bauhaus1000/E+ via Getty Images

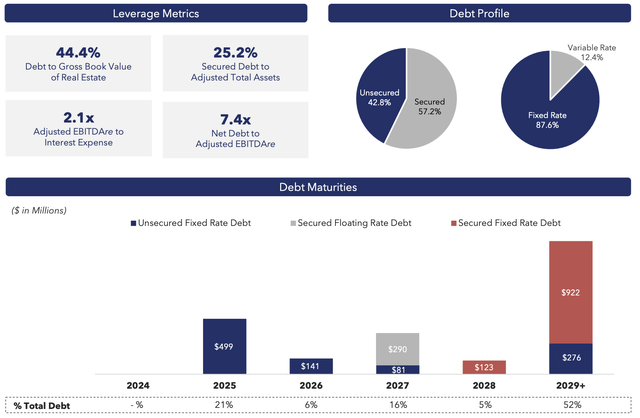

Office Properties Income Trust (NASDAQ:OPI) faces a $500 million debt repayment in February 2025, five months away. This forms 21% of the REIT’s total debt balance of $2.14 billion and is one of the single largest debt maturing payable in a single year across OPI’s debt maturity ladder. I first bought a position in the baby bonds (NASDAQ:OPINL) in late 2023 with the view that they would see some yield compression on what was then a near 50% discount to liquidation value. That discount widened through 2024, but recently tightened as market enthusiasm for fixed-income securities builds in anticipation of the September 18 FOMC meeting. The CME FedWatch Tool has placed the probability of a rate cut at 100%.

Office Properties Income Trust Fiscal 2024 Second Quarter Presentation

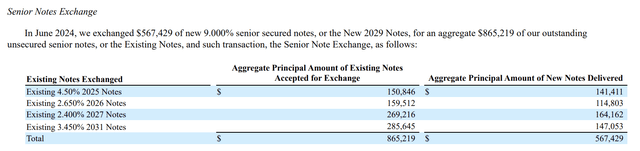

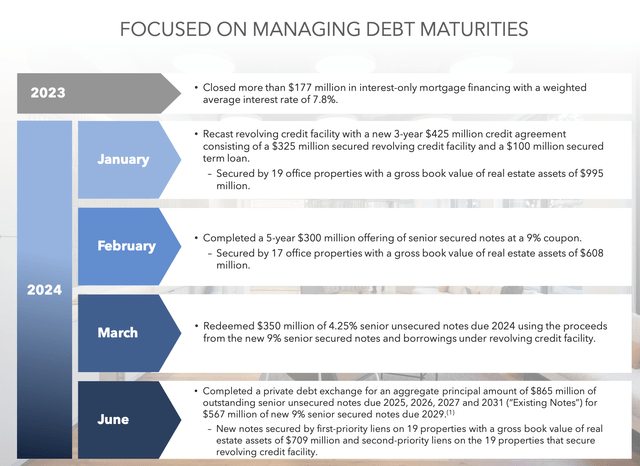

OPI’s February debt repayment, down by $150 million when I last covered the REIT on the back of a June private debt exchange, offers an existential headwind. The private exchange offer to unsecured senior notes due 2025, 2026, 2027, and 2031 allowed these bondholders to swap their existing debt for new 9% senior secured notes due 2029. The aim was to defer the 2025 maturity by offering a higher coupon but longer-dated debt. Critically, only 23% of existing 2025 bondholders would tender their debt for exchange, the lowest acceptance rate across the four tranches of existing notes to be exchanged.

Office Properties Income Trust Fiscal 2024 Second Quarter Form 10-Q

Leasing Volume, Occupancy, And Solvency Risk

The poor uptake by 2025 bondholders represents a setback to form the REIT’s core uncertainty, even as pending rate cuts spark euphoria in the fixed-income market to drive OPINL to recover sharply from lows. OPI has moved up 35% from its summer lows, and I’ve taken the rally as an opportunity to exit my position in light of the continued risk posed by the February maturity. A group of the 2025 bondholders are also reported to be in close discussion with financial advisor Lazard back in May.

Seeking Alpha

What is different between now from when I bought OPINL? A significantly more radical risk profile. The February maturity was always a specter hanging over the baby bonds, a risk now materially heightened as we pull closer to the date without a clear strategy to address the repayment. OPI’s options are getting slimmer, and I fear the REIT is heading towards a cramdown, the worst-case scenario. OPI generated fiscal 2024 second-quarter revenue of $123.68 million, down 7.7% from its year-ago comp but in line with consensus.

Office Properties Income Trust Fiscal 2024 Second Quarter Presentation

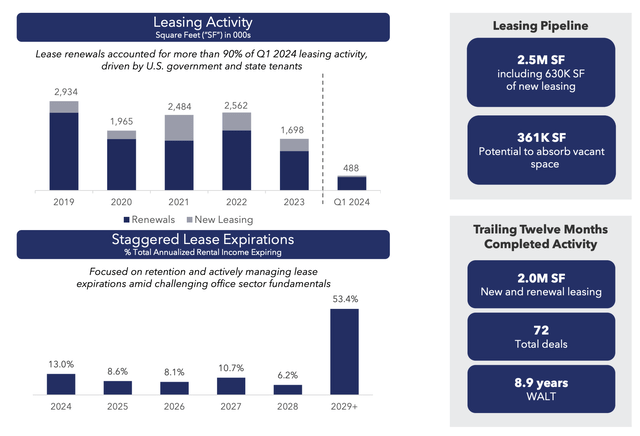

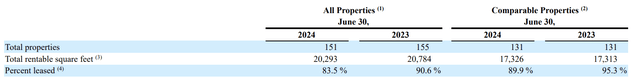

FFO at $0.68 per share beat consensus comfortably, but was down from $1.11 per share a year ago. All property occupancy was 83.5% at the end of the quarter, dipping from 90.6% a year ago with 13% of leases set to expire through the end of 2024 from the end of the second quarter. Comparable property occupancy was high at 89.9%. The REIT most recently declared a quarterly cash dividend of $0.01 per share, unchanged from its prior distribution, and $0.04 per share annualized for a 1.9% dividend yield.

Office Properties Income Trust Fiscal 2024 Second Quarter Form 10-Q

OPI held total cash and cash equivalents of just $13.5 million at the end of the quarter, as quarterly interest expenses swelled to $38.3 million during the second quarter. This was an increase of 45% over OPI’s year-ago comp and is set to move higher on the back of the private debt exchange offer which saw $865 million in existing notes swapped for $576 million in 2029 notes at 9%. The new quarterly interest expense of $51 million is nearly double the prior interest expense of $27.4 million. A dividend suspension would have been prudent, but with the existing peppercorn dividend at just $500,000 per year, a suspension now won’t be material for the February maturity. The REIT leased 208,000 square feet during the second quarter but flagged during its earnings call that its operating performance is set for a dip on upcoming lease expirations.

Office Properties Income Trust Fiscal 2024 Second Quarter Presentation

Office REITs were broadly oversold to an extent in 2023 and there was an opportunity to buy the fixed-income securities of these REITs at deeply discounted valuations against the risk posed by their maturity ladders and lease expiration schedules. OPINL is now changing hands for 52 cents on the dollar with a 12.2% yield on cost. I don’t think this is enough to compensate for the enhanced solvency risk versus a year ago, even as the dire zeitgeist of a Fed funds rate being hiked to a 23-year high is set to end. OPI and its baby bond are rated sell for now, until clarity on the February maturity.

GIPHY App Key not set. Please check settings