temizyurek

Vale S.A. (NYSE:VALE) has had a tailings problem in Brazil, one that has cost it billions of dollars. It started with the Mariana dam disaster in 2020, which killed 19 people. It was followed up by the Brumadinho dam disaster in 2019, which killed 270 people. Litigation is still ongoing, but recently, the company was court-ordered to pay almost $10 billion.

Despite that, the company is acknowledging its prior mistakes, and we expect it to be able to provide substantial future shareholder returns.

Vale Safety Improvements

Vale has worked to improve its safety despite the tragedies that the company faced.

Vale Investor Presentation

The company has removed more than 90% of the tailings from the B3/B4 dam, removing an astounding 3 million cubic meters of tailings. The company has managed to decrease its total recordable injury rate by more than 60%, and it’s planning to spend almost $6 billion on handling dam tailings by 2035. This is a massive program.

The company has made good progress, but it also had 19 deaths in 2015, and a failure to adequately respond led to 270 deaths just 4 years later. The only proof of success here is time passing without incident, and how it pans out remains to be seen. The company has faced many billions of dollars in expenses from it, and there won’t be a third chance.

Vale Iron Ore Capacity Expansion

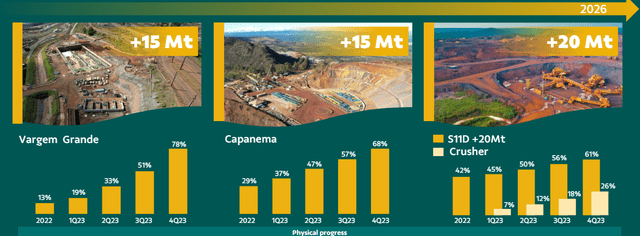

The company has worked to expand its iron ore capacity, supporting its overall portfolio.

Vale Investor Presentation

The expansions are expected to add 50 million tonnes / year in capacity, worth billions of dollars over the upcoming years. The company is targeting 2026 for these accomplishments, and it’s progressing well on all of them, with Vargem Grande at almost 80% completion and Capanema at almost 70% completion. This strong capacity expansion highlights the company’s asset strength.

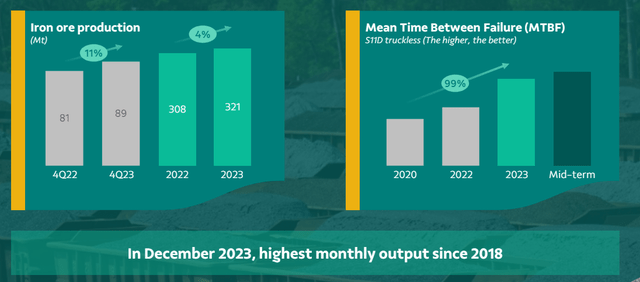

Vale Investor Presentation

Overall iron ore production for the company has remained strong, both as it improves capacity and works to decrease the MTBF. The company saw an astounding 99% increase over the last 4 years as it focuses on improving its operations versus cutting costs no matter what. QoQ for year-end 2022 to year-end 2023 production increase was 11% with annual increases at 4%.

The company exited 2023 with a production rate at almost 360 Mt, which could enable increased returns.

Vale Financial Performance

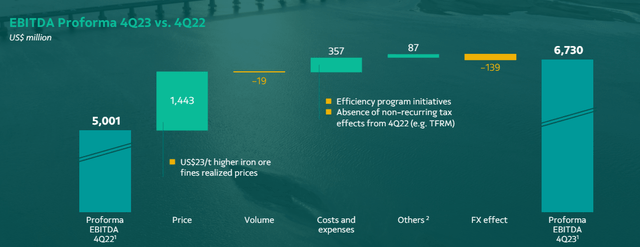

The company’s financials have remained strong on the basis of higher iron ore prices to close out the year.

Vale Investor Presentation

Last year, for the same quarter, the company had just over $5 billion in pro forma EBITDA. Since then, the company has seen realized prices increase by $23 / tonne, adding $1.4 trillion in EBITDA. That has combined with efficiency programs to push the company’s EBITDA to more than $6.7 billion, enabling strong cash flow.

It’s tough to tell right now if this will continue as China’s economic slump continues to put pressure on iron ore prices. Investors are partially betting on stimulus in China’s economy to help push up overall demand.

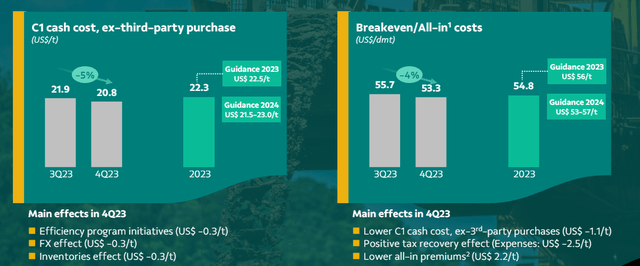

Vale Investor Presentation

The company is working to maintain lower cash costs for its production. The company’s C1 cash cost declined by 5% QoQ to $20.8 / tonne and the company’s break-even all-in costs declined by 4% to just over $53 / mt. That’s well below 2023 guidance, and the company’s guidance for 2024 is to decrease even further.

It’s also less than half of current iron ore prices. That’s a price level that enables massive shareholder returns. The company does have the risk of a continued decline in iron ore prices, but even then, it should be very profitable.

Vale Shareholder Returns

Vale has a market capitalization of just over $50 billion, and remains focused on strong free cash flow, or FCF, and shareholder returns.

Vale Investor Presentation

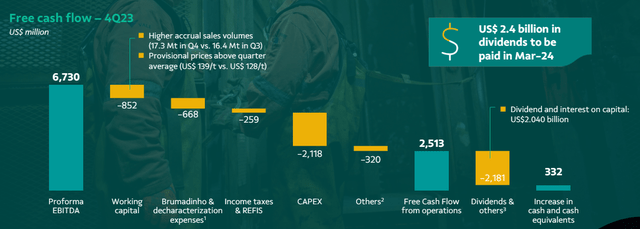

The company had more than $6 billion in EBITDA in 4Q 2023 and managed to turn that into a massive $2.5 billion in FCF. The company is spending the vast majority of that on dividends, and maintains what’s currently a double-digit dividend yield. The company remains committed to shareholder returns with its dividend.

The company’s strong cash flow enables it to continue both hefty investments in its business and future shareholder returns.

Thesis Risk

The largest risk to our thesis is iron ore prices. Iron ore is primarily used in infrastructure, and infrastructure is invested in a strong and healthy global economy. There are numerous things that can affect that, with numerous major economies seeing population declines and other risks. All of that could impact Vale’s long-term ability to drive shareholder returns.

Conclusion

Vale has a unique portfolio of assets and the company is taking advantage of it. It’s facing massive fines and strong pressure on its culture from tailing dam failings, both in 2015 and 2019. However, the company seems to be finally headed in the right direction, with the investment to match. Of course, only time will tell if that’s truly the case.

The company’s FCF remains strong, and we expect it to be able to continue generating substantial shareholder returns. Strong FCF has led to extraordinary dividends, pushing its yield into the double-digits, a level that the company can comfortably afford. The company is partially dependent on Chinese economical struggles and whether there’s stimulus, but overall, its portfolio remains strong.

GIPHY App Key not set. Please check settings