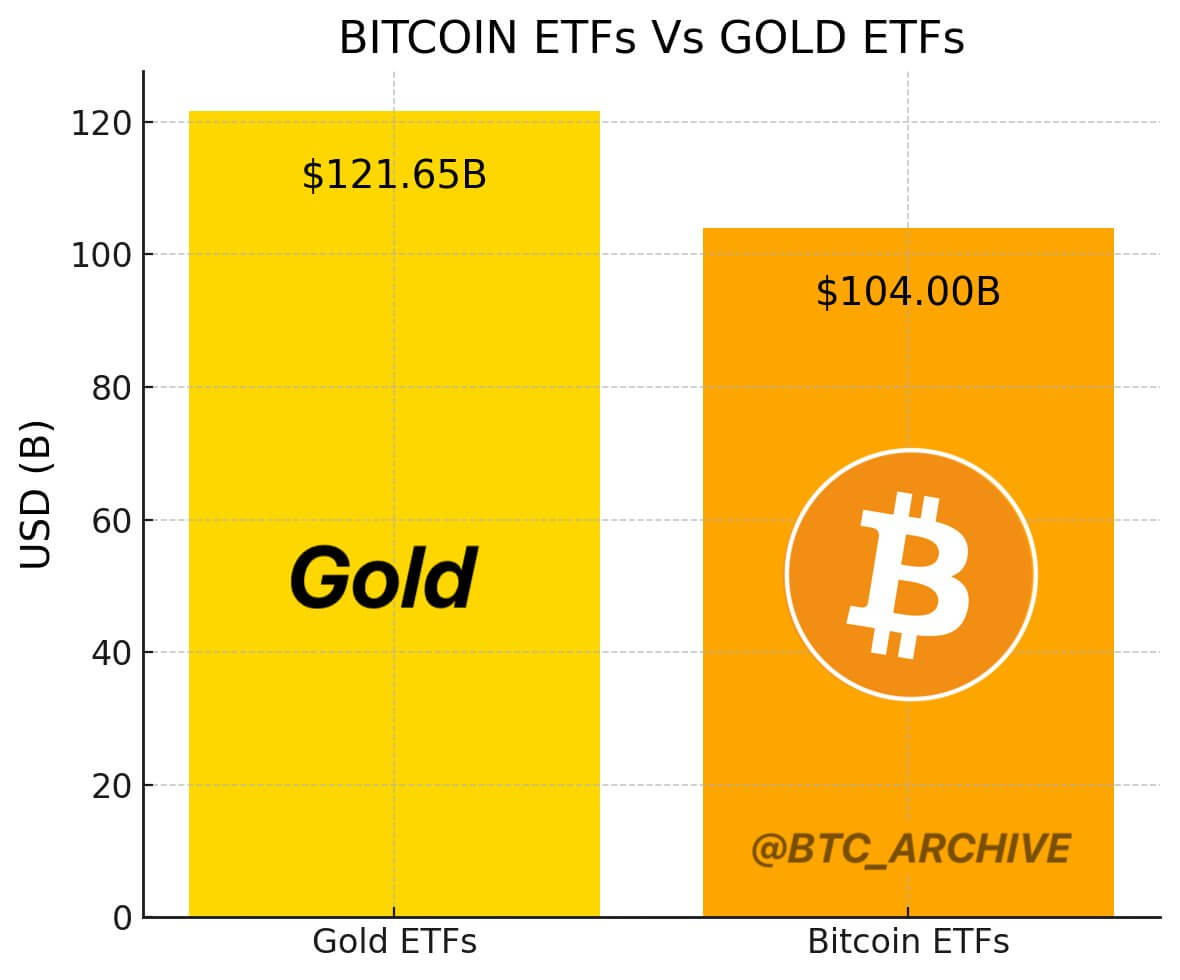

Bitcoin ETFs Vs. Gold ETFs (Source: X/Bitcoin Archive)

Bitcoin ETFs Vs. Gold ETFs (Source: X/Bitcoin Archive)

The rapid growth of spot Bitcoin ETFs makes them one of the most successful fund categories to date. Bloomberg ETF analyst Eric Balhcunas stated that the numbers show that the funds are close to overtaking Satoshi Nakamoto as the largest Bitcoin holder while advancing steadily toward surpassing gold ETFs in asset value.

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

GIPHY App Key not set. Please check settings